Cryptocurrency: What It Is, How It Works, and What You Need to Know in 2025

When you hear cryptocurrency, a digital form of money secured by cryptography and running on decentralized networks called blockchains. Also known as crypto, it lets people send value directly to each other without banks, governments, or middlemen. This isn’t science fiction—it’s happening right now, from Nigeria to Vietnam, from DeFi traders in the U.S. to underground P2P users in Tunisia.

Behind every crypto transaction is a blockchain, a public, tamper-proof digital ledger that records every transfer. This is what makes Bitcoin, Ethereum, and thousands of other coins possible. But blockchains aren’t all the same—some, like Solana and Mantle, move fast and cheap. Others, like Bitcoin, prioritize security over speed. And then there are crypto exchanges, platforms where you buy, sell, or trade these coins. Some, like Tokenlon and Merchant Moe, are decentralized and private. Others, like FutureX Pro and Ostable, don’t even exist—but scammers pretend they do.

Where you live changes everything. In India, every trade triggers a 1% tax deduction. In Vietnam, a new 0.1% tax hits every swap. The UAE, after cleaning up its compliance, became a hotspot for legit exchanges. Meanwhile, North Korea steals crypto to fund weapons, and U.S. expats face exit taxes when they give up citizenship. Crypto isn’t just about price charts—it’s about laws, risks, and survival.

And then there are the airdrops. People chase free tokens like POTS, PYM, or 1MIL, but most are fake. Real airdrops don’t ask for your wallet password. They don’t promise instant riches. They’re tied to real projects—like SundaeSwap on Cardano or Stacks on Bitcoin. But if you don’t know how to tell the difference, you’ll lose money before you even start.

This collection doesn’t hype coins or push get-rich-quick schemes. It shows you what’s real, what’s dead, and what’s dangerous. You’ll find deep dives into tokens like TROLL and EDRCoin that rose fast and crashed harder. You’ll see how hash rate keeps Bitcoin secure, how VASP licensing works in Nigeria, and why Nikita (NIKITA) has almost no trading volume. You’ll learn how to spot a scam exchange, how to read crypto laws by country, and why some coins are just payment tools for niche services—not investments.

Whether you’re trying to avoid taxes, find a safe exchange, or just understand why a meme coin went viral and then vanished, this is the place to start. No fluff. No hype. Just clear, practical info to help you make smarter moves in a messy, fast-moving world.

How North Korea Cashes Out Stolen Cryptocurrency to Fiat

North Korea has stolen over $3 billion in cryptocurrency since 2017 and turned billions into cash through hacking, cross-chain transfers, and unregulated exchanges in Cambodia and China. This is how they bypass sanctions and fund their weapons program.

Huobi Korea Crypto Exchange Review: What You Need to Know in 2026

HTX (formerly Huobi) is the global crypto exchange used by Korean traders-there's no separate Huobi Korea. Learn how Koreans access it, why it's popular for meme coins, and how it compares to Upbit in 2026.

SMAK X CoinMarketCap Airdrop: What Happened and Why It Failed

The SMAK X CoinMarketCap airdrop in 2021 gave away $20,000 in tokens, but the Smartlink project failed to build real users. Today, SMAK trades at $0.000113 with zero volume - a cautionary tale of how not to launch a crypto project.

E2P Token Airdrop: Coinstore, Greenex, and CoinMarketCap Details

The E2P Token airdrop linked to Coinstore, Greenex, and CoinMarketCap has no official confirmation. No website, no contract, no announcement. Learn why this is likely a scam and how to protect your crypto from fake airdrops.

MistSwap Crypto Exchange Review: What You Need to Know in 2026

MistSwap is a decentralized crypto exchange with multi-chain support but lacks transparency, audits, and user reviews. Learn what it offers, its risks, and whether it's worth using in 2026.

PancakeSwap V3 (Base) Crypto Exchange Review: Low Fees, Concentrated Liquidity, and What You Need to Know

PancakeSwap V3 (Base) offers zero trading fees, concentrated liquidity, and advanced order types like limit and TWAP orders. It's the fastest and cheapest DEX on Base blockchain, ideal for active traders and yield seekers.

What Happens If You Lose Your Private Key in Cryptocurrency

Losing your private key means losing your cryptocurrency forever. No one can recover it-not exchanges, not developers, not governments. Here's what happens, why it's irreversible, and how to prevent it.

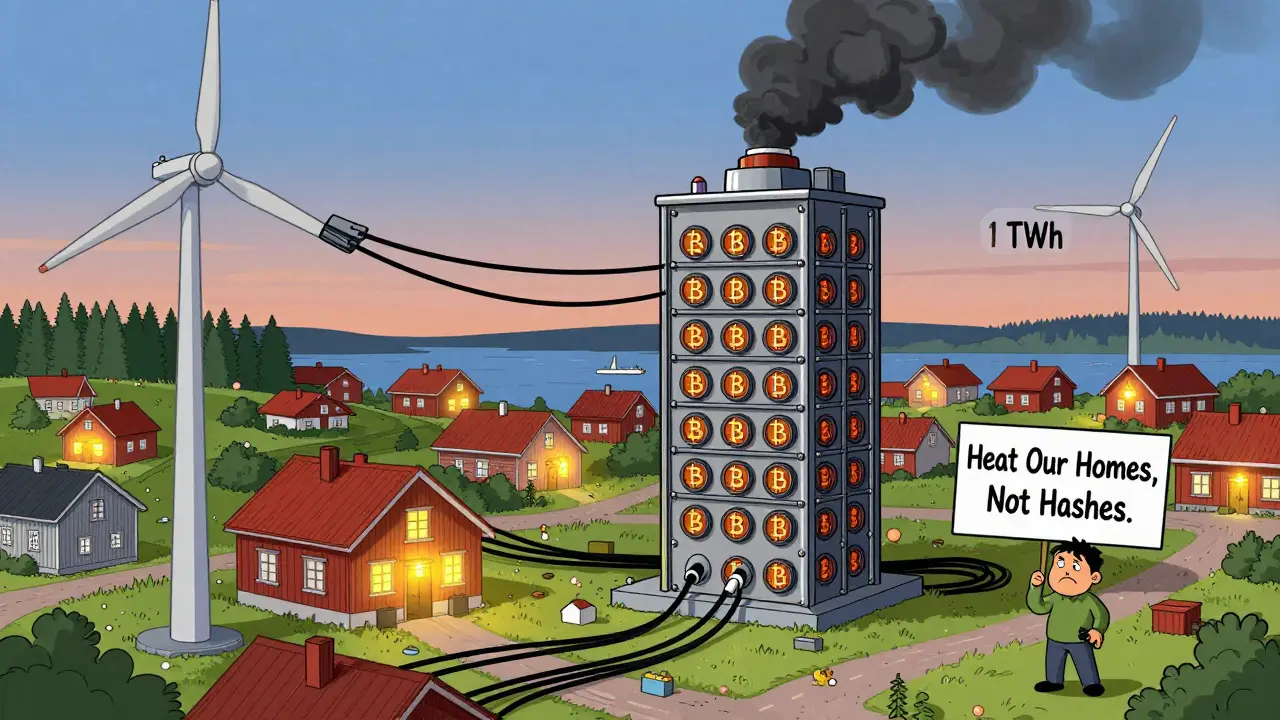

Environmental Concerns Drive Sweden’s Strict Crypto Mining Rules

Sweden is cracking down on crypto mining not because it's illegal, but because of its massive energy use. Even with renewable power, Bitcoin mining strains the grid - and Sweden is forcing miners to prove they're part of the solution, not the problem.

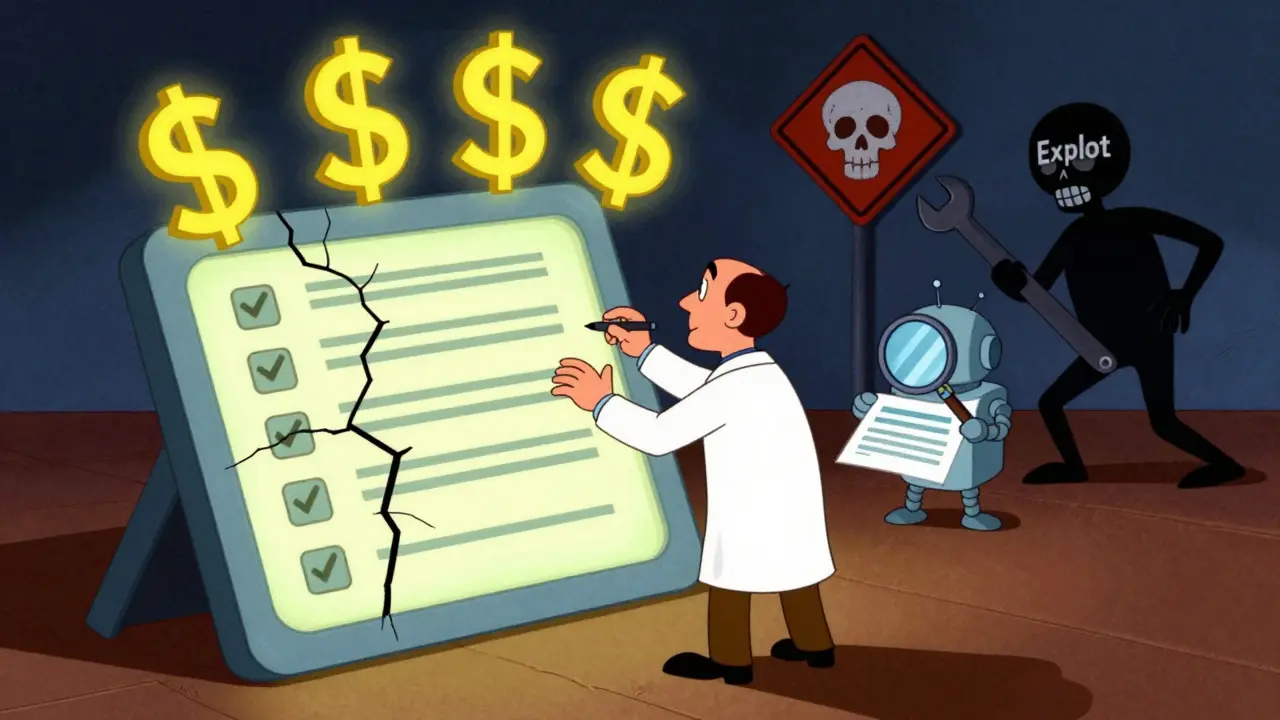

Code Review Best Practices for Blockchain

Blockchain code review is not like regular software review. Due to immutable ledgers and massive financial stakes, every line of code must be scrutinized. This guide covers manual review techniques, automated tools, checklists, and why skipping this step risks millions.

Code Review Best Practices for Blockchain

Blockchain code review is critical because smart contracts can't be patched after deployment. Learn the best practices, tools, and checklists to prevent millions in losses from exploitable vulnerabilities.

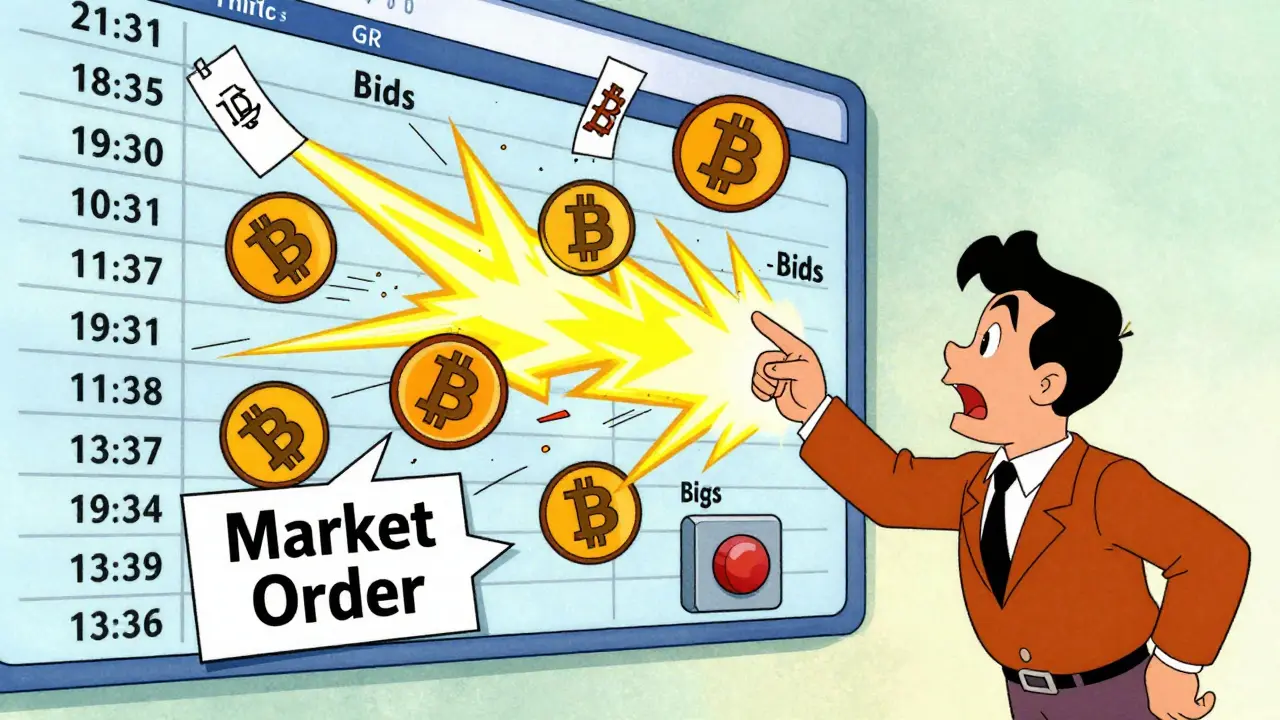

Market Orders vs Limit Orders in Order Books: When to Use Each in Crypto Trading

Market orders guarantee speed but risk slippage. Limit orders give price control but may not fill. Learn when to use each in crypto trading to avoid costly mistakes.

CPR Cipher 2021 Airdrop Details: What Happened and Why It Matters

The CPR Cipher 2021 airdrop was a real attempt to build a utility token ecosystem - but poor communication and lack of follow-through turned it into a cautionary tale. Here’s what happened, why it failed, and what you can learn from it.

© 2026. All rights reserved.