Crypto Exchange Risks: What You Need to Know Before You Trade

When you trade crypto on an exchange, you're not just buying tokens—you're trusting someone else with your money. crypto exchange risks, the hidden dangers of using platforms to buy, sell, or store digital assets. These risks aren't theoretical—they've wiped out savings in seconds, from centralized platforms like FTX collapsing to decentralized exchanges getting hacked because of flawed code. Most people think if it's on a website with a logo and a whitepaper, it's safe. That’s the first mistake.

centralized exchange, a platform that holds your crypto for you, like Coinbase or Binance. CEX sounds convenient, but it means you don’t control your keys. If the exchange gets hacked, gets shut down by regulators, or just vanishes—your coins vanish with it. That’s why decentralized exchange, a peer-to-peer trading platform where you keep control of your wallet. DEX became popular. But DEXs aren’t magic. They can have rug pulls, fake liquidity, or smart contract bugs. Solarbeam and RadioShack Swap look fine on the surface, but low volume and zero audits make them ticking time bombs.

crypto scams, fraudulent projects disguised as legitimate exchanges or tokens are everywhere. GoodExchange doesn’t exist. YOTSUBA isn’t real. SUIA has zero circulation. These aren’t glitches—they’re designed to trick you into sending funds to a wallet that can’t be reversed. And when regulators step in, like with regulatory crackdown, government actions that ban or restrict crypto platforms in Cambodia or against privacy coins, exchanges get delisted overnight. You can’t trade what’s banned. You can’t withdraw what’s frozen.

There’s no such thing as a risk-free exchange. Even the big ones have had breaches. The difference between losing money and keeping it comes down to one thing: knowing what to look for. Are they audited? Is the team real? Is there real trading volume—or just fake bots? Are they compliant with local laws—or hiding from them? The posts below break down real cases: how BitOrbit failed, why MilkshakeSwap is dead, how SundaeSwap works on Cardano, and why wrapped assets like WBTC carry hidden trust risks. You’ll see exactly how scams are built, how exchanges collapse, and how to spot the red flags before you click "Deposit".

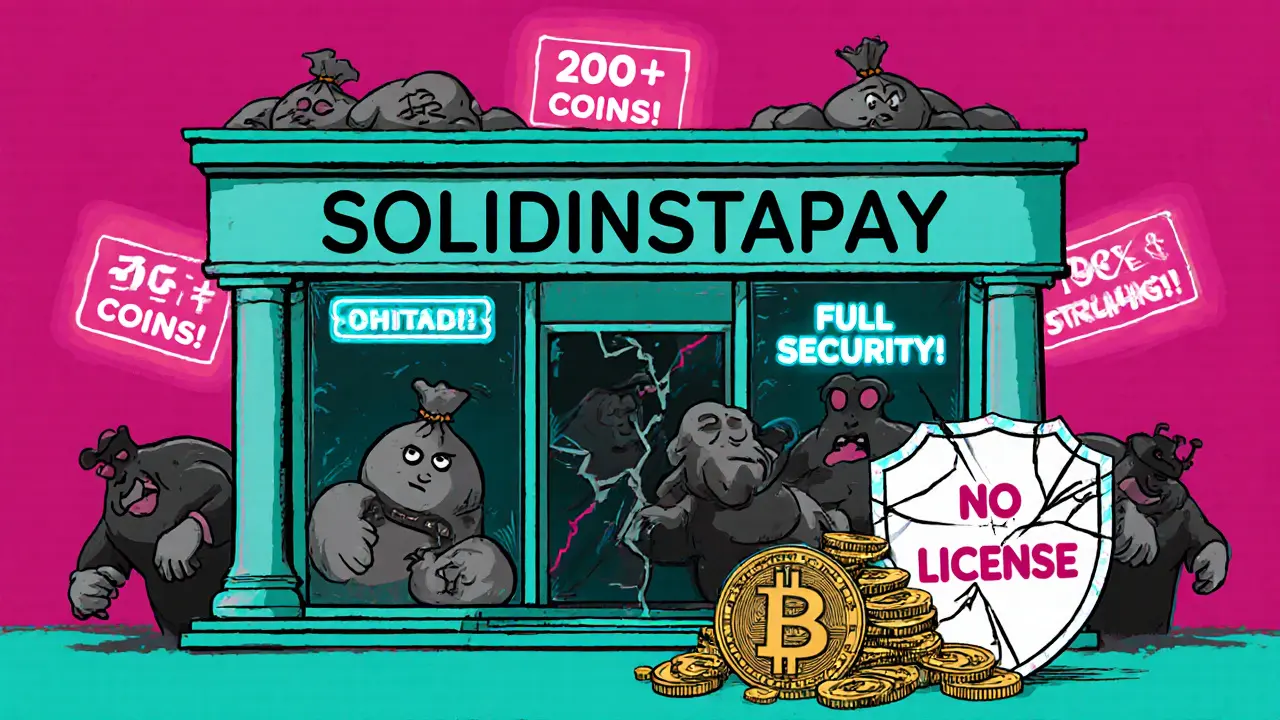

SOLIDINSTAPAY Crypto Exchange Review: Is It Safe to Trade Here?

SOLIDINSTAPAY is an unregulated crypto exchange with no transparency, user reviews, or proof of funds. Avoid it - your money isn't safe. Use regulated platforms like Gemini or Uphold instead.

© 2026. All rights reserved.