Sweden doesn’t ban cryptocurrency. But if you’re running a Bitcoin mining operation there, you’re walking a tightrope. The country isn’t stopping miners outright - but it’s making sure they pay for every kilowatt they use.

In 2023, Sweden’s Financial Supervisory Authority (FI) dropped a bombshell: Bitcoin mining was consuming as much electricity as 200,000 Swedish households, and its carbon footprint matched 100 million round-trip flights between Stockholm and Bangkok. That’s not a metaphor. That’s data from the Swedish Energy Agency and the Financial Stability Council. The message was clear: if your mining rig is using power that could heat homes or power hospitals, you’re not just a tech company - you’re a climate risk.

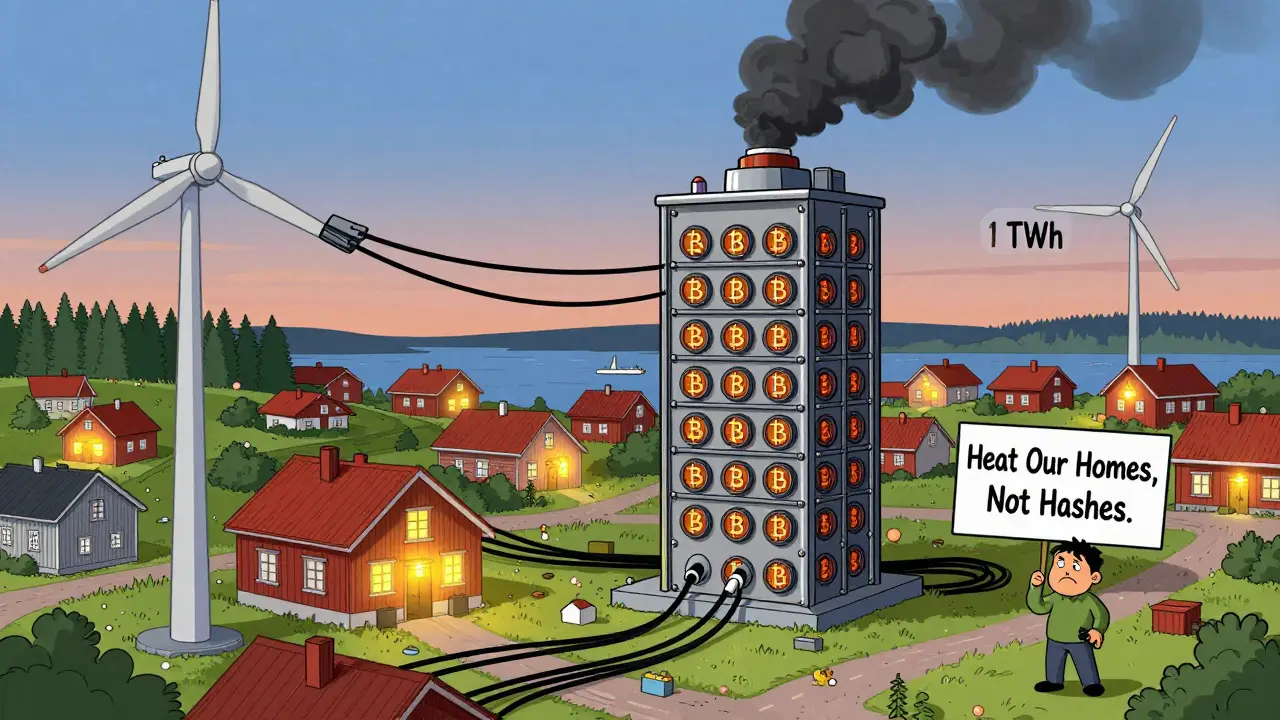

What made Sweden different from other European countries? It didn’t care if your mining farm ran on wind or hydropower. Germany and France let miners operate as long as they registered. Norway welcomed them with open arms, thanks to cheap hydro and geothermal energy. Iceland? Same thing. But Sweden said: total energy consumption matters, not the source. Even if every watt comes from a clean grid, using 1 terawatt-hour (TWh) of electricity for Bitcoin mining still adds strain to the system. And in a country that’s already aiming for net-zero emissions by 2045, that’s unacceptable.

How Much Energy Are We Talking About?

Let’s put numbers to the noise. In 2022, Bitcoin mining in Sweden spiked to nearly 1 TWh annually. That’s enough to power the entire city of Umeå. By 2025, it’s projected to drop to 0.8 TWh - not because miners vanished, but because the rules changed. Ethereum’s shift to proof-of-stake in 2022 cut its energy use by 99.95%. That alone shaved off a huge chunk of global mining demand. But Bitcoin? Still stuck on proof-of-work. And that’s the core of Sweden’s frustration.

Compare that to Visa. One Visa transaction uses 0.0023 kWh. One Bitcoin transaction? 707 kWh. That’s over 300,000 times more energy. The European Central Bank called it a “fundamental mismatch” with climate goals. Sweden took that seriously. They didn’t just point fingers - they acted.

The Regulatory Wall

Since January 2025, Sweden’s Crypto-Asset Environmental Transparency Act requires every mining operation above 0.5 megawatts to publish real-time energy usage and source data. No hiding. No guesswork. If you’re mining, the public can see exactly how much power you’re pulling - and where it’s coming from.

Local governments added more layers. Boden Municipality capped new mining facilities at 5 MW. Kiruna demands 90% renewable verification. The registration process with FI? 120 to 180 days. In Portugal, it’s under two months. And forget banking. Several miners reported their business accounts were frozen without warning, after FI quietly advised banks to cut ties with high-energy crypto operations.

Even worse, compliance isn’t optional. You need quarterly environmental impact reports using EU-mandated methodology. You must track every kilowatt-hour under the Swedish Environmental Code. And if you’re over 10,000 SEK in transactions? You’re under AML scrutiny. It’s not just about energy - it’s about accountability.

Who’s Leaving? Who’s Staying?

It’s no surprise that 68% of Swedish mining companies plan to move out by 2026. Norway is the top destination - 42% of them. Germany’s next, then the U.S., especially Texas, where renewable energy is abundant and regulations are loose. But not everyone’s running.

Some are adapting. EcoChain, a Stockholm startup, switched from Bitcoin mining to Ethereum proof-of-stake validation. Their energy use dropped from 1.2 GWh/year to just 600 kWh. That’s a 99.95% cut. Profit? Still there. Transaction fees kept them afloat. And now they’re a case study in how to survive Sweden’s crackdown.

The Swedish Blockchain Association is pushing back. They argue regulation should focus on financial risks - money laundering, fraud - not energy. But the government’s stance hasn’t budged. The focus remains: if it uses too much power, it doesn’t belong here.

The Heat That’s Left Behind

Sweden’s not just shutting down miners - it’s trying to reuse what they leave behind. In 2025, the government allocated 200 million SEK ($18.4 million USD) to turn mining waste heat into district heating. Luleå, a town in the far north, already runs a pilot where 65% of the heat from a mining facility warms homes and schools. That’s not just recycling - it’s turning a problem into a solution.

It’s clever. Instead of banning miners outright, Sweden is forcing them to contribute to the grid they’re straining. If you’re using power, you better give something back. And that’s changing the game.

What’s the Big Picture?

Sweden’s approach is extreme - but it’s working. Crypto mining’s share of the Nordic market has dropped from 38% in 2022 to 27% in 2025. Meanwhile, Norway’s share jumped to 34%. Sweden’s crypto sector is shrinking, but not because it’s anti-tech. It’s pro-sustainability.

Stockholm still hosts 37% of Nordic blockchain startups - but they’re not mining. They’re building enterprise tools, supply chain trackers, and decentralized identity systems. These projects use almost no energy. And Sweden is backing them.

The European Commission didn’t ban Bitcoin mining. But they did adopt Sweden’s transparency rules. Starting July 2025, every crypto project under MiCA must disclose its environmental impact. Sweden didn’t win the ban. But they won the conversation.

What’s Next?

Sweden’s not done. The Financial Supervisory Authority’s 2025 Strategic Plan says they’re moving toward a Swiss-style model: technology-neutral, outcome-focused. No bans on Bitcoin. No bans on blockchain. But if your tech uses energy like a coal plant, you’ll pay for it - through carbon pricing, stricter reporting, or lost access to infrastructure.

The message is simple: innovation doesn’t get a free pass on climate. If you want to build in Sweden, you don’t just need code. You need a plan for sustainability.

Why does Sweden care more about crypto energy use than other countries?

Sweden has one of the cleanest energy grids in Europe - 54% hydro, 30% nuclear, 15% wind. But even with clean power, adding 1 TWh of demand for Bitcoin mining still strains the grid and delays decarbonization goals. Other countries focus on whether the energy is renewable. Sweden focuses on total consumption. If your mining rig uses 100% solar, it still takes power that could go to homes, hospitals, or electric trains. That’s the difference.

Is Bitcoin mining illegal in Sweden?

No, it’s not illegal. But it’s heavily regulated. Any mining operation over 0.5 MW must register with the Financial Supervisory Authority, submit quarterly environmental reports, and publicly disclose real-time energy use. Many miners can’t meet the paperwork, banking, or energy sourcing requirements - so they leave. It’s not a ban. It’s a barrier.

How does Ethereum’s switch to proof-of-stake affect Sweden’s policy?

It was a game-changer. Ethereum’s energy use dropped by 99.95% after switching in 2022. That cut Sweden’s overall crypto energy consumption by a third overnight. It proved that alternatives exist. Sweden now pushes miners to shift to proof-of-stake or other low-energy models. The government even funds grants for miners who convert. It’s not about killing Bitcoin - it’s about making energy waste obsolete.

Can I still mine crypto in Sweden if I use renewable energy?

Yes - but only if you’re small and transparent. If you’re under 0.5 MW and can prove 100% renewable sourcing, you can operate. But you still need FI registration, AML compliance, and quarterly reporting. Most commercial operations are too big to fit under that limit. The system isn’t designed to support large-scale mining, even with green energy.

What happens if a mining company doesn’t comply with Sweden’s rules?

Non-compliance can lead to fines, forced shutdowns, or loss of banking services. Several operators reported banks closing their accounts without explanation after FI issued guidance. Local municipalities can also deny permits or disconnect power. There’s no formal ban - but the system is built to make it impossible to operate without following the rules.