Crypto Exchange Risk Assessment Tool

Evaluate Exchange Safety

This tool helps you assess the legitimacy of cryptocurrency exchanges using key security factors from industry standards.

When you see a crypto exchange promising fast trades, 200+ coins, and "full security," it’s easy to get excited. But if the platform doesn’t have a license, no user reviews, and no proof it even holds your money, those promises are just noise. That’s exactly the situation with SOLIDINSTAPAY.

What Is SOLIDINSTAPAY?

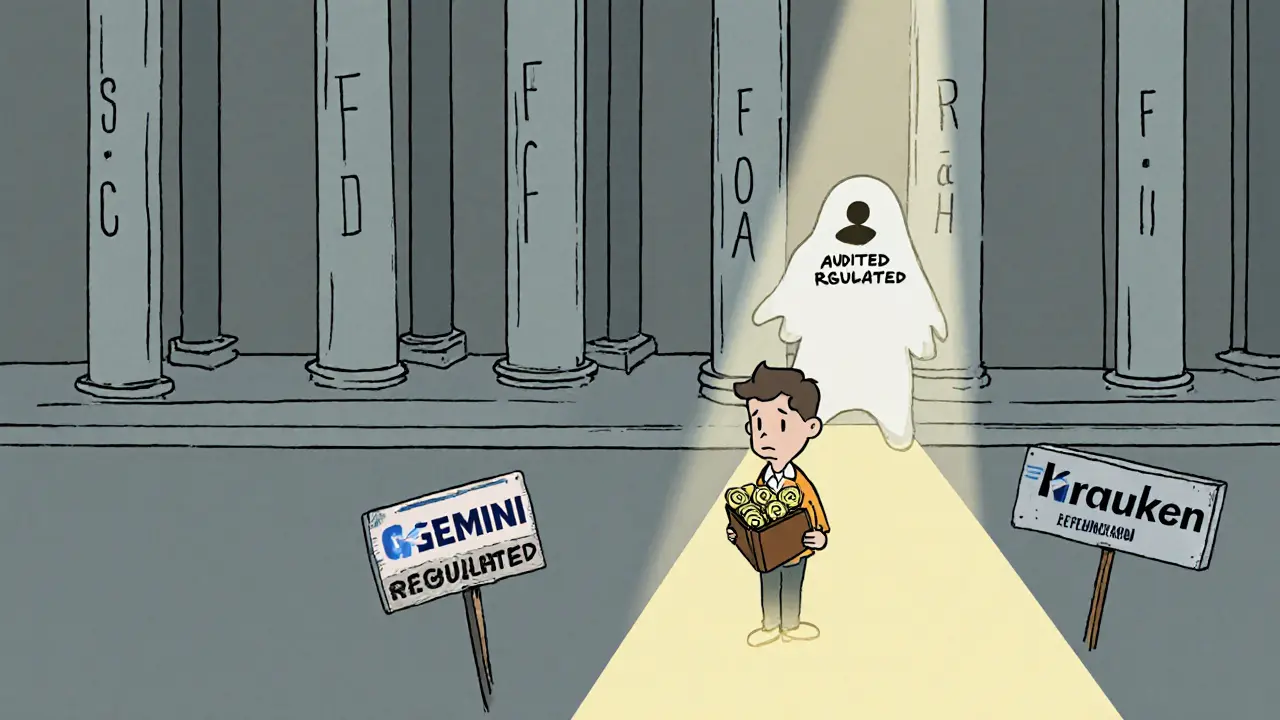

SOLIDINSTAPAY, sometimes called Solid Insta Pay, is a cryptocurrency exchange that claims to offer trading for over 200 digital assets, including Bitcoin. It says it’s built for speed and safety. But behind the polished website and social media accounts (Twitter: @solid_insta_pay, Facebook: solidinstapay), there’s a serious problem: it has no legal authorization to operate anywhere. According to Wikibit’s verification system - a trusted source that checks exchange legitimacy - SOLIDINSTAPAY is classified as having a "Suspicious Regulatory License" and carries a "Medium potential risk" rating. That’s not a warning you can ignore. It means regulators in the UK, where the company claims to be based, have not approved it. Neither has the SEC, FCA, or any other major financial authority. Compare that to exchanges like Gemini or Uphold. They’re registered with U.S. and European regulators. They publish monthly proof-of-reserves reports showing they actually have the crypto they say they hold. SOLIDINSTAPAY doesn’t publish anything. Not a single audit. Not a single transparency report. Just vague claims about "secure blockchain technology."Why the Lack of Regulation Is a Dealbreaker

Regulation isn’t just a box to check. It’s the only thing standing between you and total financial loss. If you deposit $5,000 into Gemini and something goes wrong - a hack, a glitch, a shutdown - you have legal rights. You can file a complaint with the SEC. You might even be covered by FDIC insurance on your USD deposits. If you do the same with SOLIDINSTAPAY, you have zero legal recourse. No one is watching them. No one is holding them accountable. In September 2025, the SEC took action against 17 unregistered crypto exchanges. That’s not a one-off. It’s part of a global crackdown. Gartner predicts 95% of unregulated platforms like SOLIDINSTAPAY will shut down by mid-2026. That doesn’t mean your money will be returned. It means your account could vanish overnight with no warning.No Transparency, No Trust

Legitimate exchanges don’t hide their fees, limits, or security practices. Coinbase lists every trading fee. Uphold shows exactly how much crypto they hold in cold storage. Kraken publishes quarterly security audits. SOLIDINSTAPAY? Nothing. You can’t find:- Minimum deposit requirements

- Withdrawal limits

- Trading fees (0.1%? 5%? No one knows)

- Percentage of assets in cold storage

- Encryption standards or two-factor authentication details

No User Reviews? That’s Not Normal

There’s a simple rule: if thousands of people are using a service, you’ll find reviews. On Trustpilot, Uphold has over 1,200 verified ratings with a 4.3/5 score. Coinbase has tens of thousands. SOLIDINSTAPAY? Wikibit reports zero user ratings as of October 2025. That’s not because it’s too new. It’s because people either can’t find it, won’t use it, or have already lost money and left without saying anything. In crypto, silence is often the loudest warning sign. You won’t find real user experiences on Reddit, Twitter, or crypto forums. No one’s saying, "This place saved me." No one’s sharing screenshots of successful withdrawals. That’s not an oversight - it’s a red flag.What About "No KYC"? Isn’t That a Good Thing?

Some people like exchanges that don’t ask for ID. They call it "privacy." But SOLIDINSTAPAY isn’t a privacy-focused exchange like PrimeXBT. PrimeXBT still operates under regulatory oversight in some regions, has clear withdrawal limits ($20,000/day), and is listed on major tracking sites like Koinly. SOLIDINSTAPAY has none of that. It’s not "privacy-friendly." It’s just unregulated. And unregulated no-KYC exchanges are the most common type used in scams. If you want to trade without ID, go to a platform that’s known, verified, and has a track record. Don’t gamble on a ghost.

Market Reality: SOLIDINSTAPAY Doesn’t Belong

The global crypto exchange market is worth billions. But 87% of the volume flows through platforms that are properly licensed. SOLIDINSTAPAY isn’t just small - it’s invisible. It doesn’t appear on CoinGecko, CoinMarketCap, or NerdWallet’s lists of top exchanges. It’s not mentioned in institutional adoption reports. It’s not on any reputable ranking. Cryptolegal UK, which tracks crypto scams, says complaints against unlicensed exchanges jumped 22% in 2025. SOLIDINSTAPAY fits the profile perfectly: flashy marketing, no regulation, no transparency, no users.What Should You Do Instead?

If you’re looking for a fast, reliable exchange:- For beginners: Use Uphold. Simple interface, FDIC insurance on USD, 200+ assets, 4.8/5 rating.

- For security: Use Gemini. SEC-regulated, cold storage, weekly proof-of-reserves.

- For low fees: Use Kraken. Transparent pricing, strong security, global compliance.

- For no-KYC: Use PrimeXBT. Still regulated in some areas, clear withdrawal limits, trusted by users.

Final Verdict: Avoid SOLIDINSTAPAY

There is no scenario where SOLIDINSTAPAY is the right choice. Not for beginners. Not for experienced traders. Not even for someone looking for a quick, anonymous trade. It has no regulation. No transparency. No user base. No reputation. No future. Your money is not safe there. And when it disappears - and it likely will - you won’t have a single legal option to recover it. Stick with exchanges that play by the rules. The crypto market is risky enough without adding unregulated platforms to the mix.Is SOLIDINSTAPAY a scam?

SOLIDINSTAPAY isn’t officially labeled a scam by law enforcement, but it matches every red flag used by regulators to identify high-risk platforms: no license, no transparency, no user reviews, no proof of funds. It operates in the same gray zone as known scam exchanges. Treating it as anything other than dangerous is a serious financial risk.

Can I withdraw my crypto from SOLIDINSTAPAY?

There are no verified reports of successful withdrawals from SOLIDINSTAPAY. The platform doesn’t publish withdrawal limits, processing times, or fees. Without regulation or user feedback, there’s no way to know if withdrawals work at all. Many users on unregulated platforms report delays, hidden fees, or outright frozen accounts. Assume you won’t be able to get your money out.

Why doesn’t SOLIDINSTAPAY appear on CoinGecko or CoinMarketCap?

CoinGecko and CoinMarketCap only list exchanges that meet strict criteria: regulatory compliance, liquidity, transparency, and user volume. SOLIDINSTAPAY fails all of these. Its absence isn’t an oversight - it’s proof the platform doesn’t meet basic industry standards.

Does SOLIDINSTAPAY have a mobile app?

There is no official mobile app for SOLIDINSTAPAY. Any app claiming to be SOLIDINSTAPAY on the Apple App Store or Google Play is fake and likely designed to steal your login credentials or install malware. Only use the website directly through your browser - and even then, avoid depositing any funds.

Is SOLIDINSTAPAY banned in the U.S.?

It’s not officially banned because it never had a license to begin with. But the SEC’s September 2025 enforcement action made it illegal for any U.S. citizen to use unregistered exchanges like SOLIDINSTAPAY. Using it could expose you to legal risk, even as a user. It’s also highly likely that U.S.-based payment processors will block transactions to it.

What should I do if I already deposited money into SOLIDINSTAPAY?

Stop using the platform immediately. Do not deposit more. Try to withdraw what you can - but don’t expect success. Document everything: screenshots, transaction IDs, emails. Report it to your local financial regulator and to the FTC’s ReportFraud website. Unfortunately, recovery of funds from unregulated exchanges is extremely rare. Your best move now is to cut your losses and move to a regulated exchange.

6 Comments

SOLIDINSTAPAY raises so many red flags it’s almost cartoonish. No license, no audits, no reviews. If a company can’t even show basic financial transparency, why would anyone trust them with their crypto? This isn’t speculation-it’s basic due diligence. The fact that people still consider using it is worrying.

Oh my god this is peak crypto grift material. 🤡 I swear if I see one more ‘200+ coins!!’ with zero regulatory footprint I’m gonna scream. This isn’t DeFi-it’s a digital Ponzi with a fancy logo and a fake Twitter account. You think you’re getting ‘fast trades’? Nah. You’re just prepping your wallet for a one-way ticket to the void.

YUP. I saw this platform on Reddit last week. Someone said ‘no KYC = freedom’ and I was like… bro that’s how 90% of rug pulls start. I checked their domain registration-registered 6 months ago, hidden WHOIS, hosting in a no-regulation country. Classic. And guess what? Their ‘support email’ bounces if you ask for a license number. 💀

In India, we’ve seen this before-fake exchanges promising quick returns, then vanishing. I remember a guy from my village lost his life savings to something called ‘BitFastPay’. Same story: no reviews, no license, just flashy ads. Crypto can be powerful, but only if you respect the rules. Don’t let speed fool you. Safety isn’t boring-it’s survival.

For anyone considering this: check CoinGecko’s exchange list. If it’s not there, it’s not trustworthy. Even smaller legit platforms like Bitstamp or KuCoin are listed. SOLIDINSTAPAY isn’t just unknown-it’s deliberately avoiding visibility. That’s not privacy. That’s evasion. Stick to exchanges that publish their audits. It’s not hard.

They’re not just unregulated-they’re part of a coordinated disinformation campaign. Did you know the same IP address hosts 14 other ‘crypto exchanges’ that all disappeared in 2024? The Twitter account was created by a bot farm. The Facebook page was bought from a shady agency in Eastern Europe. This isn’t a platform. It’s a digital ghost town designed to harvest wallets. The SEC didn’t just ignore it-they’re waiting to catch people in the act. Don’t be the bait.