Korean Crypto Tax Calculator

Calculate Your Tax Liability

Korea taxes crypto profits over 2.5 million KRW at 20% starting January 1, 2025. Enter your profit to see your tax obligation.

Important Note

According to Korea's Financial Services Commission, all crypto transactions (including swaps, staking rewards, and airdrops) are taxable events. The 20% tax applies to profits exceeding 2.5 million KRW ($1,800) annually. Failure to report can result in penalties up to 40% of unpaid tax.

South Korea doesn’t just regulate cryptocurrency-it controls it. If you’re trying to trade crypto in Korea, you’re not just signing up for an app. You’re entering a tightly woven system of bank partnerships, government IDs, insurance mandates, and tax traps. This isn’t Silicon Valley. This isn’t Dubai. This is Korea, where anonymity is illegal, exchanges are licensed like banks, and your profits are taxed at 20% if you make more than 2.5 million KRW a year.

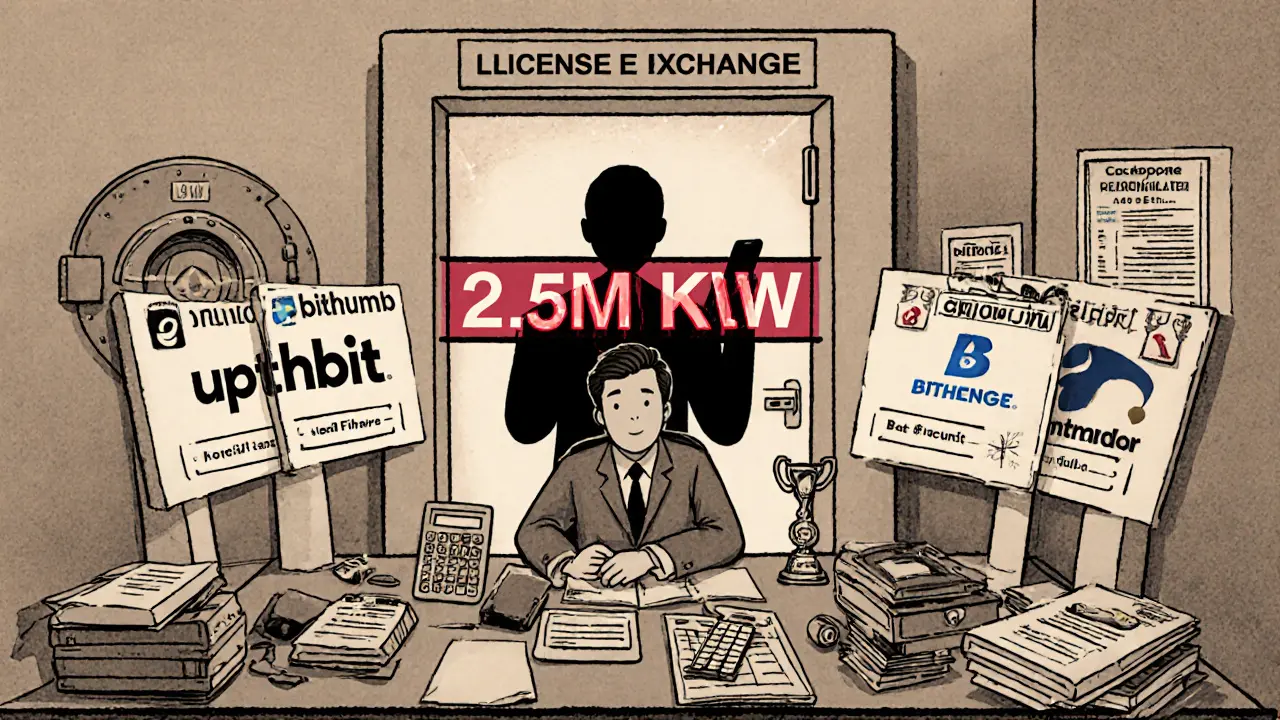

Only Four Exchanges Are Legal

You can’t just download any crypto app and start trading in Korea. Since March 2021, the Financial Services Commission (FSC) has required every crypto exchange to get a license. And only four have passed: Upbit, Bithumb, Coinone, and Korbit. These four handle over 95% of all domestic trading volume. If you’re using anything else-whether it’s a foreign app or a local startup-you’re breaking the law. The FSC has shut down more than 200 unlicensed platforms since 2021. No warnings. No grace periods. Just blocked.Real Name, Real Bank Account, No Exceptions

Anonymous trading? Gone. Since 2018, every crypto account in Korea must be tied to a real-name bank account. That means your name on your exchange profile must match your name on your bank account. No aliases. No joint accounts. No using your mom’s account. You have to link your government-issued ID (Korean Resident Registration Card or passport for foreigners) and verify your bank account through one of the big four: KB Kookmin Bank, Shinhan Bank, NH Nonghyup Bank, or Woori Bank. This isn’t just a formality. Exchanges must use real-time bank verification systems. If your bank doesn’t approve the link, you can’t trade. And if you try to deposit via international wire or credit card? It won’t work. Korea blocks those methods entirely. Your only path in and out of crypto is through a domestic bank transfer.Security Isn’t Optional-It’s Mandatory

Licensed exchanges must follow strict security rules. At least 70% of customer crypto must be stored in cold wallets-offline, air-gapped, and physically secured. The rest can be in hot wallets for trading, but even those are monitored 24/7. Every exchange must carry cyber insurance of at least 1 billion KRW ($750,000). That’s not a suggestion. That’s a legal requirement. And they need ISMS-P certification-the highest level of information security certification in Korea, issued by the Korea Internet & Security Agency. Getting it costs over 500 million KRW ($375,000) per exchange, annually. That’s why new exchanges rarely make it. The barrier to entry isn’t high. It’s nearly impossible. The result? Since 2021, there hasn’t been a single major hack on any of the four licensed exchanges. Compare that to global exchanges that lost over $3.8 billion in 2023-2024. Korea’s system works-because it’s built on control, not trust.

What Coins Can You Actually Trade?

Here’s where things get frustrating. While global platforms like Binance or Coinbase list 600+ cryptocurrencies, Korean exchanges typically offer only 200-300. Many newer or smaller projects-especially DeFi tokens, memecoins, or privacy coins-are simply not listed. Why? Because the FSC requires exchanges to vet every coin for risk, legality, and technical stability. Many projects don’t pass. Traders complain. A lot. Reddit threads and Naver Cafés are full of posts like: “Why can’t I buy $SOL on Upbit?” or “I found a new DeFi token-why isn’t it here?” The answer: compliance. Korean exchanges avoid anything that could trigger regulatory scrutiny. That means no anonymous coins, no unverified projects, no tokens tied to offshore entities. If you want access to more coins, you’ll have to use foreign exchanges. But then you’re violating Korea’s banking rules. And if your bank catches you sending money overseas for crypto? They’ll freeze your account.20% Tax on Profits-And It Starts in 2025

Korea’s crypto tax rules are among the strictest in the world. Starting January 1, 2025, any profit from crypto trading over 2.5 million KRW ($1,800) in a year is taxed at 20%. That’s not a capital gains rate. That’s a flat income tax on net gains. Losses can be carried forward, but only if you file properly. You have to report every trade-buy, sell, swap, stake, earn interest. Even if you swap BTC for ETH, that’s a taxable event. The tax authority, National Tax Service, can request transaction data from all four exchanges. They already have it. You don’t get to hide. Most traders don’t realize how quickly they hit the 2.5 million KRW threshold. A $2,000 profit on a single trade is enough. Many end up owing thousands in taxes they didn’t plan for.Who’s Allowed to Trade?

Anyone with a Korean ID or valid foreign passport can trade. But the process is heavy. First, you need a Korean bank account. Then, you need to complete Level 3 verification: upload your ID, link your bank account, and do a live video call with the exchange’s compliance team. This can take 3-7 days during busy periods. Foreigners living in Korea can do it-but only if they have a resident registration number. Tourists? No. You can’t open a bank account without residency. So if you’re visiting Seoul for a week and want to buy some Bitcoin? You can’t.

What’s Next? Stablecoins, CBDCs, and More Rules

In September 2024, the FSC announced new rules for stablecoins. USDT and USDC must now be fully backed by reserves and audited monthly. No more “we’re 95% backed” excuses. Every dollar must have a dollar in the bank. And in Q1 2025, Korea will start testing its own Central Bank Digital Currency (CBDC). This isn’t just a digital won-it’s a government-controlled alternative to private crypto. The goal? To reduce reliance on Bitcoin and Ethereum for daily transactions. Industry insiders say this is the next phase: not banning crypto, but replacing it with something the state controls.Is Korea’s System Working?

Yes-and no. On one hand, Korean traders have the safest crypto experience in the world. No hacks. No rug pulls. No exchange collapses. The Bank of Korea estimates 4.6 million active crypto users in 2024, with 87% reporting high satisfaction with security. Institutional players like Samsung Securities and KB Securities are now offering crypto custody services. That’s a sign of trust. But the cost? Innovation is stifled. New projects can’t launch in Korea. Developers leave for Singapore or Hong Kong. Retail traders complain about limited coin choices. And the tax system? It’s a minefield. Korea’s model is a paradox: the most secure crypto market in the world… and one of the most restrictive.How to Trade Legally in Korea in 2025

If you’re in Korea and want to trade crypto legally, here’s your checklist:- Get a Korean bank account (or a foreign passport with Korean residency)

- Choose one of the four licensed exchanges: Upbit, Bithumb, Coinone, or Korbit

- Complete Level 3 verification: ID + bank link + video call

- Deposit KRW via domestic bank transfer only

- Trade only listed coins (check the exchange’s official list)

- Track every trade-buy, sell, swap

- File taxes if your annual profit exceeds 2.5 million KRW

Can I use Binance or Coinbase in South Korea?

You can access Binance or Coinbase from South Korea, but you can’t fund them legally. Korean banks block transfers to foreign crypto exchanges. If you try to send KRW overseas for crypto, your bank will flag or freeze your account. You also won’t be able to complete KYC on those platforms using a Korean ID. So while you can log in, you can’t trade properly without breaking banking rules.

Are privacy coins like Monero allowed in Korea?

No. Privacy coins are banned on all licensed Korean exchanges. The FSC considers them high-risk for money laundering. Even if you find a way to buy them overseas, sending money to get them violates Korea’s real-name banking rules. Exchanges actively block transactions linked to privacy coin wallets.

Do I have to pay tax on crypto staking rewards?

Yes. Starting in 2025, all crypto income-including staking rewards, airdrops, and interest from lending-is taxable. The 20% tax applies to the fair market value of the reward in KRW at the time you receive it. You must report this as income, even if you don’t sell the asset.

Can I trade crypto if I’m a foreign student in Korea?

You can, but only if you have a Korean Resident Registration Number (RRN). Without it, you can’t open a bank account, and without a bank account, you can’t verify your identity on Korean exchanges. If you’re on a short-term visa, you’re not eligible to trade legally.

What happens if I don’t file my crypto taxes?

The National Tax Service can access all trading records from Upbit, Bithumb, and the other licensed exchanges. If you’re underreporting or not filing, you’ll face penalties of up to 40% of the unpaid tax, plus interest. In severe cases, they can freeze your bank accounts or issue a criminal investigation. Crypto tax evasion is no longer ignored-it’s actively pursued.

7 Comments

So Korea basically turned crypto into a bank branch with extra steps. No wonder people are still trading on shady platforms despite the risk. At least the system works-no hacks, no scams, no rug pulls. But man, it’s like trading in a museum where everything’s behind glass.

This is what happens when you let regulators think they’re protecting people instead of controlling them. You don’t make markets safer by banning everything that moves fast-you make them stagnant. And then you wonder why developers leave. This isn’t regulation. It’s crypto apartheid.

Let me just say-20% tax on profits starting in 2025? That’s not a tax. That’s a confession booth. You’re not just reporting income, you’re admitting you had a good year. And if you’re a trader who moves fast? You’re gonna get nailed by the NTS before you even cash out. They already have your trades. You’re not hiding anything. Not even your coffee purchases.

Okay, so to trade legally: bank account, ID, video call, only four exchanges, only listed coins, track every single trade, pay tax if over 2.5 million KRW. That’s seven steps. Miss one? Bank gets frozen. That’s not a system. That’s a trap. And it’s not even about money-it’s about control. People don’t want to be babysat when they invest.

There’s something deeply human about wanting freedom in finance. But Korea’s model shows that safety and control aren’t opposites-they’re two sides of the same coin. Maybe the real question isn’t whether this system works, but whether we want to live in a world where financial privacy is dead by design. We traded anonymity for security. But did we ever ask if we wanted to?

At least they’re not letting people get scammed. I’ve seen too many friends lose everything on random tokens. Korea’s rules are brutal, but they’re keeping people from blowing up their savings. I’d rather have fewer coins and no nightmares.

they blocked us from using credit cards? really? so now i have to wait 3 days for a bank transfer just to buy dogecoin? this is the future? lol