Crypto Trading Korea: Rules, Risks, and How Traders Stay Active

When it comes to crypto trading Korea, the practice of buying, selling, and holding digital assets within South Korea under its legal and financial framework. Also known as Korean cryptocurrency trading, it’s a high-pressure environment where regulation moves faster than markets. Unlike places like the U.S. or UAE, Korea doesn’t ban crypto—it just makes it hard to use. Banks block deposits from exchanges, taxes hit every trade, and even small transactions require full KYC. Yet, millions still trade daily. How? They bypass the system, not break it.

The real story isn’t about Bitcoin or Ethereum—it’s about KRW crypto exchange, local platforms that let users trade Korean won for digital assets like USDT or BTC. Also known as Korean fiat gateways, these are the lifelines for everyday traders. But even these platforms are under constant scrutiny. In 2025, Korea’s Financial Services Commission requires all exchanges to report every transaction, and they must freeze accounts if suspicious activity pops up. That’s why many turn to P2P crypto Korea, peer-to-peer networks where users trade directly using cash, bank transfers, or mobile payments. Also known as Korean crypto OTC, this is where real volume hides—from college students buying Dogecoin with cash to small businesses paying suppliers in USDT. And then there’s the tax angle: crypto taxes Korea, a 20% capital gains tax applied to all crypto profits, plus a 0.25% transaction levy on exchange trades. Also known as Korean crypto withholding tax, it’s automatic, non-negotiable, and applies even if you break even. No one gets a pass. This isn’t just about compliance—it’s about survival. Traders who don’t track their buys and sells end up paying penalties or worse.

What you’ll find in the posts below isn’t a list of the best exchanges. It’s the real, messy truth: how traders in Korea avoid banking blocks, why some tokens like SuperTrust (SUT) only move on local platforms, and how scams target people who don’t understand local rules. You’ll see how Vietnam’s 0.1% tax and India’s 1% TDS compare to Korea’s system. You’ll learn why no-KYC exchanges are dangerous here, and why using a VPN won’t save you if your bank flags your account. This isn’t theory. It’s what people are doing right now, under pressure, with real money on the line.

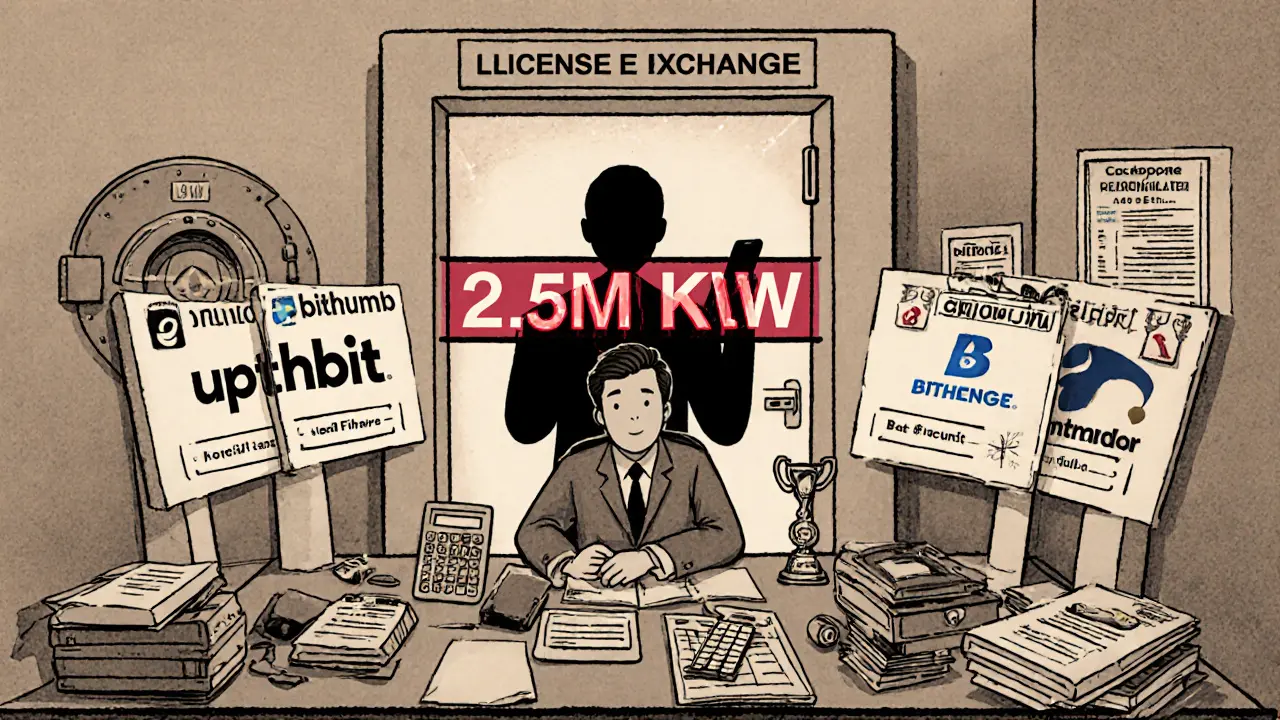

Korean Crypto Trading Restrictions and Rules: What You Need to Know in 2025

South Korea enforces strict crypto rules: only four licensed exchanges, real-name bank links, 20% tax on profits over 2.5M KRW, and no anonymous trading. Learn how to trade legally in 2025.

© 2026. All rights reserved.