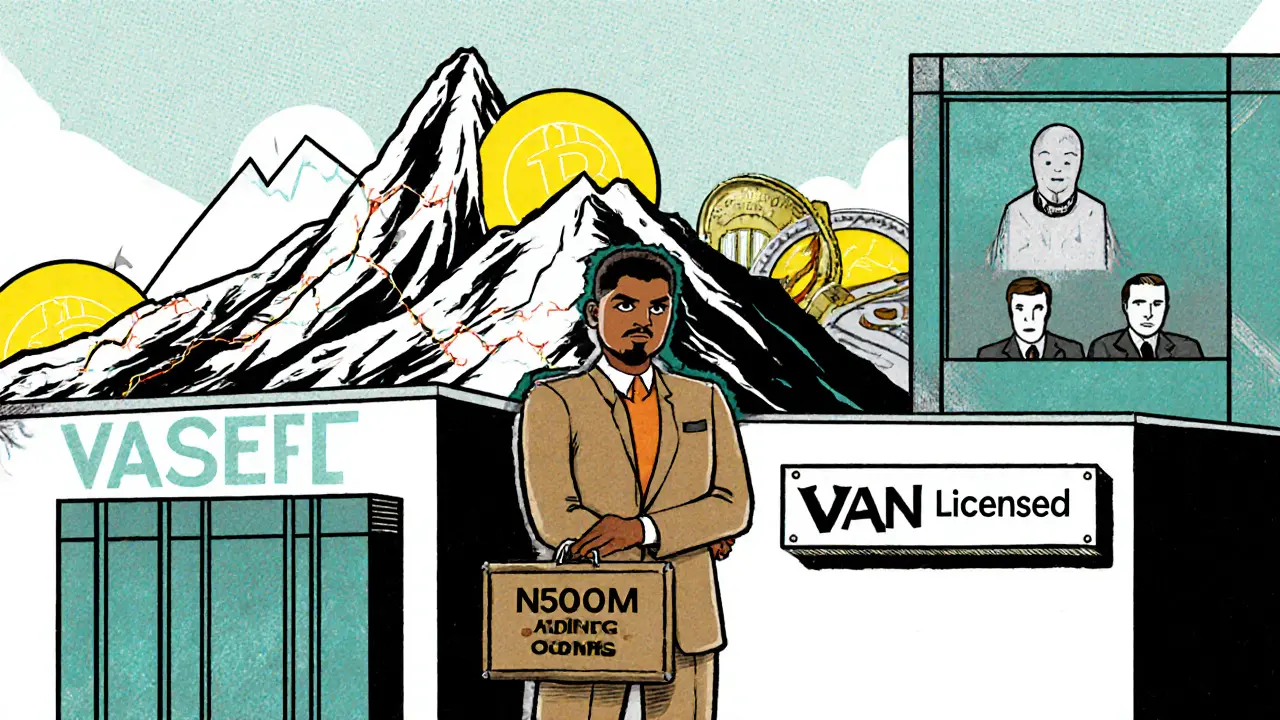

VASP Licensing Cost Calculator for Nigerian Crypto Businesses

Minimum Capital Requirement

The SEC requires a minimum of N500,000,000 (N500 million) in paid-up capital.

Additional Compliance Costs

Cost Summary

Total Estimated Cost

N0

Note: These are estimated costs based on industry benchmarks. Actual expenses may vary based on business size and complexity.

Potential Penalty: Non-compliance can result in fines up to N1 billion.

What Is a VASP License in Nigeria?

A VASP license in Nigeria is the only legal way for cryptocurrency businesses to operate after the 2025 Investments and Securities Act. VASP stands for Virtual Asset Service Provider, and it covers any company that handles digital assets - whether that’s exchanging Bitcoin for Naira, storing crypto in wallets, running staking platforms, issuing tokens, or even processing payments with crypto. Before 2025, crypto businesses in Nigeria operated in a gray zone. Banks wouldn’t touch them, and there were no clear rules. Now, the Securities and Exchange Commission (SEC) requires every crypto firm to get licensed. No license? No legal operations. Period.

Who Needs a VASP License?

If your business touches virtual assets in Nigeria, you need this license. That includes:

- Cryptocurrency exchanges (buying/selling BTC, ETH, USDT, etc.)

- Crypto wallet providers (custodial or non-custodial if you hold keys for users)

- Token issuance platforms (ICO, STO, or token sales)

- Staking services (where users lock crypto to earn rewards)

- Miners operating in Nigeria with commercial intent

- Airdrop distributors managing large-scale token distributions

- Payment processors accepting crypto for goods or services

Even if you’re based overseas but serve Nigerian customers, you still need a VASP license. The SEC doesn’t care where your server is - if Nigerians are using your service, you’re regulated.

Minimum Capital Requirement: N500 Million

The biggest hurdle for most startups is the capital requirement. To apply, you must have at least N500,000,000 (about $325,000 USD) in paid-up capital. This isn’t a loan or a projected number - it’s cash already in your bank account, verified by auditors. The SEC wants to make sure you can survive market crashes, cover compliance costs, and pay out users if things go wrong. This requirement puts Nigeria in the same league as the EU, not like Kenya or Ghana where capital rules are lighter. For small crypto startups, this is a major barrier. Many will need investors, partners, or venture funding just to qualify.

Corporate Registration and Physical Presence

You can’t apply unless you’re a registered Nigerian company. That means you must:

- Register with the Corporate Affairs Commission (CAC)

- Submit your Certificate of Incorporation

- Provide your Memorandum and Articles of Association (MEMART)

- Get a current CAC status report

And here’s another key rule: you must have a physical office in Nigeria. Not a PO box. Not a virtual address. A real office with a sign on the door. Plus, at least one director must be a Nigerian resident and physically present in the country. This isn’t just bureaucracy - it’s about accountability. If something goes wrong, regulators need to be able to walk into your office and talk to someone who lives here.

Compliance: KYC, AML, and Record Keeping

The SEC doesn’t just want your money - they want your systems to be bulletproof. You must implement full Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. That means:

- Verifying every user’s identity with government-issued ID

- Collecting proof of address

- Screening users against global sanctions lists

- Monitoring transactions for unusual patterns

You also have to keep records for seven years - not three, not five. Seven. That includes every transaction, every chat log with a customer, every verification document. This matches the Financial Action Task Force (FATF) global standards. Failure to comply means fines, suspension, or revocation of your license.

Operational Documentation: What the SEC Demands

It’s not enough to say you’re compliant. You have to prove it. Your application must include:

- A detailed business model explaining how you make money and why your service is unique

- Written internal rules on investor protection, conflict of interest, and dispute resolution

- Staffing plans showing you have qualified compliance, tech, and operations teams

- Technical infrastructure specs - servers, encryption, backup systems

- Cybersecurity protocols certified to SEC Technology Risk Management standards

- Financial projections for the next three years

- Letters of no objection from other regulators (like CBN or FIRS) if you’re also doing banking or tax-related services

Think of this as building a legal and operational house. Every brick must be documented. No shortcuts.

The Accelerated Regulatory Incubation Program (ARIP)

Not everyone can afford to jump straight into full licensing. That’s where ARIP comes in. It’s a 12-month incubator program designed for startups that are serious but not yet ready to meet all the capital and documentation requirements. Here’s how it works:

- You apply with basic documents: CAC registration, business plan, proof of Nigerian office

- If approved, you get preliminary approval to operate under SEC supervision

- You submit quarterly progress reports

- At month 10, the SEC gives you feedback - what you’re doing right, what’s missing

- At month 12, you either submit your full VASP application or shut down

ARIP isn’t a loophole. It’s a training ground. You still need to follow all AML/KYC rules. You still need to report transactions. But you get time to build systems, raise capital, and fix gaps - all under the SEC’s watchful eye.

Why This Matters for the Nigerian Crypto Market

The VASP licensing regime isn’t just about control - it’s about survival. Before 2025, Nigerian crypto users relied on peer-to-peer platforms, often with no protections. Now, licensed exchanges can open bank accounts. They can partner with fintechs. They can attract institutional investors. Users gain trust. Businesses gain legitimacy.

But there’s a cost. Compliance is expensive. A small exchange might spend over N10 million just on KYC software, legal fees, and staffing. Those costs will trickle down to users - higher trading fees, longer withdrawal times, fewer free services. Some platforms won’t survive. Others will consolidate. The market will shrink, but it will become more stable.

For international companies like Binance or Kraken, the choice is clear: get licensed or leave Nigeria. There’s no third option. And with over 100 million Nigerians using crypto, that’s a market no serious player can ignore.

What Happens If You Don’t Get Licensed?

If you’re operating without a VASP license, you’re breaking the law. The SEC has the power to:

- Shut down your website or app

- Freeze your Nigerian bank accounts

- Block payment processors from working with you

- Impose fines up to N1 billion

- Prosecute directors personally

There’s no grace period. No warning. The law is active as of 2025. If you’re still operating without a license, you’re already at risk.

Next Steps: How to Start the Process

If you’re ready to apply, here’s your checklist:

- Register your company with CAC

- Open a corporate bank account in Nigeria and deposit N500 million

- Secure a physical office with a resident director

- Hire a certified public accountant to prepare audited financials

- Build your KYC/AML system using SEC-approved tools

- Prepare your business model, internal rules, and tech specs

- Apply for ARIP (if you’re a startup) or submit full VASP application

- Wait for SEC review - expect 60 to 90 days

Don’t try to do this alone. Hire a local legal advisor familiar with SEC regulations. The process is complex, and mistakes can cost you months - or your license.

Will the Rules Change?

Yes. The SEC has said the 2025 law is just the beginning. They’re watching how licensed VASPs operate. Feedback from the ARIP program will shape future updates. Expect changes in:

- Capital requirements (possibly tiered by service type)

- Rules on cross-border transactions

- Guidance on DeFi, NFTs, and stablecoins

- Reporting frequency and format

Stay updated. Subscribe to SEC bulletins. Join industry groups. The rules aren’t set in stone - but right now, they’re the only path forward.

Can a foreign company get a VASP license in Nigeria?

Yes, but only if they set up a Nigerian subsidiary. Foreign companies can’t apply directly. They must incorporate locally with the Corporate Affairs Commission, open a physical office in Nigeria, and appoint a resident director. The SEC requires local presence to ensure accountability and enforce compliance.

How long does the VASP licensing process take?

The full licensing process typically takes 60 to 90 days after submitting a complete application. If you apply through the Accelerated Regulatory Incubation Program (ARIP), you can start operating within 30 days under provisional approval, but full licensing still requires meeting all requirements by month 12.

What happens if my VASP license is denied?

If your application is denied, the SEC will provide a written explanation of the deficiencies. You can reapply after fixing the issues. There’s no limit on reapplications, but each new submission requires updated documentation and fees. Repeated failures may trigger closer scrutiny or mandatory meetings with SEC officials.

Do I need a separate license for each crypto service I offer?

No. One VASP license covers all virtual asset services - exchanges, wallets, staking, mining, and payments. However, you must disclose all services in your application. If you later add a major new service (like token issuance), you may need to submit an amendment to your business model for SEC approval.

Can I use offshore servers for my crypto platform?

Yes, but you must still comply with Nigerian data protection laws. All Nigerian user data must be stored securely and accessible to regulators upon request. The SEC requires you to demonstrate that your cybersecurity systems meet their Technology Risk Management standards, regardless of where your servers are located. You cannot avoid local compliance by using foreign infrastructure.