South Korea Cryptocurrency Restrictions: What’s Banned, What’s Allowed in 2025

When it comes to South Korea cryptocurrency restrictions, a complex mix of financial oversight, tax enforcement, and anti-money laundering rules that tightly control how digital assets can be used. Also known as KFTC crypto rules, these regulations make South Korea one of the most controlled crypto markets in Asia. Unlike countries that welcome crypto as innovation, South Korea treats it like a high-risk financial product—something to be monitored, taxed, and contained.

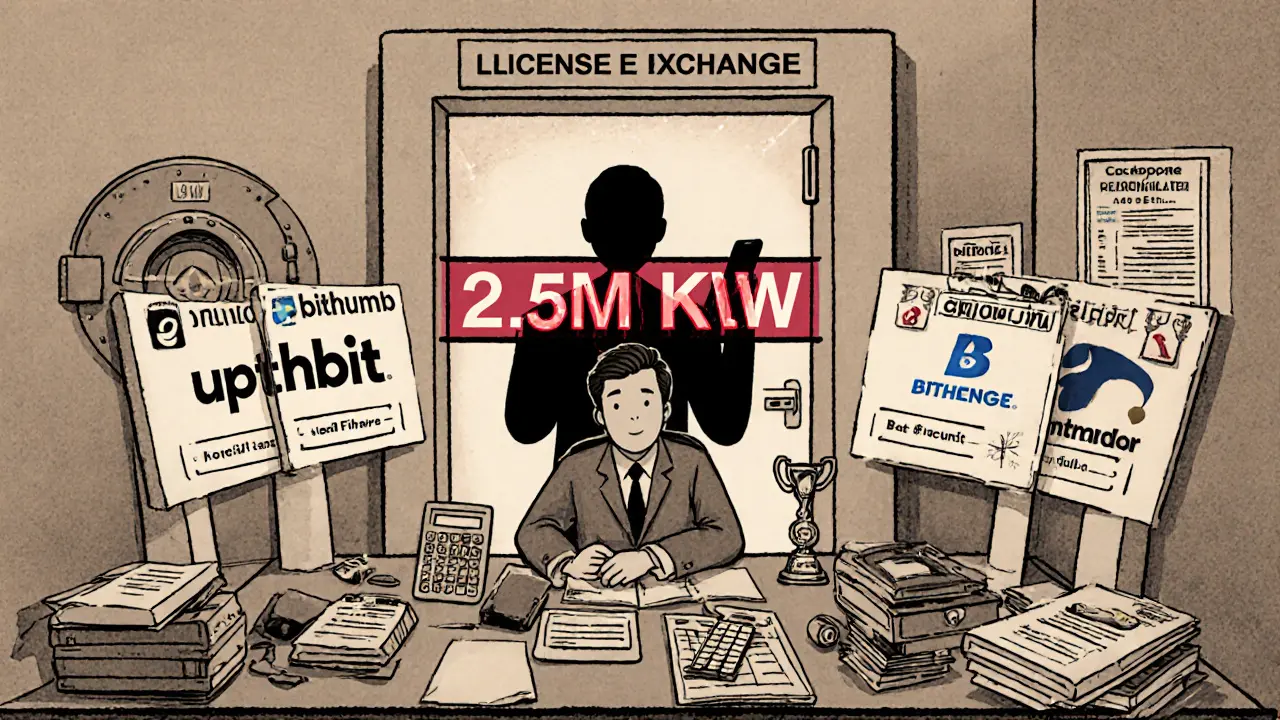

The KFTC, the Korea Financial Intelligence Unit and Financial Services Commission, the main bodies enforcing crypto rules in South Korea. Also known as Korea Financial Intelligence Unit, they require all exchanges to register, enforce strict KYC, and block anonymous trading. In 2021, the government shut down unregistered platforms overnight. Even big names had to shut down or merge to stay legal. Today, only a handful of licensed exchanges like Upbit, Bithumb, and Korbit can operate—and they’re watched like hawks. Any platform offering margin trading, leverage, or unverified tokens gets flagged fast.

Then there’s the crypto tax South Korea, a flat 20% tax on all crypto profits, no matter how small or how long you held the asset. Also known as digital asset income tax, it applies whether you trade, sell, or spend crypto. There’s no exemption for long-term holds. No deduction for losses. If you made $500 on a trade, you owe $100—even if you lost $2,000 elsewhere. The tax agency cross-checks exchange data with bank records. If your wallet sent $10,000 to a crypto exchange and your bank account suddenly shows a $9,000 deposit, expect a letter.

But here’s the twist: despite all this, crypto doesn’t disappear. People still trade. How? Through P2P platforms, offshore wallets, and cash deals. Some use VPNs to access foreign exchanges. Others trade USDT over KakaoTalk with trusted contacts. The underground market thrives because inflation is rising, wages are stagnant, and young Koreans see crypto as the only real path to wealth. It’s not legal—but it’s common.

And it’s not just about trading. The government has blocked crypto-related ads, banned crypto ATMs, and pressured banks to freeze accounts linked to exchanges. Even crypto influencers get fined for promoting tokens without disclosing risks. The message is clear: if you’re not on the official list, you’re not playing by the rules.

Below, you’ll find real stories from traders who’ve navigated these rules, guides on how to spot legal vs. illegal platforms, and breakdowns of the latest enforcement moves. Some posts expose scams pretending to be compliant. Others show how local tokens like SuperTrust (SUT) survive in this tight space—not as investments, but as payment tools inside specific ecosystems. This isn’t theoretical. These are the rules people live under every day in South Korea. And if you’re trading there, you need to know them.

Korean Crypto Trading Restrictions and Rules: What You Need to Know in 2025

South Korea enforces strict crypto rules: only four licensed exchanges, real-name bank links, 20% tax on profits over 2.5M KRW, and no anonymous trading. Learn how to trade legally in 2025.

© 2026. All rights reserved.