Cryptocurrency Regulation Nigeria: What’s Legal, What’s Not, and How Traders Survive

When it comes to cryptocurrency regulation Nigeria, the Nigerian government’s stance on digital assets is unclear, restrictive, and inconsistently enforced. Also known as Nigeria crypto policy, it’s not a full ban—but it’s far from acceptance. The Central Bank of Nigeria (CBN) issued a directive in 2021 telling banks to cut off services to crypto businesses, and that rule still hangs over the market like a shadow. But here’s the twist: people are trading anyway.

That’s where P2P crypto Nigeria, peer-to-peer trading platforms that let users buy and sell crypto directly with cash or bank transfers. Also known as Nigerian crypto P2P, it’s become the backbone of the country’s digital asset economy. Platforms like Binance P2P, Paxful, and LocalBitcoins are flooded with traders swapping naira for USDT, BTC, and ETH. No bank account? No problem. You meet someone in a mall, transfer cash, and get crypto sent to your wallet. It’s risky—scams happen—but it’s the only way millions stay connected to global markets.

And then there’s the crypto tax Nigeria, the looming question of whether the government will start taxing crypto gains. Right now, there’s no official crypto tax law, but the Federal Inland Revenue Service (FIRS) has signaled interest. If they follow India or Vietnam’s path, every trade could trigger a tax. For now, most traders operate under the radar. But with inflation hitting over 30% and the naira losing value fast, crypto isn’t just a speculation game—it’s a survival tool.

What you won’t find in official reports is how deeply crypto is woven into daily life. Small businesses use USDT to pay suppliers abroad. Students earn crypto through freelance gigs and send it home. Even farmers are using crypto to sell crops to international buyers without waiting weeks for bank approvals. The system works because it’s decentralized, fast, and doesn’t need permission.

But don’t mistake freedom for safety. Arrests for crypto-related activity have happened. Wallets get drained by fake airdrop scams. Exchanges like FutureX Pro and QB crypto exchange don’t exist—but their websites still pop up in search results, tricking newcomers. The Nigerian crypto space is full of opportunity, but also full of traps.

Below, you’ll find real stories from traders who’ve navigated these waters. Some explain how they bypass banking restrictions. Others warn about scams disguised as official projects. You’ll see what works, what fails, and what no one talks about—like how VPNs, local cash meetups, and no-KYC platforms keep the system alive. This isn’t theory. It’s what’s happening right now, on the ground, in Lagos, Abuja, and Port Harcourt.

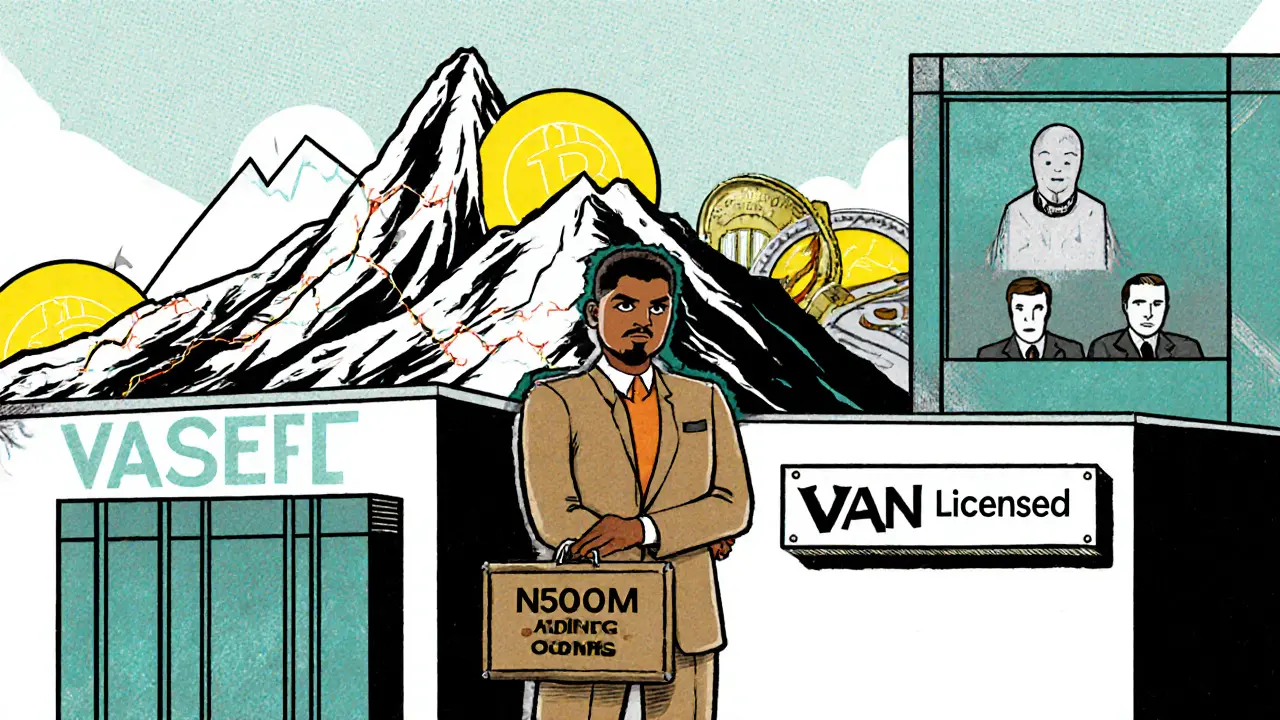

VASP Licensing in Nigeria: Requirements and Process for Crypto Businesses

Nigeria now requires all crypto businesses to obtain a VASP license from the SEC. Learn the capital, compliance, and documentation requirements to legally operate in the country’s evolving digital asset market.

© 2026. All rights reserved.