Safe Crypto Trading: How to Avoid Scams, Exchanges, and Rug Pulls

When you start safe crypto trading, the practice of buying, selling, and holding digital assets while minimizing risk of theft, fraud, or loss. Also known as secure crypto investing, it’s not about chasing the highest returns—it’s about staying alive long enough to see them. Most people lose money not because the market crashed, but because they trusted a fake exchange, clicked a phishing link, or joined a fake airdrop. The crypto space is full of noise, and the loudest voices are often the ones trying to take your money.

One of the biggest threats to safe crypto trading, the practice of buying, selling, and holding digital assets while minimizing risk of theft, fraud, or loss. Also known as secure crypto investing, it’s not about chasing the highest returns—it’s about staying alive long enough to see them. is the crypto airdrop, a free distribution of tokens meant to grow a project’s user base, but often used to lure victims into fake wallets or phishing sites. Look at the SOS Foundation airdrop—it doesn’t exist. Or KTN Adopt a Kitten—no verified details, just a smart contract waiting to drain your wallet. Even legitimate-looking ones like the Impossible Finance x CoinMarketCap airdrop had restrictions: U.S. users got locked out. If it sounds too easy, it’s probably a trap.

Then there’s the decentralized exchange, a peer-to-peer platform for trading crypto without a central authority, but one that can still be insecure if poorly built or underfunded. Solarbeam and LFJ V2.2 are real DEXs with security scores and volume. But MilkshakeSwap? Nearly dead. RadioShack Swap? Shallow liquidity. Thruster v3? Only for experts. You don’t need to use every DEX. Stick to ones with clear audits, real trading volume, and active communities. Never send funds to a contract you don’t understand.

crypto regulation, government rules that control how crypto can be used, traded, or taxed, often forcing exchanges to delist risky assets or shut down entirely. is shaping what’s safe today. Cambodia bans most crypto transactions. Pakistan’s PVARA now licenses platforms. Privacy coins like Monero are getting kicked off exchanges because regulators say they’re too anonymous. This isn’t censorship—it’s cleanup. If a project avoids regulation, it’s not rebellious—it’s reckless.

You’ll find posts here that expose fake coins like YOTSUBA and Coin Stock, both made up from thin air. Others show how airdrops like BitOrbit collapsed from $290K to under $3K. Some warn about dead projects like SUIA with zero circulation. These aren’t just stories—they’re warnings. Every post here is a lesson learned the hard way. What you’ll see isn’t hype. It’s the truth behind the tokens, the exchanges, and the scams that pretend to be opportunities. This is your filter. Use it before you click, before you connect your wallet, before you send your first dollar.

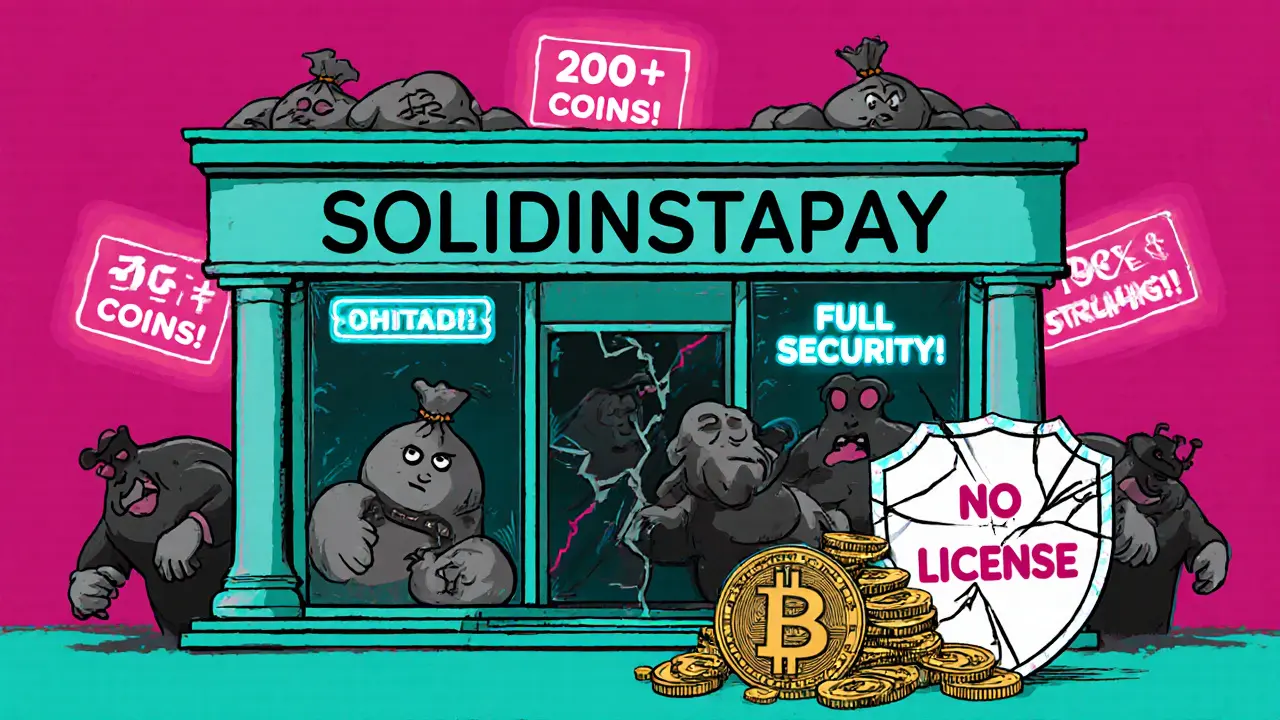

SOLIDINSTAPAY Crypto Exchange Review: Is It Safe to Trade Here?

SOLIDINSTAPAY is an unregulated crypto exchange with no transparency, user reviews, or proof of funds. Avoid it - your money isn't safe. Use regulated platforms like Gemini or Uphold instead.

© 2026. All rights reserved.