HDEX Cross-Chain Swap Fee Calculator

Estimate gas fees and potential slippage for cross-chain swaps on HDEX. Note: HDEX has limited liquidity which may affect your trade.

Enter details to see fee estimates

Most crypto traders know the frustration: you want to swap Bitcoin for TRON tokens, but your exchange only supports one chain. You’re stuck using bridges, paying extra fees, and trusting third parties with your keys. That’s where HDEX claims to solve the problem-by letting you trade directly across six major blockchains without ever giving up control of your assets.

What Is HDEX?

HDEX is a decentralized exchange built on Bluehelix’s cross-chain infrastructure. Unlike Uniswap, which mostly runs on Ethereum, or PancakeSwap, locked into BSC, HDEX connects Bitcoin, Ethereum, Binance Smart Chain, Huobi ECO Chain, TRON, and Dogecoin-all in one place. You don’t need to wrap BTC into wBTC or move assets through a centralized bridge. HDEX handles the cross-chain swap directly using smart contracts.

It’s not just another AMM (Automated Market Maker) like Uniswap. HDEX mixes two trading styles: AMM for simple swaps and a traditional orderbook for limit and stop orders. That’s rare in DeFi. Most DEXes stick to one model. HDEX gives you the choice: quick, automatic trades or precise, manual control.

It’s non-custodial. Your keys stay with you. No one holds your crypto-not even HDEX. That’s a big deal after FTX, Celsius, and other centralized exchanges collapsed and stole billions in user funds.

How HDEX Works

To use HDEX, you need a Web3 wallet like MetaMask or Trust Wallet. You connect it, select the chain you’re sending from (say, BSC), pick the token (like BNB), then choose what you want to receive (say, TRX on TRON). HDEX finds the best path across chains and executes the swap.

Here’s the catch: each chain has its own gas fee. If you’re swapping from Bitcoin, you need BTC to pay the miner fee. From BSC? You need BNB. From Ethereum? ETH. There’s no universal fee token. You have to manage multiple native currencies, which adds complexity.

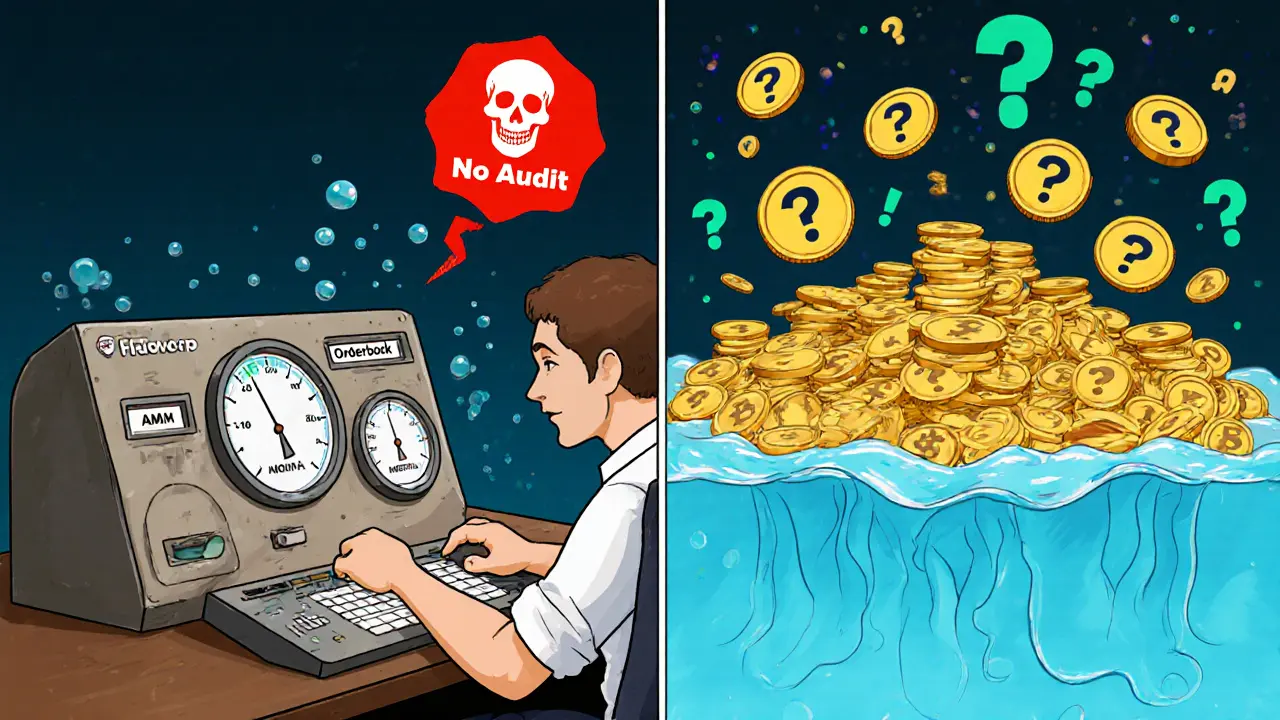

The platform uses the Bluehelix OpenDEX protocol for atomic swaps. That means the trade either completes fully or fails entirely-no partial swaps. It’s safer than bridges that can get hacked (remember the $600 million Multichain exploit in 2024?). But HDEX doesn’t publish audit reports. No third-party security review is publicly available. That’s a red flag.

Supported Chains and Tokens

HDEX supports six blockchains right now:

- Bitcoin (BTC)

- Ethereum (ETH)

- Binance Smart Chain (BSC)

- Huobi ECO Chain (HECO)

- TRON (TRX)

- Dogecoin (DOGE)

That’s a solid list-covering the most popular chains by user base. But there’s no Solana, Avalanche, or Polygon. And while Bitcoin is included, it’s not natively smart contract-enabled. HDEX uses a wrapped version or sidechain mechanism to make BTC tradable, which introduces some trust assumptions.

Token support is limited to the native assets of those chains. No obscure memecoins, no new DeFi tokens. You won’t find Shiba Inu or Pepe here. That’s actually good for safety-but limits trading options.

Trading Experience: AMM vs Orderbook

HDEX’s hybrid model is its strongest feature. Most DEXes only offer AMM, which means you get the current market price with slippage. If you want to buy ETH at exactly $3,200, you’re out of luck on Uniswap unless you use a limit order on a centralized exchange.

HDEX lets you place limit orders. You can set a price to buy or sell, and the system waits until it’s met. That’s huge for traders who don’t want to guess the market.

But here’s the trade-off: orderbook liquidity is thin. You won’t find deep markets like you do on Binance or Coinbase. If you try to trade $10,000 worth of ETH for TRX, you’ll likely get slippage or partial fills. The AMM pools are small too. Compared to Uniswap’s $320 billion in 2024 volume, HDEX’s numbers are invisible. No public stats. No DappRadar ranking. That suggests low usage.

Comparison: HDEX vs Uniswap vs PancakeSwap

Here’s how HDEX stacks up against the leaders:

| Feature | HDEX | Uniswap | PancakeSwap |

|---|---|---|---|

| Supported Chains | 6 (BTC, ETH, BSC, HECO, TRON, DOGE) | 1 (Ethereum + Layer 2s) | 1 (BSC) |

| Trading Modes | AMM + Orderbook | AMM only | AMM only |

| Custody Model | Non-custodial | Non-custodial | Non-custodial |

| 2024 Trading Volume | Not disclosed | $320 billion | $180 billion |

| Security Audits | None publicly available | Multiple (Consensys, CertiK) | Multiple (Hacken, CertiK) |

| User Base | No public data | 2.5M+ monthly | 1.8M+ monthly |

| Customer Support | Community-only | Community + limited docs | Community + docs |

HDEX wins on multi-chain support. It loses on everything else: liquidity, security proof, user base, and support. Uniswap and PancakeSwap are proven. HDEX is experimental.

Who Is HDEX For?

HDEX isn’t for beginners. If you’re new to crypto, stick to Coinbase or Kraken. HDEX requires you to understand gas fees, wallet management, and blockchain networks. You need to know when to use BSC vs TRON based on cost and speed.

It’s for advanced users who:

- Own assets on multiple chains and hate bridging

- Want limit orders without switching to a centralized exchange

- Trust decentralized tech more than companies

- Are willing to trade smaller amounts because liquidity is thin

It’s not for investors looking for high-volume trading or quick exits. You won’t find big orders filled here. It’s for niche use cases: swapping BTC to TRX without using a bridge, or trading DOGE to ETH without leaving your wallet.

Risks and Downsides

There are real risks with HDEX:

- No audits: No public security review. No one knows if the smart contracts are safe.

- Low liquidity: Small pools mean slippage and failed trades.

- No support: No live chat, no email, no help center. You’re on your own.

- Unclear roadmap: No announced updates, no timeline for new chains or features.

- Regulatory gray zone: Multi-chain DEXes could attract scrutiny from regulators, especially if HBC tokens are seen as securities.

Remember: the Multichain bridge hack wiped out $600 million in 2024. HDEX doesn’t use a bridge, but its cross-chain tech is still new. If a flaw is found, funds could be lost-and there’s no recovery team.

The Future of HDEX

HDEX has a Global Ambassador Program. People get paid in HBC tokens to promote it. That’s a sign they’re trying to grow-but it’s not the same as organic adoption. No one is talking about HDEX on Reddit or Twitter. No major crypto YouTubers review it. It’s not listed in any “Best DEX 2025” guides.

The idea of cross-chain DEXes is solid. Gartner predicts 60% of DeFi volume will cross chains by 2026. But HDEX isn’t leading that wave. It’s one of many trying to ride it. The real winners will be the ones with deep liquidity, strong audits, and easy-to-use interfaces.

HDEX could grow-if it gets funding, publishes audits, and attracts liquidity providers. But right now, it’s a prototype with potential, not a reliable tool.

Final Verdict

HDEX is an interesting experiment. It solves a real problem: cross-chain trading without bridges. The orderbook + AMM combo is smart. The non-custodial model is correct.

But it’s not ready for prime time. Low liquidity. No audits. No support. No track record.

If you’re a technically skilled user with small amounts to swap across chains, and you’re okay with risk, give it a try. Use only what you can afford to lose.

For everyone else? Stick with Uniswap, PancakeSwap, or a trusted centralized exchange. Wait until HDEX proves itself.

Is HDEX safe to use?

HDEX is non-custodial, so your keys stay with you-that’s good. But there are no public security audits, no bug bounty program, and no history of incident reports. Without verified audits, you can’t be sure the smart contracts are secure. Use only small amounts you can afford to lose.

Does HDEX support limit orders?

Yes. HDEX is one of the few decentralized exchanges that offers both AMM and traditional orderbook trading. You can set limit and stop orders, which is rare in DeFi. But because liquidity is low, your orders may not fill quickly-or at all.

What wallets work with HDEX?

HDEX works with MetaMask, Trust Wallet, and other Web3 wallets that support multiple blockchains. You need to have the correct native token for each chain (like BNB for BSC, ETH for Ethereum) to pay gas fees. No fiat on-ramps or credit card support.

Is HDEX better than Uniswap?

Only if you need to trade across six chains without bridges. Uniswap has far more liquidity, better security, and a proven track record. HDEX’s cross-chain feature is unique, but it’s not faster, cheaper, or safer. For most users, Uniswap is the better choice.

Can I earn HBC tokens on HDEX?

Yes, through the Global Ambassador Program. You can earn HBC tokens by creating content, recruiting users, or reporting bugs. But HBC is not listed on major exchanges, so it has little liquidity or value right now. Don’t expect to cash out.

Is HDEX available in the United States?

HDEX doesn’t restrict access by country, so technically yes. But it’s not listed on any U.S.-focused exchange comparison guides, and there’s no compliance information. Using it may carry regulatory risk, especially if HBC tokens are later classified as securities.

6 Comments

HDEX is basically DeFi’s ‘cool kid’ trying to be edgy but forgot to bring snacks. I’ve used it to swap BTC to TRX-worked once, then gas fees ate my BNB like a hungry raccoon. No audits? Bro, I’d rather trust a meme coin than this. 🤡

I tried HDEX last week because I was tired of bridging. The orderbook feature is 🔥 but the liquidity? More like a puddle. Tried to dump 2 ETH for TRX and got 0.3 back. Also, no support? I sent a DM on X and got a bot reply that said ‘stay decentralized’ 😂 Still, the idea is genius. Just needs 100x more users.

Look, I get why people are skeptical-but HDEX is like that weird startup that doesn’t have a website but somehow runs a rocket ship. The cross-chain tech? Solid. The fact that you don’t need to trust a middleman? HUGE. Yeah, liquidity’s thin, but so was Uniswap in 2018. If you’re patient, this could be the foundation of the next-gen DeFi layer. Don’t write it off because it’s quiet. Quiet doesn’t mean dead. 🌱

This is a scam waiting to happen. No audits? No team? No transparency? And you’re calling this ‘innovation’? LOL. You’re not a trader-you’re a lab rat. HDEX is a graveyard for crypto newbies who think ‘non-custodial’ means ‘safe.’ Remember Poly Network? Remember Wormhole? This is the same energy. If you’re dumb enough to use this, you deserve to lose everything. 🚨💸

I love how people act like DeFi has to be a giant, liquid, audited platform to be valid. HDEX is a prototype. It’s not meant for everyone. It’s meant for people who care about sovereignty over convenience. I’ve swapped 0.1 BTC to DOGE on it three times. Each time, my keys stayed mine. That’s worth more than 1000x the volume on Uniswap. If you’re scared of risk, fine-but don’t call it useless because it doesn’t look like Binance. Maybe the future isn’t loud. Maybe it’s quiet. And maybe that’s okay.

HDEX is just a glorified script. No one uses it. No one talks about it. Why? Because it’s trash. If it was good, it’d be on CoinGecko. It’s not. End of story. Stop pretending it’s the next big thing. It’s not. It’s a ghost town with a fancy UI.