SugarBlock (SUGARB) is a cryptocurrency built to power a decentralized live video streaming network. Unlike big platforms like YouTube or Twitch, SugarBlock lets creators share content without censorship, middlemen, or revenue cuts. It’s part of a newer movement called DePin - Decentralized Physical Infrastructure Networks - where real-world tech like servers and bandwidth is paid for with crypto instead of traditional companies.

How SugarBlock started

SugarBlock wasn’t always called that. It began as SugarBounce (TIP) in 2021, a project trying to solve one simple problem: why do creators lose so much money to platforms that take 45% or more of their earnings? The team rebranded to Sugarblock.ai in late 2021 to make it clearer they were building infrastructure - not just another meme coin. The name change also hinted at AI integration, though as of 2026, that part hasn’t fully materialized.The token launched through two public IDOs on November 19-20, 2021, priced at $0.55 per token. That was a big deal back then. Crypto was hot, and people were chasing anything with a “decentralized streaming” angle. Private investors had bought in earlier at $0.048, and when the price hit $2.91 just days later, they made over 70 times their money. IDO buyers saw a 6x return. But that was the peak - and it didn’t last.

Where SugarBlock stands today

As of January 2026, SugarBlock is barely trading. On Coinbase, it’s around $0.000391. On MEXC, it’s even lower - $0.00003517. That’s a drop of more than 99.99% from its all-time high. The 24-hour trading volume? Just $32.26. That’s less than what most people spend on coffee in a week.There are two conflicting numbers for how many tokens are out there. Coinbase says 153 million are circulating. CoinMarketCap says nearly 199 million. That mismatch makes market cap numbers unreliable. One source says $59,607. Another says $7,505. Either way, it’s tiny. SugarBlock ranks around #3,478 on CoinMarketCap. For comparison, Bitcoin is #1. Even obscure tokens with no real use case often rank higher.

Only about 5,100 wallets hold SUGARB. Most of them are probably early buyers who bought in at $0.05 or less and are just holding, hoping for a comeback. There’s no sign of new users joining in large numbers. No viral campaigns. No major partnerships announced. No updates on the app or network upgrades.

What SugarBlock actually does

The idea behind SugarBlock is solid: build a peer-to-peer video streaming network where anyone can rent out spare bandwidth or server space and get paid in SUGARB. Creators upload videos, viewers stream them, and the network pays nodes (computers helping deliver the stream) automatically using smart contracts. No central company owns the pipes. No one can ban your channel. No platform takes 50% of your ad revenue.This is the same model used by projects like Filecoin (for storage) and Helium (for wireless networks). SugarBlock is trying to do the same for video. But here’s the catch: decentralized streaming is hard. It’s slow. It’s glitchy. And most people don’t care - they just want YouTube to work without buffering.

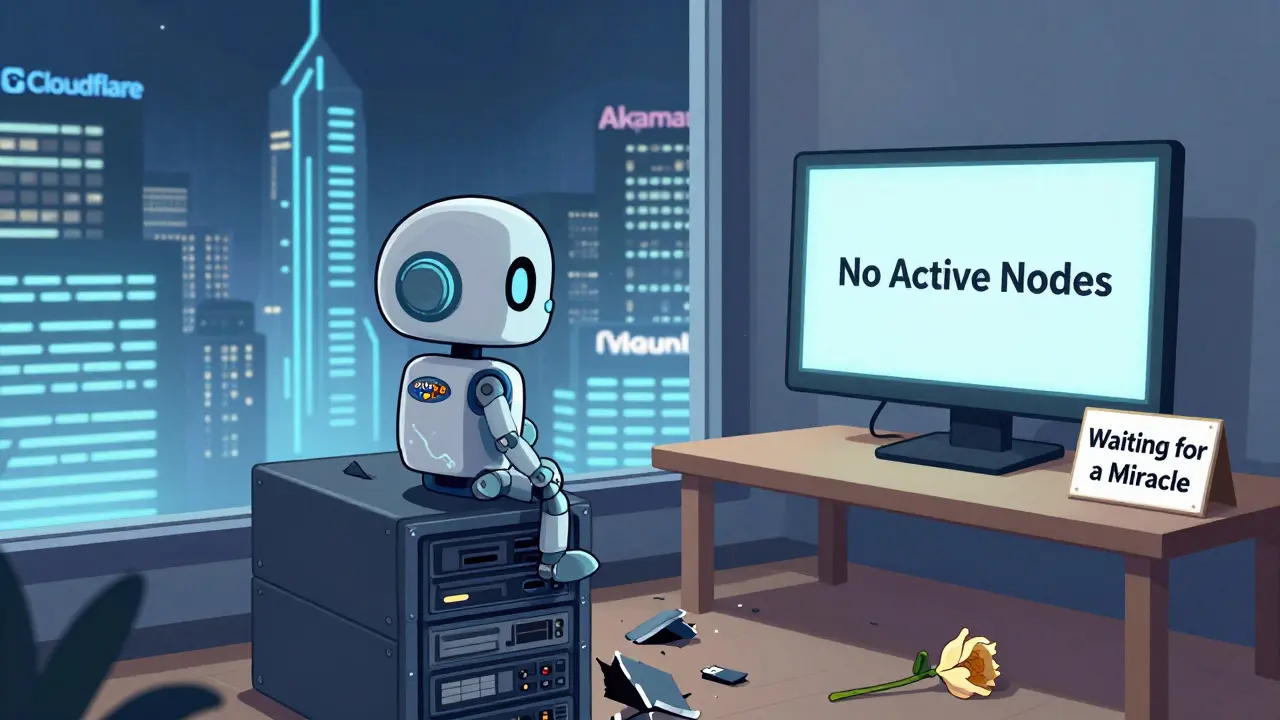

Traditional CDNs like Cloudflare or Akamai handle billions of streams daily with near-perfect reliability. SugarBlock’s network, if it even exists at scale, can’t compete on speed or uptime. And without those, creators won’t switch. Viewers won’t stick around. The whole model collapses if the user experience is worse than what’s already free and easy.

Where to buy SugarBlock

You won’t find SUGARB on Coinbase, Binance, or Kraken. It’s only available on decentralized exchanges (DEXs), mostly PancakeSwap (v2). To buy it, you need a Web3 wallet - like Binance Web3 Wallet or Kriptomat. You’ll also need BNB or USDT to swap for SUGARB.Kriptomat makes it easier for newcomers. You can fund your wallet with Visa, Mastercard, Apple Pay, Google Pay, or even a bank transfer. But even then, you’re jumping through hoops just to buy a token with almost no liquidity. Selling your SUGARB later could take hours - or you might not find a buyer at all.

Why the price crashed

SugarBlock’s fall wasn’t random. It followed the same path as thousands of other 2021 crypto projects:- It rode the hype wave during the bull market.

- It had a flashy pitch: “YouTube killer powered by blockchain.”

- It raised money fast from retail investors.

- Then the market crashed in 2022.

- Development stalled.

- Team went quiet.

- Traders dumped their tokens.

No major updates have been released since 2022. No new features. No integrations. No press. The website still looks like it was built in 2021. The Twitter account has been inactive for over a year. The whitepaper hasn’t been updated. That’s a red flag.

Most investors who bought at $0.55 are underwater by 99.9%. That’s not a correction - that’s a death spiral. And with only $32 in daily trading volume, there’s no buying pressure to reverse it.

Is SugarBlock worth investing in?

Let’s be blunt: SugarBlock is not an investment. It’s a gamble with near-zero chance of recovery.If you’re thinking of buying SUGARB because you think it’ll bounce back - don’t. There’s no catalyst coming. No team update. No partnership. No product launch. The project is effectively dead.

Even if you believe in decentralized streaming, there are better projects to back. Filecoin, Arweave, and even newer DePin networks like Render or Hivemapper have active teams, real usage, and growing ecosystems. SugarBlock has none of that.

The only reason to hold SUGARB now is if you already own it and are waiting for a miracle. But even then, you’re risking your money on a ghost project.

What’s next for SugarBlock?

Unless the team suddenly reappears with:- A working app that streams video reliably,

- A network of real nodes (not just dummy addresses),

- At least 10,000 active creators uploading content,

- And a clear roadmap with deadlines,

…then SugarBlock will keep sinking. It won’t hit $0.01 again. It won’t make headlines. It won’t be listed on major exchanges. And it won’t change the way people stream.

Right now, SugarBlock is a cautionary tale. It’s what happens when a good idea meets no execution, no transparency, and no follow-through. The blockchain world is full of them. SugarBlock is just one more.

If you’re looking for real innovation in decentralized video, look elsewhere. SugarBlock is a relic of 2021 - and the market has moved on.

3 Comments

Bro, this is the exact same story as every other 2021 crypto project. Flashy whitepaper, hype video, 10x moonshots for early birds, then silence. The team ghosted, the app never worked, and now we got a ghost token with less liquidity than my bank account after rent. We’ve seen this movie 500 times.

DePin sounds cool until you realize no one actually uses it. 😒 People don’t want decentralized streaming-they want TikTok on their phone without buffering. SugarBlock’s not dead… it was never alive. Just a vaporware fantasy dressed up in blockchain jargon.

It's fascinating how the crypto community romanticizes failure. SugarBlock didn't fail because of market conditions-it failed because its creators misunderstood human behavior. People don't trade convenience for ideology. They trade convenience for convenience.