Crypto Exchange Reviews and Blockchain Trends in November 2025

When navigating the crypto world in late 2025, you need more than hype—you need crypto exchange, platforms where users buy, sell, or trade digital assets, often with varying levels of regulation, security, and liquidity. Also known as crypto trading platforms, these are the gateways to everything from stablecoin swaps to institutional-grade order books. Not all exchanges are created equal. Some, like FalconX, serve hedge funds with guaranteed execution and T+0 settlement. Others, like SOLIDINSTAPAY or GoodExchange, have no transparency, no reviews, and no real users—just empty promises. And then there are the dead ones: CoinCasso, MilkshakeSwap, SUIA—all once talked about, now gone with zero circulation or trading volume.

Behind these exchanges lie deeper shifts in how blockchains work. blockchain scalability, the ability of a network to handle growing transaction volume without slowing down or becoming too expensive. Also known as scalable blockchain design, it’s no longer about just making blocks bigger—it’s about splitting functions. Modular blockchains separate consensus, data storage, and execution, cutting costs and letting networks grow smarter. That’s why projects like Ardor, with its parent-child chain model, still matter even in a crowded market. Meanwhile, DeFi lending, the practice of lending crypto without banks, using smart contracts to match borrowers and lenders. Also known as non-custodial lending, it’s where real yield lives—in platforms like Aave, Compound, and Morpho. But not every platform is safe. Some, like Solarbeam, offer low fees and strong security scores. Others? Zero audits, zero liquidity, zero future. And then there’s the wild west of crypto airdrop, free token distributions meant to grow user bases, often tied to new projects or partnerships. Also known as token giveaways, they’re a minefield. The Impossible Finance x CoinMarketCap airdrop was real. The SOS Foundation one? A ghost. Dogelon Mars? No official airdrop. And KTN Adopt a Kitten? A contract risk waiting to happen. Even privacy coin delisting, the trend of major exchanges removing coins like Monero and Zcash due to regulatory pressure. Also known as FATF compliance crackdown, it’s reshaping what financial privacy means today. If you still use privacy coins, you’re either on niche DEXs or holding them off-exchange.

This archive isn’t just a list of articles—it’s a map of what actually happened in November 2025. You’ll find reviews of real exchanges, breakdowns of broken ones, and deep dives into the tech behind them. No fluff. No guesses. Just what worked, what blew up, and what you should never touch again. Whether you’re looking for the best DeFi lending platform, trying to avoid a scam airdrop, or wondering why privacy coins keep disappearing, everything you need is right here.

DFX Finance (Polygon) Crypto Exchange Review: A Niche Stablecoin Exchange for Cross-Border Payments

DFX Finance is a niche decentralized exchange on Polygon that swaps fiat-backed stablecoins like EURT and JPYC without USD intermediaries. It's fast, cheap, and built for cross-border payments - but not for casual traders.

Scalability Through Modularity in Blockchain Systems

Modularity transforms blockchain scalability by separating functions like data storage, consensus, and execution into independent layers. This approach cuts costs, boosts speed, and enables growth without sacrificing security.

CoinCasso Crypto Exchange Review: Is It Safe or a Scam?

CoinCasso was a crypto exchange that claimed to offer fiat trading and profit-sharing but is now confirmed dead and listed as a scam. Learn why it failed, how the fraud worked, and safer alternatives.

FalconX Crypto Exchange Review: Institutional Trading Powerhouse in 2025

FalconX is the leading institutional crypto exchange for hedge funds and asset managers, offering guaranteed execution, 24/7 options trading, and T+0 settlement. Learn how it compares to Coinbase Prime and why it's the top choice for large-scale traders.

North Korea Crypto Ban and State-Sponsored Hacking Operations in 2025

North Korea stole over $2.17 billion in crypto in 2025, mostly through the ByBit hack. State-sponsored hackers use remote workers and Cambodia-based laundering networks to fund nuclear programs. Here's how it works - and why it's getting harder to stop.

HDEX Crypto Exchange Review: Cross-Chain DEX with Potential but Limited Liquidity

HDEX is a cross-chain decentralized exchange supporting BTC, ETH, BSC, TRON, and more. It offers AMM and orderbook trading without custodial risk, but low liquidity and no audits make it risky for most users.

What is xPET tech (XPET) crypto coin? A practical guide to the SocialFi 2.0 pet game on Arbitrum

xPET tech (XPET) is a SocialFi 2.0 Web3 game on Arbitrum where you raise a digital pet on Twitter to earn tokens. Learn how it works, its risks, and whether it's worth your time in 2025.

Cambodia Banking Restrictions on Crypto Transactions: What You Need to Know in 2025

Cambodia's banking system bans most crypto transactions as of 2025, allowing only two licensed platforms. Learn how the NBC's strict rules impact users, banks, and remittances-and why Bakong is the government's chosen alternative.

What Are NFT Token Standards? ERC-721, ERC-1155, Solana, and More Explained

NFT token standards like ERC-721, ERC-1155, and Solana's protocol define how digital ownership works on blockchains. Learn how each standard differs in cost, speed, and use cases.

VDR Airdrop by Vodra x CoinMarketCap: How to Participate and What You Get

The Vodra x CoinMarketCap VDR airdrop offers 1,500 winners up to 2,898 VDR tokens. Learn how to enter, what VDR does, and why this isn't just another crypto giveaway.

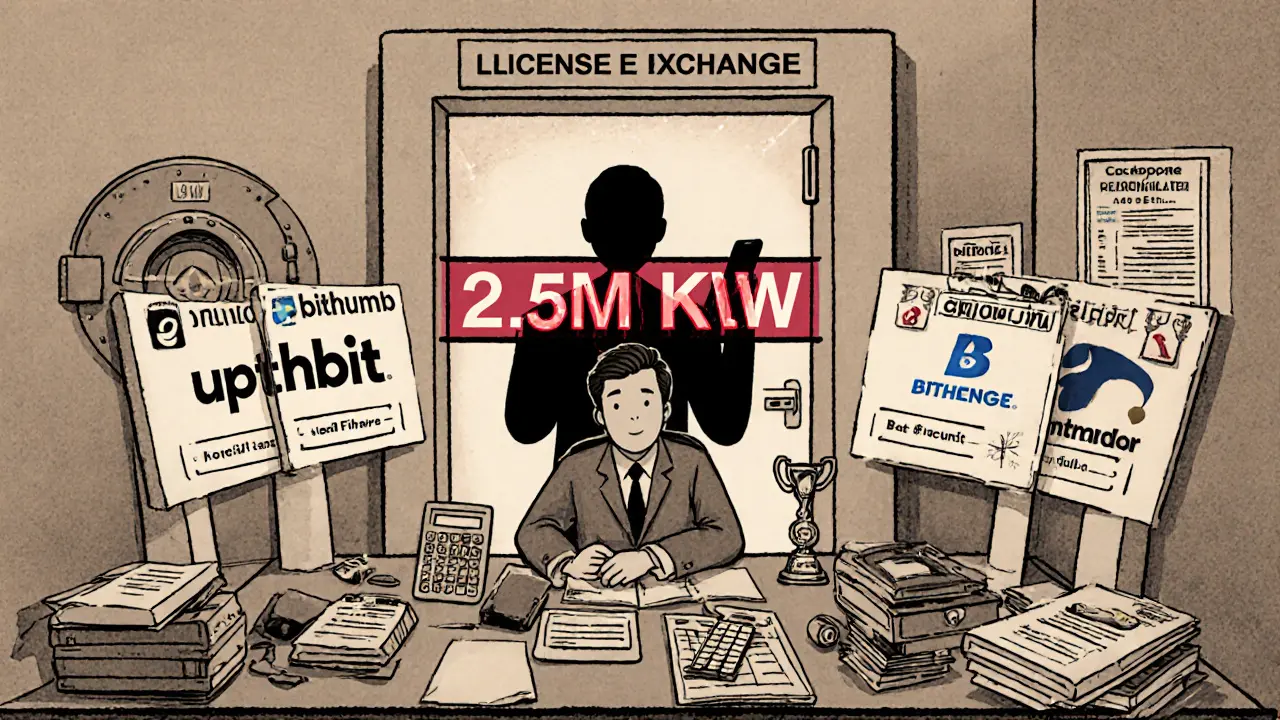

Korean Crypto Trading Restrictions and Rules: What You Need to Know in 2025

South Korea enforces strict crypto rules: only four licensed exchanges, real-name bank links, 20% tax on profits over 2.5M KRW, and no anonymous trading. Learn how to trade legally in 2025.

PlayerMon PYM Metaverse NFT Airdrop: What We Know and What’s Missing

No official PYM airdrop from PlayerMon has been confirmed as of November 2025. Learn what’s real, what’s fake, and how to avoid scams while waiting for any potential token launch.

© 2026. All rights reserved.