Korean Crypto Taxes: What You Must Know in 2025

When you trade or hold cryptocurrency in South Korea, a country that treats crypto as a taxable asset with no legal gray areas. Also known as Korea, it enforces some of the strictest crypto tax rules in Asia. Unlike places where crypto is ignored or lightly taxed, South Korea demands full disclosure—every trade, every gain, every gift. The government doesn’t care if you made a profit or lost money. If you moved crypto, you owe tax.

There are three big things you need to track: crypto income, any crypto you earn from staking, airdrops, or mining, capital gains, profit from selling or swapping crypto, and crypto gifts, transferring crypto to someone else, even a friend. All three are taxed as ordinary income at up to 45%. No deductions. No exemptions. Even if you swap Bitcoin for Ethereum, the IRS-style rule applies: it’s a taxable event. And yes, the tax office can see your wallet addresses through exchange data sharing.

Exchanges like Binance and Upbit must report user activity to the National Tax Service. If you traded on a no-KYC platform, you’re still on the hook. The government doesn’t care if you think you’re hidden—they have tools to trace on-chain activity. Failing to report can mean fines up to 40% of the unpaid tax, plus criminal charges in serious cases. In 2024, over 12,000 Koreans received tax notices just for unreported crypto activity. This isn’t a warning—it’s enforcement.

What about mining? If you mine crypto in South Korea, it’s treated like earned income. You report the fair market value of the coins when they hit your wallet. Staking rewards? Same rule. Airdrops? Taxable the moment you claim them. Even receiving crypto as payment for freelance work counts as income. There’s no "hobby" exception. No "small amount" loophole. The tax code doesn’t have soft spots for crypto.

Reporting is done through your annual income tax return using Form 11. You must list every transaction: date, type, amount in KRW, and cost basis. Many use Excel sheets or crypto tax software like Koinly or CryptoTaxCalculator to stay organized. But even the best tools won’t help if you didn’t track it in the first place. Most people lose records after a few months—then panic when the tax letter arrives.

There’s one silver lining: losses can offset gains. If you lost money on one trade and made it back on another, you can net them out. But you still have to report both. Ignoring losses won’t hide them—it just makes your filing look suspicious. And remember: holding crypto for years doesn’t lower your tax rate. There’s no long-term capital gains break in South Korea. A coin held for 10 years is taxed the same as one held for 10 days.

What you’ll find below are real guides from traders, investors, and accountants who’ve dealt with Korean crypto taxes firsthand. You’ll see how people report staking rewards from Solana tokens, how they handle P2P trades on Binance, and what happens when the tax office asks for wallet history. Some posts warn about scams pretending to be tax advisors. Others show step-by-step filing methods that actually work. No fluff. No theory. Just what you need to file correctly and avoid penalties in 2025.

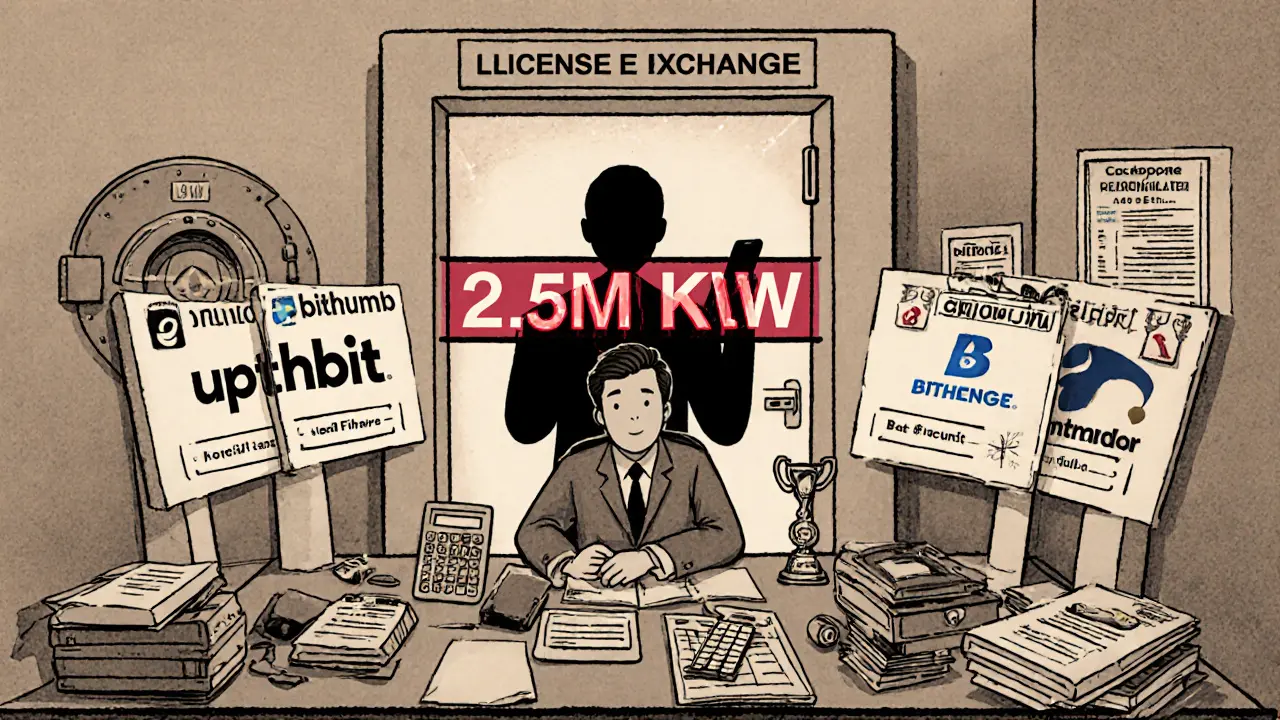

Korean Crypto Trading Restrictions and Rules: What You Need to Know in 2025

South Korea enforces strict crypto rules: only four licensed exchanges, real-name bank links, 20% tax on profits over 2.5M KRW, and no anonymous trading. Learn how to trade legally in 2025.

© 2026. All rights reserved.