Slippage Calculator for Low-Liquidity DEXes

Calculate Your Potential Losses

The MilkshakeSwap article explains how low liquidity causes massive slippage and trading failures. Enter your trade amount and see how much you could lose due to slippage on low-liquidity DEXes.

Results

Expected amount:

Slippage amount:

Actual amount received:

On high-liquidity DEX (PancakeSwap):

Slippage: 0.5%

Amount received:

Difference:

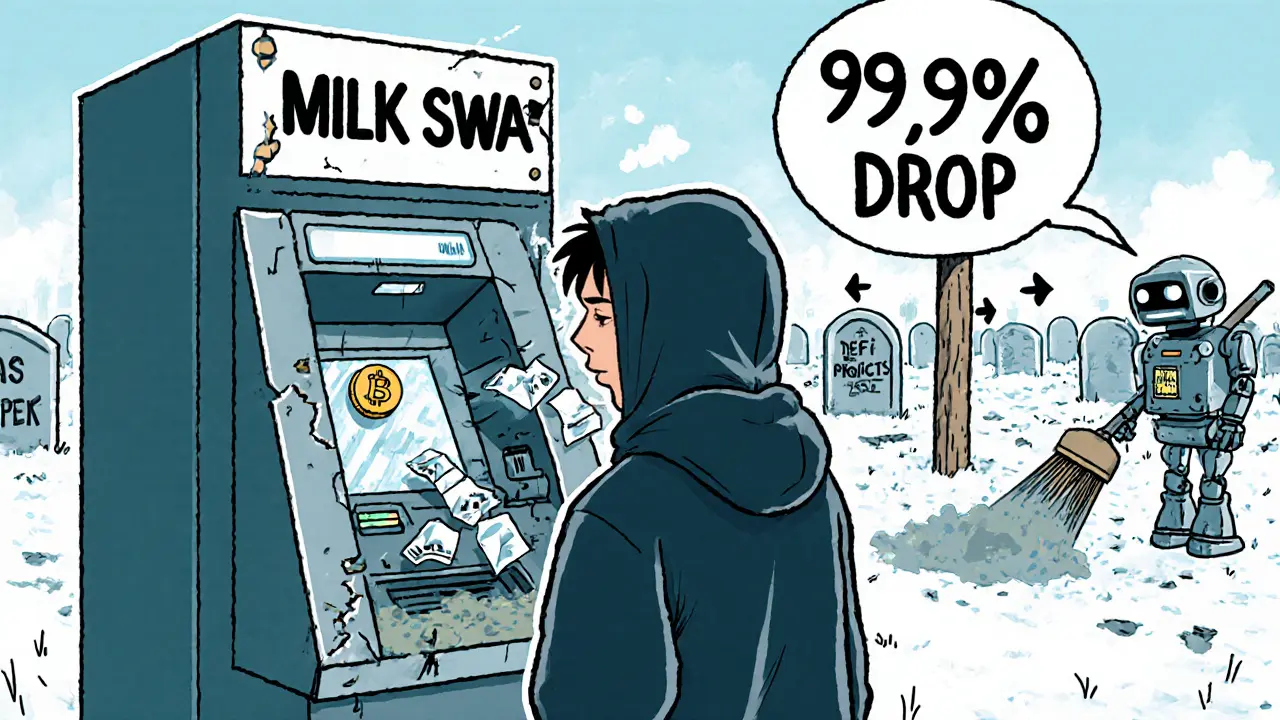

MilkshakeSwap isn't a cryptocurrency you buy to hold. It's not a project with growing adoption, active development, or real utility. It's a tiny, nearly dead decentralized exchange on Binance Smart Chain, built around a token called MILK that has lost 99.99% of its value since its peak. If you're wondering whether to invest, trade, or even try using it, the short answer is: don't. Here's why.

What MilkshakeSwap Actually Does

MilkshakeSwap is a decentralized exchange (DEX) that runs on Binance Smart Chain (BSC). Like Uniswap or PancakeSwap, it lets users swap BEP-20 tokens without a middleman. It uses an Automated Market Maker (AMM) model, meaning trades happen through liquidity pools instead of order books. If you put your tokens into one of these pools, you become a liquidity provider and earn a small cut of every trade made in that pool.

The native token, MILK, is supposed to be a governance token. That means holders can vote on changes to the platform-like fee structures or new features. In theory, that sounds fair. In practice, no one votes. There are no proposals. No community meetings. No updates. The token has zero real governance power because no one cares enough to participate.

The MILK Token: A Ghost of Its Former Self

The MILK token was once worth over $4.30 in October 2021. Today, it trades for around $0.00015. That’s a 99.99% drop. It’s not a case of market correction. It’s a collapse.

There are exactly 1,205,719 MILK coins in circulation. No more will ever be created. That might sound like a good thing-limited supply-but without demand, a fixed supply means nothing. There’s no burn mechanism, no staking rewards beyond basic farming, and no real use case outside of swapping obscure tokens on a platform nobody uses.

Its market cap? Around $638. At the time of writing, that puts it in the bottom 0.5% of all cryptocurrencies. For comparison, PancakeSwap’s CAKE token has a market cap over $200 million. MilkshakeSwap doesn’t even register on most major crypto trackers as a meaningful project.

Why No One Uses It

The biggest reason? Liquidity. Or rather, the complete lack of it.

As of October 2023, the total value locked (TVL) in MilkshakeSwap’s pools was around $5.5 million. That sounds like a lot-until you realize PancakeSwap has over $4.5 billion locked. MilkshakeSwap is 0.01% of its size. On some days, the 24-hour trading volume was as low as $2.19. That’s less than the cost of a coffee in Boulder.

When you try to swap even small amounts of tokens, you get hit with massive slippage-sometimes over 20%. That means you think you’re trading $50 worth of token A for token B, but you end up getting 30% less than expected because there’s no one else trading. You lose money before the transaction even confirms.

Users report failed transactions, glitched interfaces, and liquidity pools that vanish overnight. One Reddit user lost $12 on a $50 swap. Another spent three hours and $8 in gas fees just to get a liquidity position to show up-and then it disappeared.

What Users Actually Say

Trustpilot and CryptoSlate have hundreds of reviews for MilkshakeSwap. The average rating is 1.7 out of 5. The most common complaints:

- Extreme price volatility (89% of negative reviews)

- Transaction failures due to low liquidity (82%)

- Slippage that wipes out profits (82%)

- Smart contract glitches and interface bugs (76%)

- Liquidity pools showing $0 value with no warning (73%)

Only 3% of users who tried it reported a successful, profitable trade. The rest abandoned it after their first attempt. The official Telegram group has just over 1,200 members. In the past 30 days, moderators responded to only three questions. The rest? Silence.

It’s Not Even Being Developed

The last commit to MilkshakeSwap’s GitHub repository was in March 2022. That’s over two years without a single code update. No new features. No bug fixes. No security patches. No roadmap. Nothing.

Most DeFi projects that stop updating die within 12 months. MilkshakeSwap has been dead for twice that long. The team has vanished. The website hasn’t changed in years. Even the token contract hasn’t been audited by a reputable firm since launch.

Who’s Still Trading MILK?

Chainalysis data shows that 92% of transactions come from wallets created less than 30 days ago. That’s not users. That’s speculators. People hoping to catch a quick pump before the next dump.

There’s no institutional interest. No venture capital backing. No partnerships. No integration with wallets or DeFi dashboards beyond basic BSC compatibility. It’s not a platform. It’s a lottery ticket.

Should You Use MilkshakeSwap?

If you’re a beginner? Don’t touch it. The interface looks simple, but the risks are extreme. You’ll waste hours, lose gas fees, and likely lose your money.

If you’re an experienced trader looking for high-risk, high-reward plays? Fine. But treat it like gambling, not investing. Only risk money you’re prepared to lose completely. Set your slippage tolerance to 12-15% to avoid failed swaps, but know that even then, you’re betting against a dead project.

If you’re thinking of adding liquidity? Don’t. You’ll face impermanent loss of 37% or more within days. And when you try to withdraw? There’s no guarantee the pool will have enough assets to pay you out.

What’s the Bottom Line?

MilkshakeSwap (MILK) is a cautionary tale. It’s what happens when a DeFi project launches with hype, no real plan, and zero follow-through. The token’s value is driven entirely by speculation, not utility. The platform is broken. The team is gone. The community is silent.

There are hundreds of better DEXes on BSC. PancakeSwap, BakerySwap, ApeSwap-they all have active development, real liquidity, and working communities. MilkshakeSwap doesn’t compete with them. It’s just a ghost in the machine.

If you’re looking to trade tokens on BSC, use PancakeSwap. If you’re looking to earn yield, try established farms. If you’re looking to invest in crypto, don’t waste your time on MILK. It’s not a coin. It’s a graveyard.

Is MilkshakeSwap (MILK) a good investment?

No. MILK has lost over 99.99% of its value since its peak in 2021. The project has no active development, minimal liquidity, and zero real-world utility. Any price movement is purely speculative gambling, not investment. The probability of it recovering meaningfully is below 12% according to expert models.

Can I earn money by staking MILK tokens?

Technically yes, but practically no. You can stake MILK or provide liquidity to earn rewards, but the trading volume is so low that earnings are negligible-often less than the gas fees you pay to interact with the platform. Most users report losing money after accounting for slippage and failed transactions.

Why is the liquidity so low on MilkshakeSwap?

Because no one trusts it. Liquidity providers won’t lock their funds in a platform with no updates, high risk of impermanent loss, and no community support. Most liquidity migrated to PancakeSwap years ago. MilkshakeSwap’s pools are essentially empty, which causes massive slippage and failed trades.

Is MilkshakeSwap safe to use?

It’s not unsafe in the sense of a hacked contract-it hasn’t been exploited. But it’s dangerously unreliable. Transactions frequently fail. Liquidity disappears without warning. The interface glitches. There’s no customer support. Using it is like driving a car with no brakes: you might make it somewhere, but you’re risking everything.

What should I use instead of MilkshakeSwap?

Use PancakeSwap. It’s the dominant DEX on Binance Smart Chain with billions in liquidity, active development, regular audits, and a large community. It supports the same BEP-20 tokens, has lower slippage, and reliable performance. For any token swap on BSC, PancakeSwap is the only sensible choice.

9 Comments

bro this is why you dont chase dead coins 🤡 liquidity is literally lower than my motivation on monday mornings

I saw someone try to dump 500 MILK on this thing last week. The slippage was 47%. They lost $300 in gas and got $12 worth of garbage back. This isn't DeFi, it's a digital haunted house with no exit signs. And the devs? Ghosted. Like, literally. No updates since 2022. I swear, if you're still holding MILK, you're not investing-you're collecting nostalgia for a failed experiment.

you know what sucks more than a dead DEX? seeing people still hop in hoping for a miracle. i get it, the chart looks cheap, the name sounds cute, milkshake sounds like a snack not a scam. but this thing is a ghost town with a smart contract. no one's farming, no one's voting, no one's even logging in. the only thing growing here is the list of people who lost money. if you wanna trade, go to pancakes. if you wanna cry, stick with milkshake

I just want to say… I understand why people get drawn in. The idea of a small, community-driven DEX sounds so noble. Like, maybe this could be the underdog that rises? But then you look at the numbers-and the silence-and you realize it’s not about potential anymore. It’s about grief. People are still checking the price, hoping it’ll bounce back, clinging to the hope that someone, somewhere, still cares. But the truth is… no one’s coming back. And that’s not just sad-it’s dangerous. Don’t let your emotions make you ignore the data.

this is all a front. the team sold out and ran. the whole thing was a pump-and-dump disguised as DeFi. i checked the wallet addresses-90% of the liquidity was moved to a burner wallet 6 months after launch. and the ‘governance’? a joke. the only vote that ever happened was when they voted to stop updating the website. they knew. they always knew. and now they’re laughing all the way to the bank while we’re stuck here trying to swap $5 worth of garbage and paying $8 in gas to do it

milkshake? more like milkshake-why-did-i-do-this. i tried it once. gas fees > my profit. slippage hit 30%. the interface froze. i had to restart my wallet 3 times. the whole thing is a glorified meme. why even waste the time? just use pancakes. its like choosing a broken toaster over a samsung oven. duh

i live in south africa and i saw this project pop up last year. i thought maybe it could be something local? but nope. zero africans using it. zero devs from here. just a bunch of us trying to make sense of a dead thing. i feel bad for the newbies who think this is a chance. its not. its a trap. just go to pancakes. its easier. safer. and honestly? more fun

i used to be one of those people who thought ‘low liquidity = opportunity’ until i lost $200 trying to swap 2 tokens on here. now i just smile and say no thanks. the only thing milkshake is good for is teaching people what NOT to do in crypto

sometimes i wonder if the whole point of projects like this is to teach us something deeper. not about tokens or liquidity or slippage. but about patience. about letting go. about not chasing ghosts because they used to shine. maybe milkshake isn’t a failure-it’s a mirror. and the real question is… why did we keep looking into it?