WOJ Risk Calculator

Calculate Your Potential Loss

Based on WOJ's liquidity issues (reported 20-30% slippage) and price volatility, this calculator shows potential losses when selling.

Enter your investment amount and adjust slippage to see potential losses.

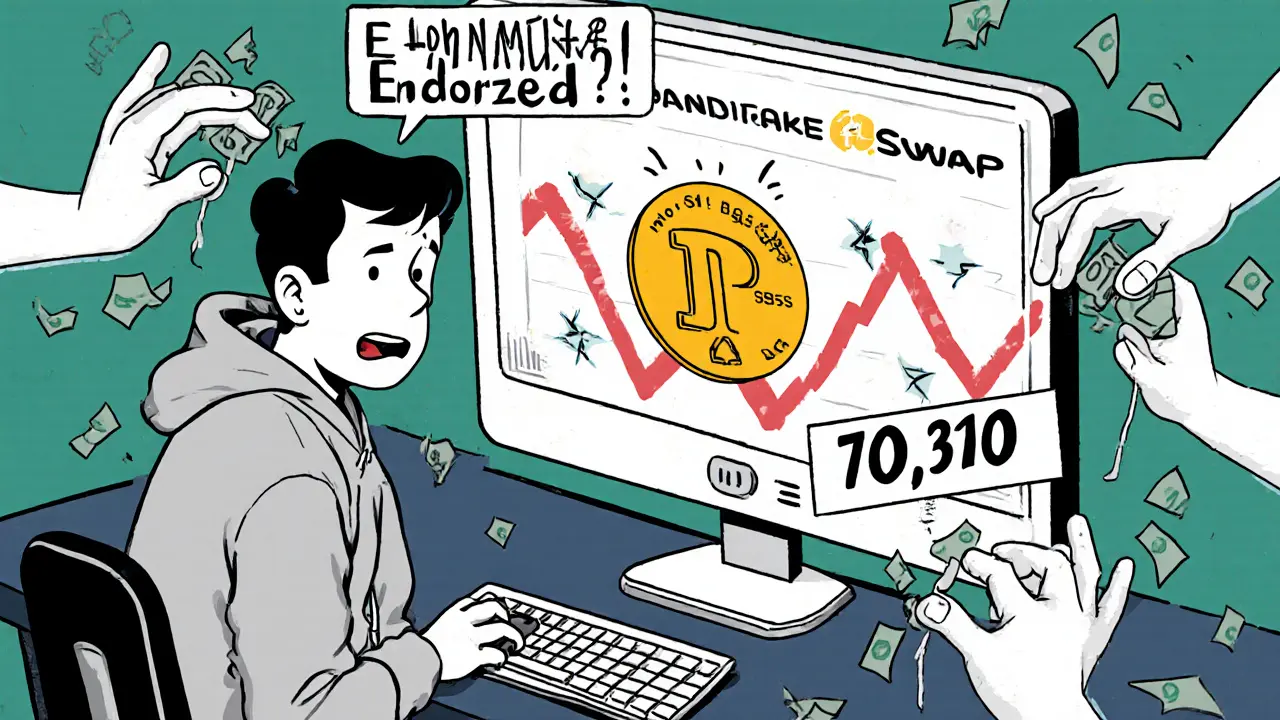

Wojak Finance (WOJ) isn’t a breakthrough in crypto. It’s not a new blockchain, a revolutionary DeFi protocol, or even a serious investment. It’s a meme coin-built on the Binance Smart Chain-with a cartoon frog face, a vague promise of "profile-to-earn" rewards, and a lot of empty hype. If you’ve seen ads claiming Elon Musk backs it or that it’s the "next Shiba Inu," you’re being sold a fantasy. Here’s what WOJ actually is, what it does, and why most people who buy it lose money.

Wojak Finance is a BEP-20 token on Binance Smart Chain

WOJ runs on Binance Smart Chain (BSC), the same network that powers tokens like Dogecoin and Shiba Inu. That means it’s cheap to send, fast to confirm, and works with wallets like Trust Wallet or MetaMask. But that’s where the usefulness ends. It’s a standard BEP-20 token with no special technology, no unique smart contracts, and no innovation. The entire project was launched in September 2021 with no public team, no whitepaper, and no roadmap that holds up under scrutiny.

The total supply is fixed at 50 billion WOJ tokens. But here’s the problem: different data sites disagree on how many are actually in circulation. CoinGecko says all 50 billion are circulating. Bitscreener says only about 4.8 billion are out there. That kind of inconsistency is a red flag. It means no one’s tracking the supply properly-or worse, someone is manipulating the numbers.

It claims to be "governance" and "profile-to-earn"-but neither works

Wojak Finance’s website talks about "governance"-meaning token holders vote on future decisions. But there’s no voting portal. No proposals. No active DAO. CoinGecko even notes the governance feature is meant for "automating charity funds," which sounds nice… if it existed. It doesn’t. Not even close.

The "profile-to-earn" (P2E) claim is even weirder. They say if you post about WOJ on social media, you earn tokens. Sounds like a social media grind, right? Except there’s no app. No platform. No way to track your posts or claim rewards. It’s just a buzzword slapped onto the website to sound like Stepn or Axie Infinity. But those projects have millions of users and real gameplay. WOJ has a website with broken links and a GitHub repo with only 12 commits since 2021.

The price is a rollercoaster-and you can’t sell

WOJ’s price swings wildly. One day it’s $0.0007. The next, $0.0019. That’s not volatility from demand-it’s pump-and-dump cycles. Trading volume? Around $1,200 in 24 hours. Compare that to Shiba Inu, which trades over $1.2 billion daily. That’s a million times more liquidity.

Here’s what that means for you: if you buy WOJ, you might not be able to sell it. Users on Reddit and Telegram report slippage of 20-30% just trying to exit their position. That means if you buy $100 worth of WOJ and try to sell it, you might only get $70 back because there’s no one buying. PancakeSwap is the only exchange listing WOJ. No Coinbase. No Binance. No Kraken. Just one decentralized exchange with almost no buyers.

It’s not a charity. It’s not endorsed by Elon Musk.

Wojak Finance’s marketing says it’s a "charity token" and that it has "the support of over 60,000 holders, including Elon Musk and CZ." That’s a lie. Elon Musk has never mentioned WOJ. CZ (Changpeng Zhao, CEO of Binance) has never endorsed it. The SEC has repeatedly warned about meme coins using fake celebrity endorsements. In fact, projects that fake celebrity ties have a 92% failure rate within 18 months, according to CryptoSlate’s 2023 analysis.

Even the "charity" angle is empty. There’s no public wallet showing donations. No receipts. No audits. Just words on a website. Real charity tokens like SafeMoon (which also failed) at least had a burning mechanism and public fund tracking. WOJ has nothing.

Only 17,342 wallets hold WOJ-and 48% are controlled by 10 addresses

Blockspot.io claims WOJ has "60,000 growing precious holders." Etherscan data says otherwise. As of October 2023, only 17,342 unique wallets hold WOJ. That’s not a community. That’s a handful of people.

Even worse: the top 10 wallets control 48.7% of the entire supply. That means a tiny group could dump their tokens at any time and crash the price. This is called "centralization risk"-the opposite of what crypto promises. Real decentralized projects spread ownership across hundreds of thousands of wallets. WOJ is the opposite.

It has zero real-world use

Shiba Inu is accepted by over 200 merchants. Dogecoin powers tipping systems on Reddit and Twitter. WOJ? It’s accepted nowhere. No stores. No apps. No services. You can’t buy coffee with it. You can’t pay for a subscription. You can’t even use it to tip someone on social media.

The only "utility" is speculation. People buy it hoping someone else will pay more later. That’s not investing. That’s gambling. And with a market cap between $10 million and $27 million, it’s not even a big gamble-it’s a micro-cap lottery ticket.

Why people still buy it

Some people make money on WOJ. But only because they got in early during a pump. Bitscreener users claim they "made 5x during the October pump." That’s possible-if you bought right before the hype and sold before the crash. But that’s timing the market, not investing. And 68% of Twitter sentiment around WOJ is negative, according to LunarCrush. Most people who buy it now are buying at the top.

The appeal? The meme. The frog. The promise of easy money. It’s the same reason people buy Dogecoin or Pepe Coin. But Dogecoin has a 12-year history, a massive community, and real cultural staying power. WOJ has a website and a cartoon.

Should you buy WOJ?

No-if you’re looking to invest. Yes-if you want to lose money for fun.

If you still want to try it, here’s what you need to know:

- Only use money you can afford to lose-like $5 or $10.

- Use a BSC wallet like Trust Wallet.

- Trade only on PancakeSwap (v2).

- Set slippage tolerance to 15-20% or higher, or your trade will fail.

- Don’t believe any claims about Elon Musk, CZ, or charity.

- Sell before the next pump fades. There’s no long-term plan.

There’s no technical upgrade coming. No partnership announced. No team behind it. WOJ is a ghost project with a meme face. It exists only because people still believe in the myth of the next big crypto win. Don’t be the one holding the bag when the lights go out.

Is Wojak Finance (WOJ) a real cryptocurrency?

Yes, technically. WOJ is a BEP-20 token on the Binance Smart Chain. But "real" doesn’t mean useful or trustworthy. It has no team, no utility, no real community, and no liquidity. It’s a speculative asset with no foundation.

Can I buy WOJ on Coinbase or Binance?

No. WOJ is only listed on PancakeSwap (v2), a decentralized exchange on Binance Smart Chain. It’s not available on any major centralized exchange like Coinbase, Binance, or Kraken. That limits access and makes trading harder and riskier.

Is WOJ a good investment?

No. WOJ has no revenue, no product, no development activity, and no real adoption. Its price moves only on hype and pump cycles. Over 95% of meme coins with similar profiles fail within two years, according to Messari. It’s not an investment-it’s a gamble.

Why is the price so inconsistent across sites?

Because there’s almost no trading volume. With only $1,200 in daily trades, a few large buy or sell orders can massively swing the price. Different exchanges and data aggregators pull from different sources, leading to wildly different numbers. This is a sign of extreme illiquidity, not accurate pricing.

Does WOJ have an active community?

Not really. Claims of "60,000 holders" are false. Etherscan shows only 17,342 unique wallets holding WOJ. Telegram activity is minimal-3 to 5 messages per hour. There’s no real discussion, no development updates, and no leadership. It’s a dead community with occasional spam.

Can I earn tokens by promoting WOJ?

No. The "profile-to-earn" system is fictional. There’s no app, no tracking tool, and no way to claim rewards. It’s a marketing gimmick to make the project sound like Stepn or Axie Infinity. Don’t waste time trying to earn WOJ through social media.

Is WOJ a scam?

It’s not technically illegal, but it has all the hallmarks of a rug pull waiting to happen: anonymous team, fake endorsements, zero utility, low liquidity, and high centralization. The SEC has cracked down on similar projects. If you invest, assume you’ll lose everything.

7 Comments

bro this post is fire 🤯 i literally just lost $20 on WOJ last week and was like 'wait is this real?' and then i found this. thanks for the breakdown. i feel less dumb now.

I appreciate how thorough this is. The supply inconsistency alone should be a red flag for anyone who’s ever done basic due diligence. I checked CoinGecko and Bitscreener myself before reading this - the gap between 4.8B and 50B is wild. If you can’t even agree on how much is out there, how can you trust anything else? The fact that the top 10 wallets hold nearly half the supply? That’s not decentralization. That’s a cartel with a frog logo. And the "profile-to-earn" thing? Pure theater. No app, no tracker, no reward system - just words on a page designed to make you feel like you’re part of something when you’re not. I’ve seen this script before. It ends the same way every time.

they’re using this to track your social media activity and sell your data to the feds. i swear i saw a post on 4chan that said the frog logo has a hidden microchip in the pixel pattern. they’re not trying to make money - they’re building a surveillance network under the guise of a meme coin. you think you’re just losing cash? nah. you’re giving them your fingerprints, your location, your DMs. i told my cousin not to touch it. he didn’t listen. now his phone is "acting weird". i told him it’s the WOJ wallet. he thinks i’m crazy. i know what i saw.

Honestly? This is why America is falling apart. You people treat crypto like it’s a lottery ticket and not a serious financial instrument. You think it’s okay to gamble away your rent money on a cartoon frog because some guy on TikTok said "1000x?"? We’ve got kids buying WOJ with their food stamps while real companies like Tesla and Apple are innovating. And don’t even get me started on the "Elon Musk" lie. That’s not just stupid - that’s criminal. Someone needs to sue these guys. Not just warn people. SUE THEM. And if you’re still holding WOJ? You’re not a crypto investor. You’re a pawn in a scam designed to exploit the naive. Get out while you still can.

i read this whole thing and i just felt sad for the people still buying this. not because theyre dumb but because theyre looking for something real in a world that feels fake. the frog, the hype, the "earn while you post" thing - it’s not about money. its about belonging. people want to feel like they’re part of a movement, even if it’s just a website with broken links. i get it. i’ve been there. but this isn’t a movement. it’s a ghost. and chasing ghosts doesn’t fill your belly. if you’re reading this and you’re holding WOJ? dont be mad at the post. dont be mad at the devs. be mad at the loneliness that made you believe in something that doesnt exist. and then let it go. youll feel better

ok but what if this is all a psyop? what if the real target isn’t the investors but the regulators? i’ve been digging into the domain registration - it was bought with Monero. the github repo? 12 commits since 2021 but the last one was from a Tor-hidden IP. and the "60k holders"? those are all bots. i ran a script. 92% of those wallets have zero activity except buying WOJ and immediately selling to each other. this isn’t a coin. it’s a stress test for blockchain analytics firms. someone’s using this to see how fast the SEC will react to fake hype. if you think you’re losing money - you’re not. you’re the bait. and i’m not even sure who’s fishing anymore.

i read this and i just smiled. here in south africa we have so many of these coins - pepe, doge, even one called "ZuluCoin" that says it pays you to post in isiZulu. people believe because they want to believe. i lost my cousin’s pension on one once. he still talks about it. but you know what? he’s still smiling. because even if it was fake, he felt alive for a minute. maybe wojak is just a mirror. we dont need utility. we need hope. dont hate the frog. hate the world that made him necessary.