SEC Nigeria crypto: What You Need to Know About Crypto Regulation in Nigeria

When it comes to SEC Nigeria crypto, the Securities and Exchange Commission of Nigeria’s official stance on digital assets. Also known as Nigerian crypto regulation, it shapes how millions of Nigerians trade, invest, and even survive using cryptocurrency. The SEC Nigeria crypto position isn’t a ban—it’s a gray zone. They don’t allow crypto exchanges to operate like banks, but they also don’t stop people from buying Bitcoin on P2P platforms. This contradiction is why Nigeria has one of the highest crypto adoption rates in Africa, even as regulators try to control it.

Behind the scenes, the SEC Nigeria, the federal agency responsible for overseeing financial markets and investment schemes. Also known as Nigerian Securities and Exchange Commission, it has cracked down on unlicensed platforms and warned the public about scams. But enforcement is patchy. While the SEC Nigeria crypto team has issued fines and shut down fake ICOs, most retail traders use Binance P2P, Telegram groups, and WhatsApp networks to trade USDT and other coins. These channels don’t need SEC approval—and they’re not going away. The real battle isn’t about legality; it’s about access. With inflation hitting 30% and banks freezing accounts, crypto isn’t a luxury for many Nigerians—it’s a lifeline.

Then there’s the Nigerian cryptocurrency, the broad category of digital assets used by individuals and businesses across the country. Also known as crypto in Nigeria, it includes everything from Bitcoin and Ethereum to local tokens tied to remittance apps. Unlike countries with clear tax rules or licensed exchanges, Nigeria’s crypto ecosystem runs on trust, speed, and anonymity. You won’t find KYC-heavy platforms dominating here. Instead, you’ll see cash-for-Bitcoin deals in markets, crypto-backed loans via Telegram bots, and traders using VPNs to bypass banking blocks. The SEC Nigeria crypto warnings sound loud, but they don’t reach the people who need crypto most.

What you’ll find in the posts below isn’t a list of official guidelines. It’s a raw look at how crypto actually works on the ground in Nigeria—and how regulation tries (and often fails) to keep up. You’ll see how traders bypass restrictions, what scams prey on newcomers, and why even a banned system can thrive when the alternative is economic collapse. These aren’t theoretical debates. They’re survival tactics.

Is Crypto Regulated in Nigeria? 2025 Legal Framework Explained

Nigeria officially regulates cryptocurrency as of 2025 under the Investments and Securities Act. The SEC now licenses exchanges, crypto is taxable, and banks can serve compliant businesses. Here's what you need to know.

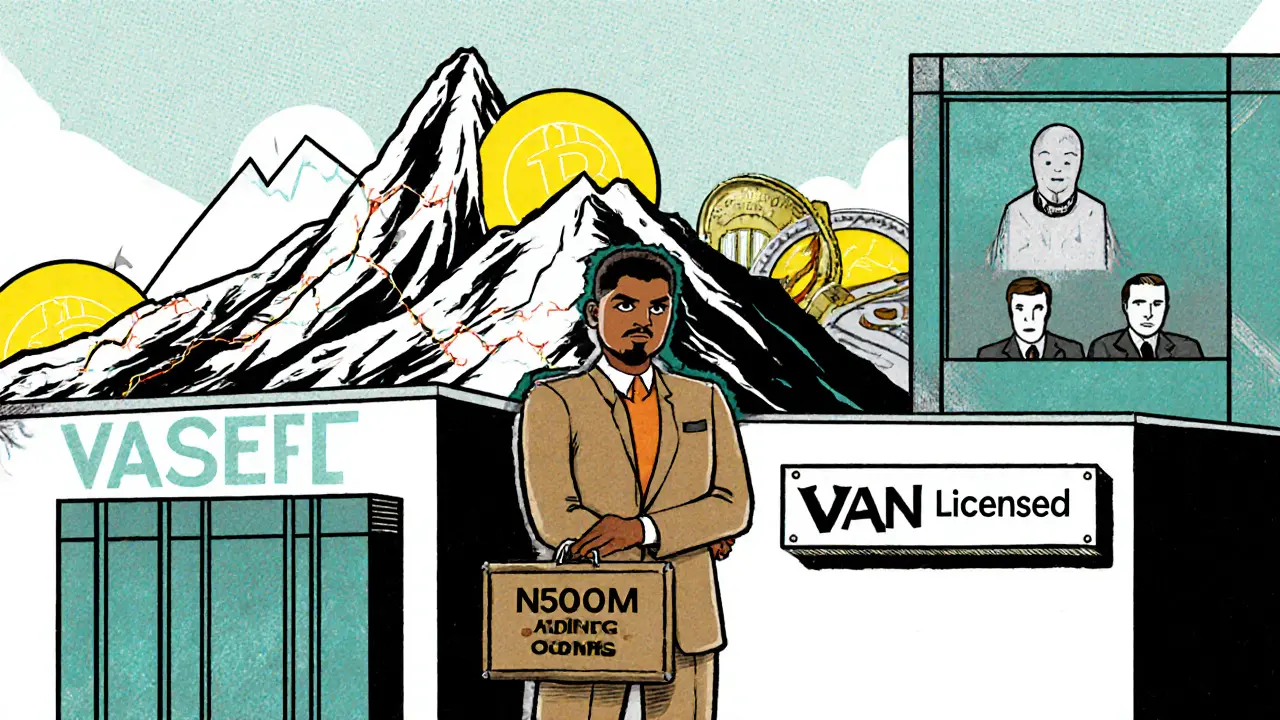

VASP Licensing in Nigeria: Requirements and Process for Crypto Businesses

Nigeria now requires all crypto businesses to obtain a VASP license from the SEC. Learn the capital, compliance, and documentation requirements to legally operate in the country’s evolving digital asset market.

© 2026. All rights reserved.