When you trade crypto on a decentralized exchange, you don’t need a bank or a middleman. You trade directly from your wallet. That’s the promise of DeFi. And PancakeSwap V3 (Base) is one of the most powerful tools making that real - especially if you’re trading on the Base blockchain.

Launched in 2023, PancakeSwap V3 on Base isn’t just another upgrade. It’s a full redesign of how liquidity works. It’s faster, cheaper, and smarter than its predecessors. But it’s also more complex. If you’ve used PancakeSwap before, you might think you know what to expect. You don’t. This version changes everything.

How PancakeSwap V3 (Base) Works

PancakeSwap V3 (Base) runs on Coinbase’s Base blockchain, which is built on Ethereum but optimized for speed and low fees. That means trades settle in seconds, not minutes. And gas costs? Often under $0.10. Compare that to Ethereum mainnet, where fees can spike to $5 or more during busy times.

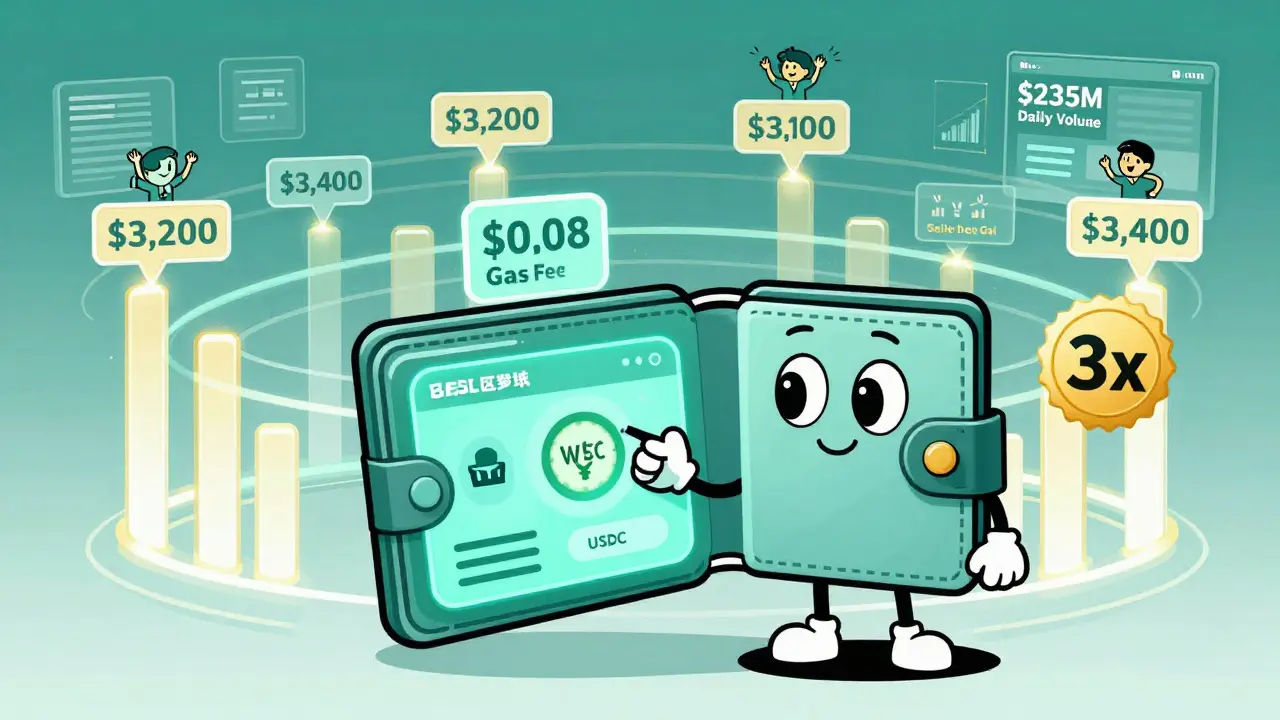

Unlike older DEXs like Uniswap V2, which spread your liquidity across every possible price, V3 lets you choose exactly where your money works. This is called concentrated liquidity. Instead of putting $10,000 across a wide price range, you can put it all between $3,200 and $3,400 for ETH/USDC. If the price stays in that zone, you earn way more trading fees. If it moves out? You stop earning - but you also don’t lose money to price swings outside your range.

This isn’t just theory. Liquidity providers on V3 (Base) are seeing 3x to 5x higher yields than on V2. One user on Reddit reported earning $87 in fees over 7 days with $5,000 staked - a 15% annualized return - just by setting a tight range around the current price. That’s not a fluke. It’s how the system was designed.

Trading Features That Actually Matter

Let’s talk about what you can do as a trader, not just a liquidity provider.

- Limit Orders: Set a price to buy or sell, and the trade executes automatically. No more staring at your screen waiting for the right moment.

- Time-Weighted Average Price (TWAP) Orders: Need to swap $50,000 without moving the market? TWAP breaks it into 100 tiny trades over an hour. This prevents slippage and saves you money.

- Smart Order Routing: The platform scans all liquidity pools across Base and even other chains. It finds the best price for your trade - even if it means splitting the order across multiple pools.

These aren’t gimmicks. They’re tools that professional traders have used on centralized exchanges for years. Now they’re free and open on a decentralized platform.

As of February 2026, PancakeSwap V3 (Base) supports 59 tokens and 113 trading pairs. The most popular pair is WETH/USDC, which traded over $112 million in 24 hours. That’s more than half of the platform’s total volume. The second biggest? WBTC/USDC. That tells you something: traders here want stablecoins and major cryptos. Not obscure memecoins.

Fees? Almost Zero

Most centralized exchanges charge 0.1% to 0.5% per trade. Binance, Coinbase, Kraken - they all take a cut. PancakeSwap V3 (Base) charges 0.00% for both makers and takers. That’s right - no fees.

How? Because liquidity providers earn the fees instead. Every trade you make pays a tiny percentage to the people who supplied the pool. You don’t pay a platform fee. You help fund the system. It’s a win-win - if you’re providing liquidity.

For traders, this means you keep every penny of profit. No hidden costs. No surprise deductions. Just clean, direct swaps.

Who Is This For? And Who Should Stay Away?

PancakeSwap V3 (Base) isn’t for everyone.

Best for:

- Traders who use limit orders or TWAPs regularly

- Liquidity providers who want to maximize yield on stablecoin pairs

- Users who already use Base or want low-cost Ethereum alternatives

- Advanced DeFi users who understand price ranges and impermanent loss

Not for:

- Beginners who just want to swap ETH for USDC and leave

- People who don’t want to manage positions manually

- Users in regulated jurisdictions where unlicensed DeFi platforms are restricted

Here’s the catch: managing concentrated liquidity takes work. You need to monitor your price ranges. If the market moves too far, your liquidity gets pulled out. You have to reposition it. That’s not hard - but it’s not passive. If you want to just “stake and forget,” stick with V2 or a yield farm.

Performance and Traffic: Is It Popular?

Yes - and growing.

The main site, pancakeswap.finance, gets over 1.2 million visits per month. Almost all of it - 99% - comes from organic search. That means people are finding it on their own. They’re not being pushed by ads. They’re searching for it.

Users spend over 5 minutes per visit and view 8+ pages. That’s engagement. People are exploring liquidity pools, checking analytics, reading guides. The bounce rate is 36%, which is low for crypto. Most platforms hover around 60-70%.

Trading volume? $235 million in 24 hours. Down 39% from the day before - but that’s normal. Crypto volume swings wildly. The platform still ranks in the 93rd percentile among DEXs. Only 7% of decentralized exchanges trade more than this.

How to Get Started

It’s simple - if you’ve used a wallet before.

- Install MetaMask or Trust Wallet.

- Switch your network to Base (you can add it manually or use the一键切换 feature in MetaMask).

- Go to pancakeswap.finance and connect your wallet.

- Click “Trade” and pick your pair - say, USDC/WETH.

- For a simple swap: enter the amount, approve the token, and click swap.

- For limit orders or concentrated liquidity: click “Pool” > “Create Position” and set your price range.

The interface is clean. No clutter. No pop-ups. You’ll be trading in under 5 minutes.

But if you want to use advanced features, watch a 10-minute YouTube tutorial. The platform’s own docs are solid, but community guides explain it better. Search for “PancakeSwap V3 concentrated liquidity explained” - you’ll find clear walkthroughs.

What’s Missing? The Risks

No system is perfect.

First - no regulation. PancakeSwap V3 (Base) isn’t licensed anywhere. That means if something goes wrong - a smart contract bug, a hack, a rug pull - you have no recourse. You lose your money. Period.

Second - complex features mean complex mistakes. A user on Twitter lost $12,000 last month because they set a liquidity range too wide. The price moved, and their capital got diluted. They didn’t realize how quickly the range could become inactive.

Third - the Base chain is still young. It’s fast and cheap, but it’s not as battle-tested as Ethereum or BNB Chain. There’s a small chance of network congestion or downtime. It’s rare - but it’s happened.

And finally - the fees are zero because liquidity providers pay. If no one adds liquidity, the pools dry up. If a pair has low liquidity, your trade will have high slippage. Always check the pool depth before trading.

Competition: How Does It Stack Up?

Uniswap V3 on Ethereum is the giant. It has more total volume. But its fees are higher, and transactions are slower. If you’re trading $500, Uniswap on Ethereum might cost you $3 in gas. On PancakeSwap V3 (Base)? $0.08.

Curve Finance? Great for stablecoins, but it doesn’t support limit orders or TWAPs. SushiSwap? Still on V2 in most places. It hasn’t caught up.

PancakeSwap V3 (Base) wins on three things: speed, cost, and features. It’s the only DEX that combines all three at this scale.

And it’s expanding. The team is adding more chains, better analytics dashboards, and mobile app features. By mid-2026, they plan to introduce automated rebalancing for liquidity positions - meaning you won’t have to manually adjust ranges anymore.

Final Verdict

PancakeSwap V3 (Base) is the most advanced decentralized exchange for active traders and yield seekers. It’s faster than Ethereum DEXs, cheaper than centralized exchanges, and more powerful than older versions of PancakeSwap.

It’s not a “set it and forget it” tool. You need to understand price ranges, monitor your positions, and stay aware of market shifts. But if you’re willing to learn, the rewards are real.

If you’re trading stablecoins, holding ETH or WBTC, or looking to earn high yields without locking funds for months - this is the platform to use. Skip the noise. Skip the hype. Just try it with $50. See how it feels. You might never go back.

Is PancakeSwap V3 (Base) safe to use?

It’s as safe as any decentralized exchange. Your funds stay in your wallet. No one holds them. But the smart contracts aren’t audited by a government agency. There’s always a risk of bugs or exploits. Always start small. Use trusted wallets like MetaMask. Never connect to fake sites - always check the URL: pancakeswap.finance. Never share your private key.

Do I need to pay gas fees on Base?

Yes, but they’re tiny. Base uses a gas fee model that’s 10-100x cheaper than Ethereum. Most swaps cost under $0.10. Adding liquidity or creating a position might cost $0.20-$0.50. You’ll need some ETH or USDC in your wallet to cover these, but you won’t notice the cost.

Can I use PancakeSwap V3 (Base) on my phone?

Yes. Use the MetaMask or Trust Wallet mobile app. Open the app, switch to Base network, then tap the built-in DEX browser and go to pancakeswap.finance. You can trade, add liquidity, and manage positions directly from your phone. The interface is optimized for mobile.

What’s the difference between PancakeSwap V2 and V3?

V2 spreads your liquidity across all prices - you earn less, but it’s automatic. V3 lets you choose a price range - you earn more, but you have to manage it. V3 also adds limit orders, TWAPs, and smart routing. V2 is simple. V3 is powerful. V3 is the future.

Why Base? Why not BSC or Ethereum?

Base is fast, cheap, and backed by Coinbase. It’s designed for everyday users. BSC is also fast and cheap, but it’s been around longer and has more scams. Ethereum is secure but expensive. Base strikes the best balance: low cost, strong security, and growing adoption. If you’re new to DeFi, Base is the easiest entry point.

Does PancakeSwap V3 (Base) support NFTs or yield farming?

Yes. The main PancakeSwap site includes an NFT marketplace, prediction markets, and syrup pools for staking. But these are separate from the V3 trading engine. You can access them from the same site, but they operate independently. V3 is focused on trading and liquidity provision.

Is there a mobile app for PancakeSwap V3?

No standalone app. But the PancakeSwap interface works perfectly in mobile wallets like MetaMask and Trust Wallet. You don’t need a separate app. Just use your wallet’s built-in browser to access pancakeswap.finance. That’s how most users do it.

How do I withdraw my liquidity from a V3 position?

Go to the “Pool” section, find your position, click “Remove Liquidity,” and select how much you want to pull out. You’ll get back your original tokens - plus any fees earned. The system will show you exactly what you’ll receive before you confirm. No hidden surprises.

What happens if the price moves outside my liquidity range?

Your liquidity gets “inactive.” You stop earning fees until the price returns to your range. You don’t lose money - your tokens are still there. But you’re not earning. That’s why monitoring your range is important. Some users set wider ranges to avoid this. Others set tighter ones to earn more - and check daily.

Can I use PancakeSwap V3 (Base) without crypto?

No. You need crypto in your wallet to pay gas fees and to trade. You can’t buy crypto directly on PancakeSwap. Use a centralized exchange like Coinbase or Binance first to buy ETH, USDC, or WBTC, then transfer it to your wallet on Base.

1 Comments

Let’s cut through the noise-PancakeSwap V3 on Base isn’t just an upgrade, it’s a paradigm shift in liquidity efficiency. Concentrated liquidity isn’t some buzzword; it’s mathematically optimal capital allocation. When you deploy $5K between $3,200 and $3,400 for WETH/USDC, you’re not ‘risking’ price movement-you’re engineering yield density. V2 was liquidity theater. This? It’s institutional-grade price discovery on-chain. The 3x–5x fee capture isn’t anecdotal-it’s a direct function of the fee tier and tick spacing. Anyone still using V2 is leaving 80% of potential APY on the table. Period.