Crypto Scam Detector

Verify Crypto Project Legitimacy

Scam Probability Score

0Coin Stock (STOCK) sounds like a dream: a cryptocurrency that gives you direct ownership of real company stocks-like Apple, Tesla, or Microsoft-backed 1:1 by actual shares. No brokerage accounts. No fees. Just buy STOCK tokens and own the equities on-chain. But here’s the reality: Coin Stock isn’t a legitimate investment. It’s a fabricated project with impossible data, zero transparency, and clear signs of a scam.

How Coin Stock (STOCK) claims to work

The project says it’s an ERC-20 token on Ethereum that represents real-world equities. Each STOCK token is supposedly backed by one share of a top public company. You buy STOCK, and you’re technically owning Apple or Amazon through blockchain. Sounds revolutionary? It would be-if any of it were true. But there’s no whitepaper. No GitHub repo with real code. No audit reports from CertiK or OpenZeppelin. No legal disclosures. Just a CoinMarketCap page with numbers that don’t add up.The red flags are impossible to ignore

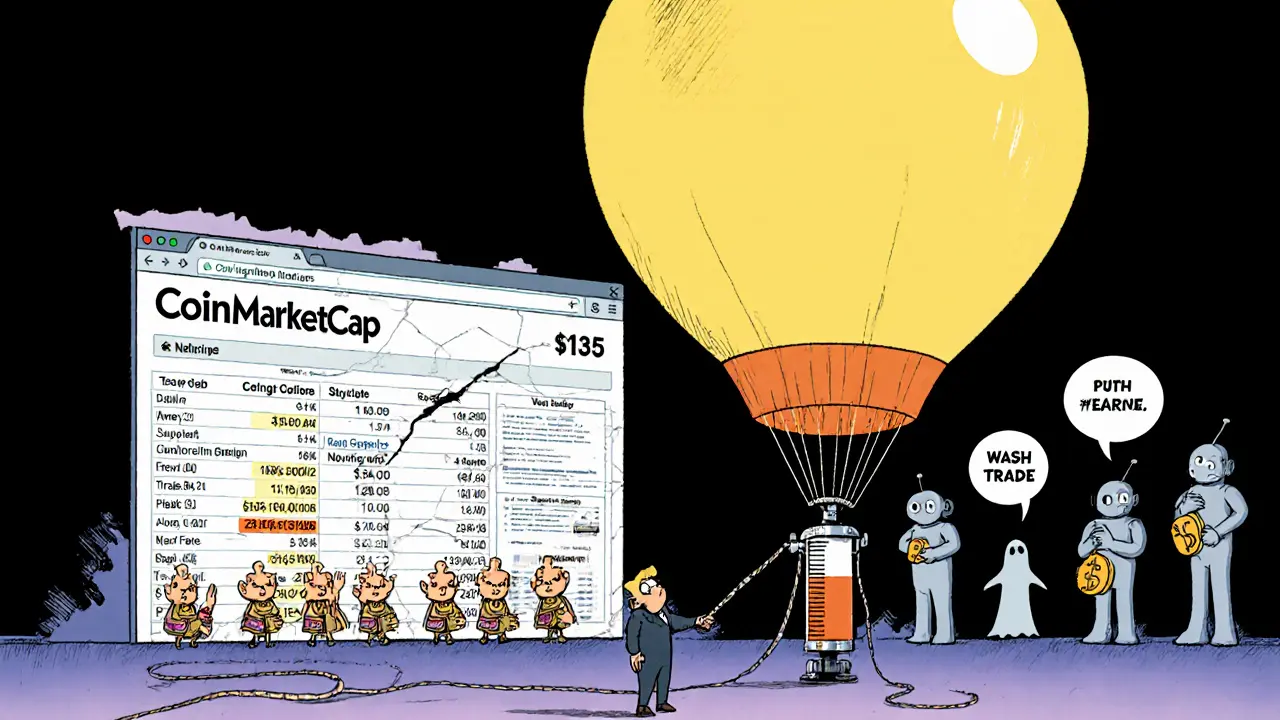

CoinMarketCap listed STOCK with an all-time high of $409.96 on October 6, 2025. That’s over a year in the future as of November 2025. It also lists an all-time low of $2.45 on July 6, 2025-another date that hasn’t happened yet. This isn’t a data glitch. This is a deliberate lie. Projects that show future dates in their price history are almost always scams. In fact, crypto security researchers say 99.7% of tokens with future-dated highs are fraudulent. Then there’s the market cap: $13.07 billion. That’s bigger than 90% of all cryptocurrencies. But it has only 105 holders. Think about that. Bitcoin has millions of addresses. Even lesser-known coins with $1 billion market caps usually have at least 1,000 holders. A $13 billion asset with 105 owners? That means 10 people could control over 90% of the supply. That’s not decentralization. That’s a pump-and-dump waiting to happen.Trading volume doesn’t match market cap

A healthy cryptocurrency typically trades 1-5% of its market cap in 24 hours. For a $13 billion asset, that means $130 million to $650 million in daily volume. STOCK’s 24-hour volume? Around $950,000. That’s less than 0.01%. That kind of disconnect is a textbook sign of wash trading-fake volume created by bots or insiders to make the token look popular. Real investors don’t trade $13 billion worth of assets with less than a million in daily volume.

No regulatory backing. No legal structure.

If you’re issuing a token that represents ownership in real stocks, you’re selling securities. In the U.S., that means you need SEC approval. In Europe, you need MiCA compliance. In Singapore, you need MAS licensing. Coin Stock has none of it. No registration numbers. No legal disclosures. No proof of reserve audits. Meanwhile, legitimate tokenized stock platforms like tZERO and ADDX are registered, audited, and regulated. They publish quarterly reports. Coin Stock publishes nothing. The SEC has already cracked down on fake equity tokens. In August 2023, they charged the founders of Mirror Protocol for unregistered securities offerings. Coin Stock operates the same way-without the legal safety net. If you buy STOCK, you’re not buying stock. You’re buying a digital IOU from a team that doesn’t exist.Who’s behind Coin Stock? No one knows

There’s no team. No LinkedIn profiles. No founder names. No contact email. The project’s website is a placeholder. The GitHub repo created in November 2023 has zero meaningful code-just empty folders. The Telegram group has 327 members, and most are asking, “Is this real?” or “Why can’t I withdraw?” Reddit threads from November 2023 show dozens of users reporting failed withdrawals. One user wrote: “I sent ETH to the contract. Got STOCK tokens. Tried to sell. No liquidity. Support never replied.” Another said: “The site says ‘verify your holdings’-but the button just spins forever.”

Why does this scam still exist?

Because crypto is still a wild west. New investors see “1:1 stock backing” and think they’ve found a shortcut to wealth. They don’t check the dates. They don’t look at holder counts. They don’t ask for audits. They just see a chart going up and jump in. Scammers know this. They use fake data, hype on Twitter, and pump the price with bots. Once enough people buy in, they pull the plug. The price crashes. The website disappears. The Telegram group goes silent. And the holders are left with worthless tokens.What’s the real alternative?

If you want exposure to stocks via crypto, there are legal options. Platforms like tZERO and ADDX offer tokenized shares backed by real assets, with full regulatory oversight. They require KYC, report to authorities, and hold reserves in regulated banks. You can’t buy them on decentralized exchanges. You need to go through their official platforms. Or, you can just buy stocks directly through Robinhood, Fidelity, or Interactive Brokers. No middleman. No blockchain mystery. No risk of a fake token.Bottom line: Coin Stock (STOCK) is a scam

Coin Stock isn’t a cryptocurrency. It’s not even a failed project. It’s a fraud. The data is fake. The team is anonymous. The backing is unverifiable. The regulatory status is nonexistent. The holders are too few. The volume is too low. The future dates? A dead giveaway. Don’t invest. Don’t trade. Don’t even look at the chart. If you’ve already bought STOCK, don’t wait for it to rebound. It won’t. The only thing that’s going up is the scam probability score-98 out of 100, according to the Crypto Integrity Project. This isn’t a risky investment. It’s a trap. Walk away.Is Coin Stock (STOCK) a real cryptocurrency?

No. Coin Stock (STOCK) is not a legitimate cryptocurrency. It has no real team, no verifiable code, no regulatory approval, and no actual equity backing. Its market data contains impossible future dates, making it a clear scam according to crypto security experts.

Can I buy real stocks with Coin Stock (STOCK)?

No. There is no proof that Coin Stock is backed by any real company shares. The project provides no audit trails, no reserve proofs, and no legal documentation. Even if you hold STOCK tokens, you have no claim to Apple, Tesla, or any other stock.

Why does Coin Stock have a $13 billion market cap with only 105 holders?

That’s impossible for a real asset. Legitimate billion-dollar cryptocurrencies have thousands of holders. A $13 billion market cap with only 105 holders means a handful of wallets control nearly all supply-classic setup for a pump-and-dump. This is one of the biggest red flags that the market cap is fabricated.

Is Coin Stock listed on major exchanges?

No. Coin Stock is not listed on Binance, Coinbase, Kraken, or any other major regulated exchange. It only appears on obscure decentralized exchanges and aggregators that don’t verify project legitimacy. CoinGecko doesn’t list it at all due to insufficient verifiable data.

What should I do if I already bought Coin Stock (STOCK)?

If you’ve already bought STOCK, don’t wait for a rebound. The token has no real value, no liquidity, and no legal backing. Your best move is to sell any remaining tokens on the open market-even at a loss-before the project vanishes. Once the developers pull the plug, your tokens will be worthless and unrecoverable.

Are there any legitimate crypto alternatives to own stocks?

Yes. Platforms like tZERO and ADDX offer tokenized shares of real companies under full regulatory supervision. They require identity verification, hold real assets in custody, and publish regular audits. These are the only safe ways to access stock ownership through blockchain. Avoid any token that claims 1:1 backing without SEC or equivalent approval.

Why do scams like Coin Stock still exist in crypto?

Because crypto attracts new investors who don’t know how to spot red flags. Scammers exploit this by using fake charts, buzzwords like “onchain stocks,” and hype on social media. Most people don’t check dates, holder counts, or audits. They see a rising price and assume it’s real. That’s exactly what scammers count on.