VASP Licensing Nigeria: What You Need to Know About Crypto Regulation in Nigeria

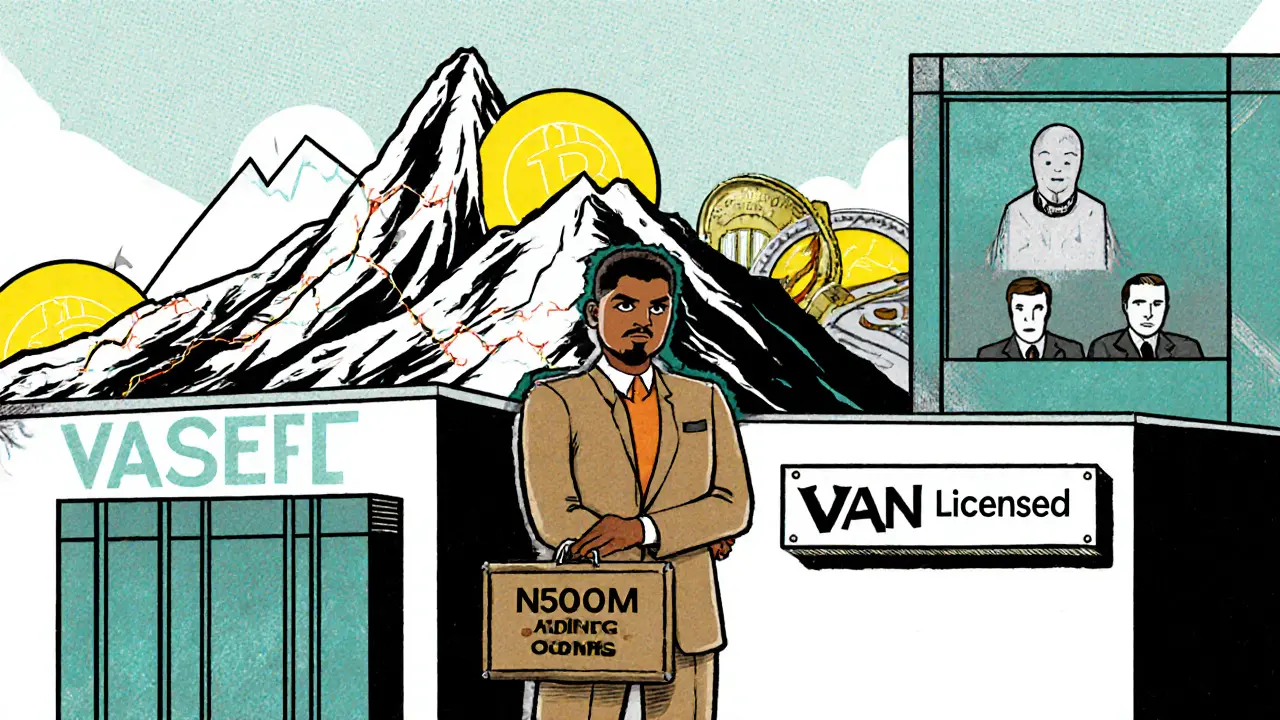

When we talk about VASP licensing Nigeria, a regulatory framework that requires virtual asset service providers to register with Nigeria’s securities watchdog. Also known as crypto exchange licensing, it’s not just paperwork—it’s a make-or-break requirement for any platform serving Nigerian users. Before 2023, crypto trading in Nigeria flew under the radar. Now, if you’re running a wallet, exchange, or even a P2P service that touches Naira, you need to be licensed by the Securities and Exchange Commission (SEC). This shift didn’t come from nowhere. It followed years of wild growth, scams, and capital flight that forced regulators to step in.

Related to this are crypto regulation Nigeria, the broader legal environment that now includes anti-money laundering rules, customer due diligence, and real-time transaction reporting. These aren’t optional. They mirror global standards like FATF’s Travel Rule, which Nigeria officially adopted. That means exchanges must collect and share sender/receiver info for transactions over 1,000 USD. For users, this feels like KYC on steroids. But for legitimate businesses, it’s a path to banking access, legitimacy, and long-term survival. Meanwhile, VASP compliance, the ongoing process of meeting these rules through audits, reporting, and staff training. is becoming a full-time job for Nigerian crypto startups. Many smaller players can’t afford the legal fees or tech upgrades. Some shut down. Others go underground—using offshore entities or hiding behind P2P platforms where enforcement is weak.

What you won’t find in official documents is how everyday traders are adapting. People still use Binance P2P, but now they’re more careful. They avoid platforms that refuse KYC. They watch for SEC warnings. They know that a platform without a license isn’t just risky—it’s illegal. And with Nigeria’s central bank still blocking crypto-related bank accounts, the pressure is on. The real question isn’t whether VASP licensing works—it’s whether it’s too late. Many traders already moved on. Others are waiting to see if the government will actually enforce the rules, or if corruption and bureaucracy will bury them. What’s clear is this: if you’re doing crypto in Nigeria, you’re no longer in the wild west. You’re in a regulated space, whether you like it or not. Below, you’ll find real stories, platform reviews, and breakdowns of what’s allowed, what’s banned, and who’s still standing after the crackdown.

VASP Licensing in Nigeria: Requirements and Process for Crypto Businesses

Nigeria now requires all crypto businesses to obtain a VASP license from the SEC. Learn the capital, compliance, and documentation requirements to legally operate in the country’s evolving digital asset market.

© 2026. All rights reserved.