RingLedger Crypto Archive: March 2025 Market Moves and Airdrops

When you’re trying to make sense of crypto airdrops, free token distributions given to wallet holders as incentives or rewards. Also known as token giveaways, they’re one of the most direct ways new projects build communities and reward early supporters. March 2025 delivered a wave of them—some tiny, some with real value. Not every airdrop is worth your time, but the ones that mattered this month had clear eligibility rules, active teams, and real utility behind them. RingLedger tracked every one that met the bar: no vaporware, no pump-and-dump schemes. Just what’s real.

Behind every airdrop is a bigger story: blockchain insights, practical, non-hype analysis of how networks behave, who’s building on them, and where value is actually moving. This month, we saw Ethereum L2s like Arbitrum and Base dominate transaction volume, not because of flashy marketing, but because developers kept shipping tools that actually reduced fees and sped up trades. Meanwhile, Solana’s ecosystem quietly recovered from last year’s lull, with new DeFi protocols launching that didn’t rely on speculative yield farming. These aren’t trends you hear on Twitter—they’re patterns you see in on-chain data, and we broke them down for you without the noise.

And then there’s crypto exchanges, platforms where you buy, sell, and store digital assets, each with different fees, security levels, and supported tokens. In March, two major exchanges changed their listing policies—one started requiring projects to prove real usage before being added, another dropped support for six low-liquidity coins. These aren’t minor tweaks. They shape what you can trade, how safe your funds are, and even what new tokens might succeed. We didn’t just report these changes; we explained what they meant for your portfolio.

Market updates in March weren’t about price spikes. They were about quiet shifts: a wallet address that moved 12 million tokens from a long-dormant vault, a new wallet standard that made cross-chain swaps faster, a regulatory hint from the SEC that didn’t panic the market but made developers rethink compliance. These are the signals that matter when you’re not just gambling but building a strategy.

What you’ll find in this archive isn’t a list of headlines. It’s a collection of real actions taken by real people—developers, traders, early adopters—whose choices moved the needle. No fluff. No recycled news. Just the stuff you need to know to stay ahead without chasing every rumor.

Most Expensive NFTs Ever Sold: Record-Breaking Digital Art Sales

The most expensive NFTs ever sold include Murat Pak's $91.8 million 'The Merge,' Beeple's $69.3 million 'Everydays,' and rare CryptoPunks. These sales redefined digital art ownership during the 2021-2022 boom.

Metaverse Cryptocurrency and Tokens: How Digital Assets Power Virtual Worlds

Metaverse cryptocurrencies like MANA, SAND, and RENDER power virtual worlds where users buy land, create content, and earn real income. Learn how these tokens work, who's winning, and how to get started without falling for scams.

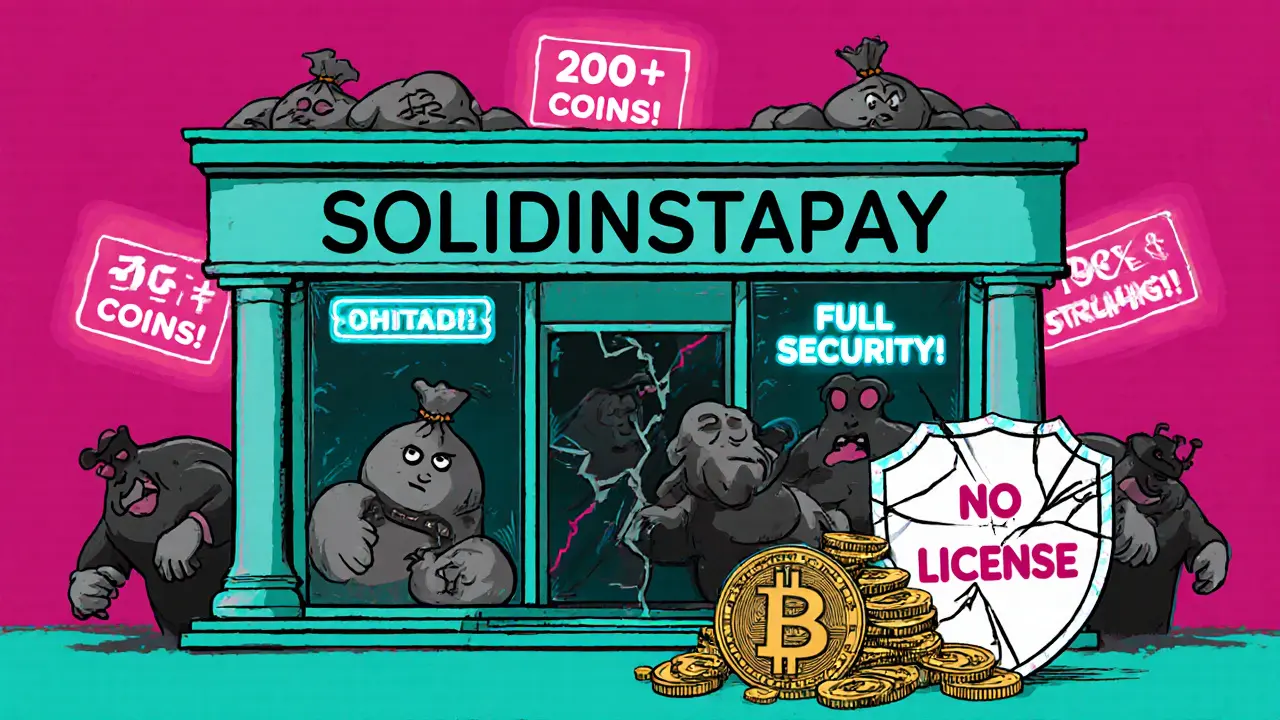

SOLIDINSTAPAY Crypto Exchange Review: Is It Safe to Trade Here?

SOLIDINSTAPAY is an unregulated crypto exchange with no transparency, user reviews, or proof of funds. Avoid it - your money isn't safe. Use regulated platforms like Gemini or Uphold instead.

1MIL Airdrop by 1MillionNFTs: What’s Real, What’s Not, and Where to Watch

No official 1MIL airdrop exists from 1MillionNFTs. Learn what the project actually does, how the 1MIL token works, and why confusion with Monad's Nads airdrop is causing false rumors.

What is Coin Stock (STOCK) crypto coin? The truth behind the scam token

Coin Stock (STOCK) claims to offer tokenized stocks backed 1:1 by real equities, but it's a scam with fake data, impossible future dates, and zero regulatory oversight. Don't invest.

Wrapped Asset Custody and Trust: How Cross-Chain Tokens Are Managed and Why It Matters

Wrapped asset custody lets Bitcoin and other cryptos move across blockchains-but it relies on centralized custodians who hold your real assets. Understand how WBTC, cbBTC, and others work, their risks, and why regulation is changing everything.

Wealth Tax Treatment of Crypto in Switzerland: What You Need to Know in 2025

Switzerland doesn't tax crypto gains for private investors, but you must declare all holdings at year-end. Wealth tax applies based on cantonal rates, while staking and mining are taxed as income. Learn the rules for 2025.

Fundamental Analysis Frameworks for Blockchain Investments

Fundamental analysis frameworks help you evaluate blockchain projects based on real data-tokenomics, usage, team, and economics-not hype. Learn how to spot undervalued crypto assets and avoid costly mistakes.

What is MilkshakeSwap (MILK) crypto coin? The truth about this low-liquidity BSC DEX

MilkshakeSwap (MILK) is a nearly defunct DEX on Binance Smart Chain with almost no liquidity, zero development, and a token that lost 99.99% of its value. Avoid it-use PancakeSwap instead.

© 2026. All rights reserved.