Korean crypto rules: What you need to know about South Korea's crypto rules in 2025

When it comes to Korean crypto rules, the strict regulatory framework enforced by South Korea’s Financial Services Commission and Korea Financial Intelligence Unit to control cryptocurrency trading, taxation, and exchange operations. Also known as South Korea crypto regulation, it’s one of the most transparent but also one of the most demanding systems in Asia. Unlike countries that ban crypto or ignore it, South Korea treats digital assets as financial instruments—and holds everyone accountable.

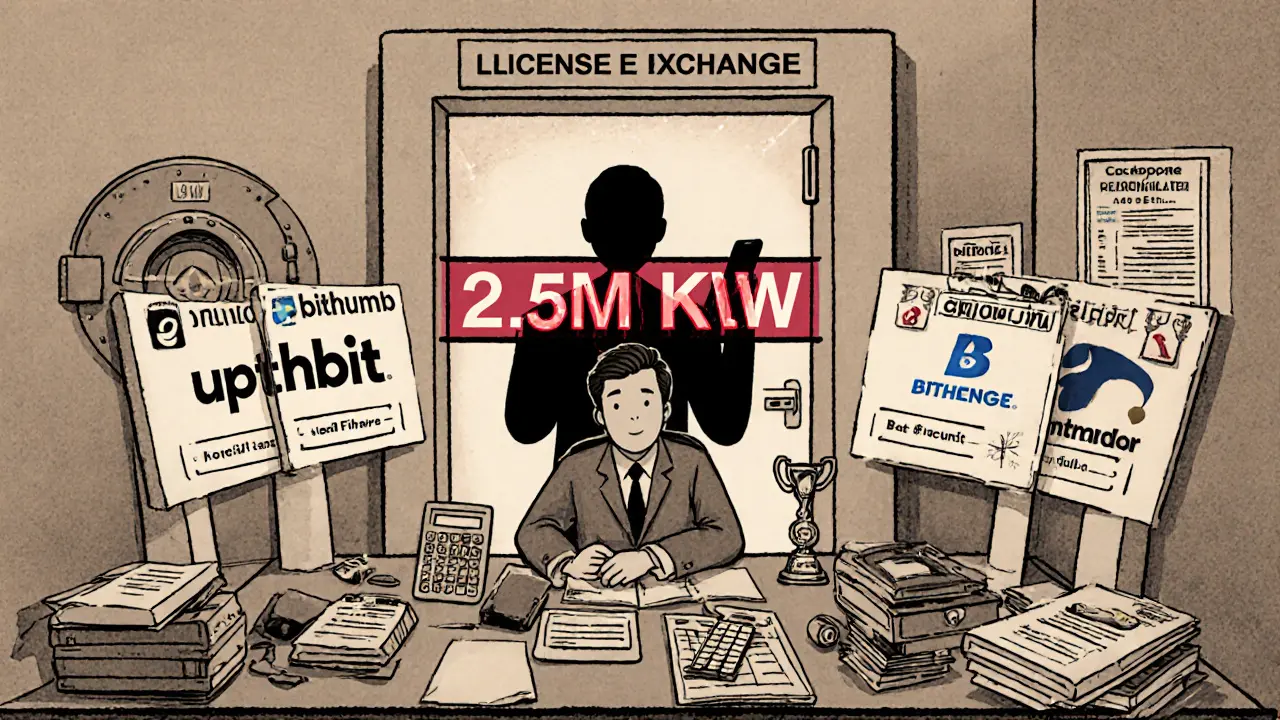

If you’re trading, investing, or running a business in crypto here, you’re dealing with real consequences. The KFTC, Korea Financial Intelligence Unit, the government body responsible for monitoring crypto transactions and enforcing anti-money laundering rules requires every exchange operating in the country to be fully licensed, KYC-compliant, and audited. No anonymous trading. No offshore platforms. Even if you’re using Binance or Kraken from a VPN, the law still applies to your local bank transfers and tax filings. And if you’re sending crypto to an unlicensed exchange? You could be flagged for money laundering.

The crypto tax Korea, the 20% capital gains tax on crypto profits over 2.5 million KRW ($1,800 USD) annually, applied since 2022 and still active in 2025 hits hard. It doesn’t matter if you made $10 or $100,000—you pay tax on every profit above the threshold. Losses don’t offset gains like in the U.S. You file separately, report every trade, and keep records for five years. The government even cross-checks wallet addresses with exchange data. If you think you can hide your activity, think again.

There’s also no gray area for airdrops, staking rewards, or NFT sales. All are taxable income. Even if you didn’t sell—just received tokens—you owe tax. And if you’re running a crypto-related business? You need a VASP license, just like in Nigeria or the UAE. The rules are clear, the penalties are steep, and the enforcement is getting smarter.

That’s why so many Koreans use P2P platforms like Binance or LocalBitcoins—not because they want to break the law, but because they need flexibility. Some still trade through unofficial channels, but the risks are rising. The government has cracked down on fake exchanges, scam tokens, and unlicensed mining farms. In 2024 alone, over 300 crypto-related cases went to court.

What you’ll find in the posts below are real examples of how these rules play out in practice: how traders navigate the tax system, how exchanges adapt to licensing, and how scams still slip through the cracks. You’ll see how Korean crypto rules shape behavior—not just in Seoul, but across the global crypto scene. This isn’t theory. It’s what’s happening right now, on the ground, in one of the world’s most active crypto markets.

Korean Crypto Trading Restrictions and Rules: What You Need to Know in 2025

South Korea enforces strict crypto rules: only four licensed exchanges, real-name bank links, 20% tax on profits over 2.5M KRW, and no anonymous trading. Learn how to trade legally in 2025.

© 2026. All rights reserved.