VASP Requirements: What Crypto Platforms Must Do to Stay Legal

When you use a crypto exchange, wallet, or trading platform, you’re likely interacting with a VASP, a Virtual Asset Service Provider that handles crypto transfers, exchanges, or custody. Also known as crypto intermediaries, these entities are now legally required to follow strict rules in most major economies to prevent money laundering and terrorist financing. If a platform doesn’t meet these standards, it gets blocked, fined, or shut down—and you could lose access to your funds overnight.

VASP requirements aren’t suggestions. They’re enforced by global bodies like the FATF, the Financial Action Task Force that sets international anti-money laundering standards and adopted by countries from the U.S. to Singapore. These rules force exchanges to collect your identity (KYC), monitor your transactions (AML), and report suspicious activity. Without them, platforms like FutureX Pro or Ostable can’t operate legally—and that’s why you’ll never see them listed on regulated app stores or banking partners.

These rules also connect to real-world outcomes. When the UAE was removed from the FATF grey list, it wasn’t because they changed their tech—it was because they enforced VASP requirements across all exchanges. That’s why Binance, Kraken, and Coinbase expanded there. Meanwhile, countries with weak enforcement, like Tunisia, see underground P2P trading thrive because users can’t access compliant platforms. And when India or Vietnam slap on crypto taxes, it’s often tied to the same VASP reporting systems that track every trade.

You don’t need to run a crypto business to care about VASP requirements. If you’re using any exchange that asks for your ID, limits your withdrawals, or blocks certain coins, it’s because of these rules. They’re why you can’t just swap tokens anonymously anymore. They’re why some platforms vanish overnight. And they’re why some airdrops—like PlayerMon PYM or POTS—are fake: scammers know real VASP-compliant platforms won’t hand out tokens without identity checks.

What you’ll find in the posts below isn’t just a list of crypto news. It’s a map of how VASP requirements shape everything—from why TROLL coin crashed (no team, no compliance, no future) to why Stacks (STX) is gaining traction (it plays by the rules of Bitcoin’s trusted network). You’ll see how India’s 1% TDS and Vietnam’s 0.1% tax are direct results of VASP reporting. You’ll learn why QB crypto exchange is a scam (no real entity, no compliance), and why the UAE’s regulatory shift changed the whole game. These aren’t random stories. They’re all connected by one thing: the need for crypto to work within the real financial system.

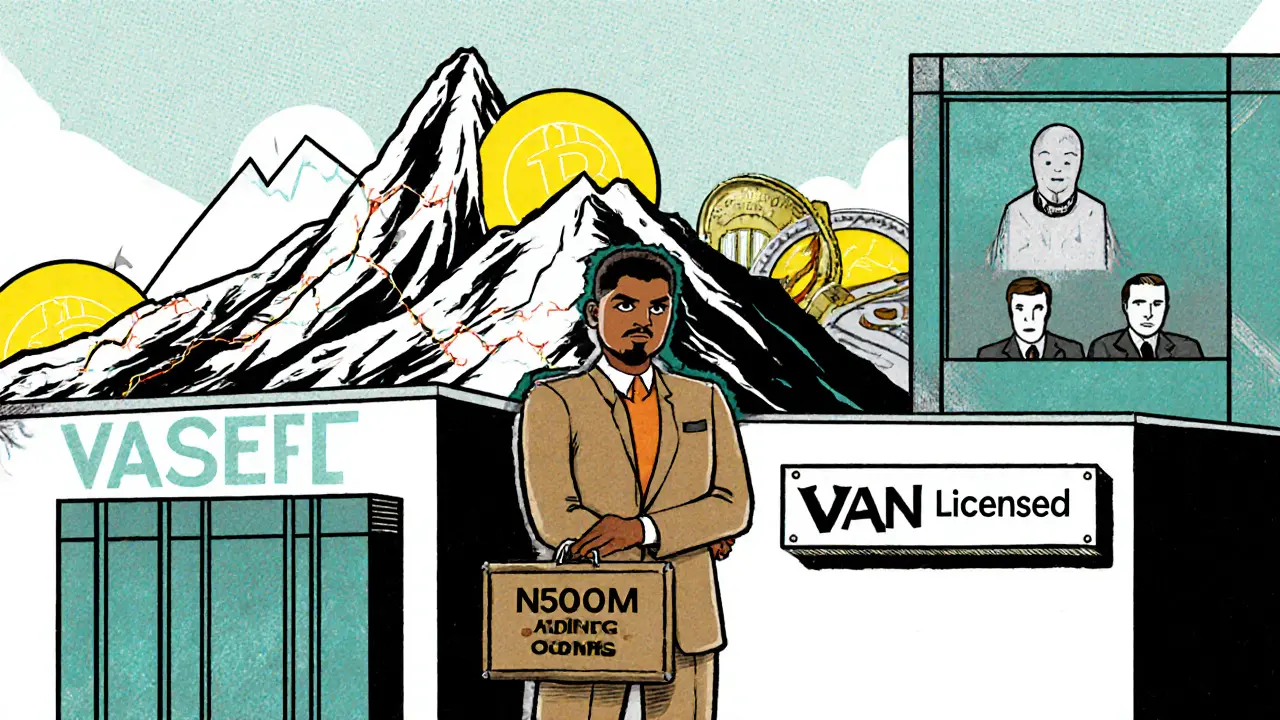

VASP Licensing in Nigeria: Requirements and Process for Crypto Businesses

Nigeria now requires all crypto businesses to obtain a VASP license from the SEC. Learn the capital, compliance, and documentation requirements to legally operate in the country’s evolving digital asset market.

© 2026. All rights reserved.