Sanctioned Crypto Transaction Estimator

How Analytics Firms Calculate Sanctioned Transactions

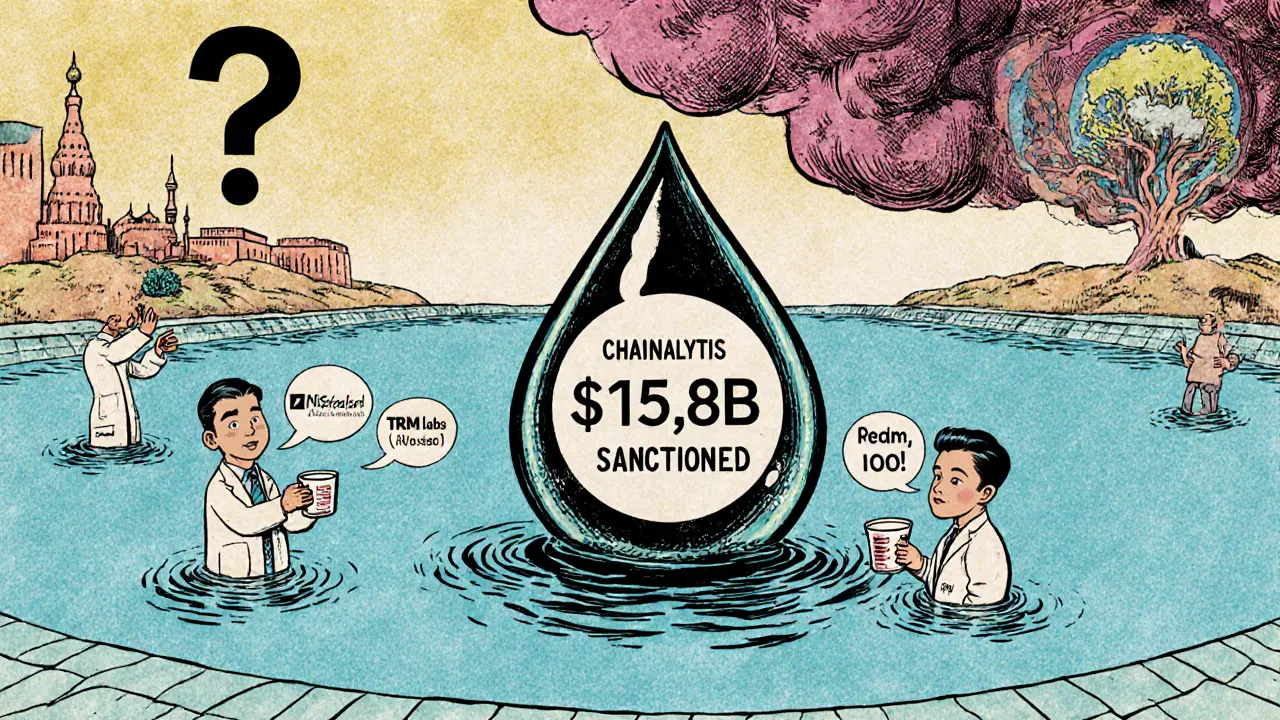

Different blockchain analytics firms report varying figures for sanctioned crypto transactions because they use different methodologies. The $15.8 billion figure from Chainalysis includes all transactions with known sanctioned addresses. TRM Labs uses more restrictive criteria, while CoinLaw.io focuses only on direct transactions to OFAC-listed wallets.

Bitcoin

68% of sanctioned transactions

Ethereum

20% of sanctioned transactions

Stablecoins

12% of sanctioned transactions

How Methodology Affects Results

Chainalysis includes any wallet that interacted with a sanctioned address (e.g., money laundering transactions).

TRM Labs only counts direct transactions to OFAC-listed wallets, excluding intermediary steps.

CoinLaw.io uses the most restrictive criteria, counting only transactions to known sanctioned entities.

In 2024, sanctioned crypto transactions hit a record $15.8 billion - a number that shouldn’t have been possible. Not because crypto is untraceable, but because enforcement is playing catch-up in a game where bad actors are moving faster than regulators can react.

Who’s Really Behind the $15.8 Billion?

This isn’t random noise. Nearly 60% of that total came from sanctioned countries - mostly Iran and Russia. Iran’s centralized exchanges, like Garantex and Nobitex, became the main pipelines for moving money out of the country. People weren’t just trading Bitcoin - they were using it to bypass freezing bank accounts and avoid capital controls. Russia’s role was even more targeted: $800 million in ransomware payments flowed through sanctioned wallets. That’s not speculation. That’s data from Chainalysis, TRM Labs, and U.S. Treasury filings. The biggest names in crypto crime? Ransomware gangs like Conti, LockBit, and Black Basta. They didn’t vanish after sanctions hit. They just moved their cash through crypto. Garantex, a now-sanctioned exchange, handled millions in payments from these groups. One money launderer, Ekaterina Zhdanova, converted over $2 million in Bitcoin to Tether (USDT) through the same platform. These aren’t ghosts. They’re real people with real wallets - and regulators now know exactly where they are.Bitcoin Still Rules the Sanctioned Underground

You might think privacy coins like Monero or Zcash are the go-to for criminals. But in 2024, Bitcoin was the backbone of sanctioned activity. It made up 68% of all transactions tied to OFAC-designated wallets. Ethereum followed at 20%. Stablecoins like USDT accounted for the rest - not because they’re anonymous, but because they’re stable. If you’re laundering money from ransomware, you don’t want your cash losing 30% of its value in a week. Why Bitcoin? Because it’s the most liquid. It’s the easiest to move across borders without triggering traditional banking alerts. And because, despite being public on-chain, it’s still hard to link wallets to real identities - unless you’re tracking patterns over time. That’s where blockchain analytics firms come in. Chainalysis, TRM Labs, and CoinLaw.io all track these flows. But here’s the problem: their numbers don’t match. Chainalysis says $15.8 billion. TRM Labs says $14.8 billion. CoinLaw.io says just $2.7 billion. Why the gap? Because each firm defines “sanctioned entity” differently. Some include any wallet that ever touched a sanctioned address. Others only count direct transactions to OFAC-listed wallets. One counts DeFi bridges. Another ignores them. The truth? No one has the full picture - but all agree on one thing: sanctions-related crypto is still the biggest source of illicit activity.DeFi and Cross-Chain Bridges Are the New Escape Routes

The old way of laundering crypto was through centralized exchanges. You’d deposit, convert, withdraw. Easy. But now, exchanges like Garantex are shut down. So bad actors moved to DeFi. In 2024, 33% of all illicit crypto funds passed through decentralized finance platforms. These aren’t banks. They’re smart contracts. No CEO. No KYC. No one to subpoena. Liquidity pools became money mules. OFAC flagged 150 of them. But shutting down a smart contract? You can’t. You can only blacklist addresses. And even then, criminals just create new ones. Cross-chain bridges were used in 19% of sanctioned transactions. That means money moved from Bitcoin to Ethereum, then to Solana, then to Polygon - each time breaking the trail. One wallet might be flagged on Ethereum. But after three bridges? It’s invisible. These tools were built to make crypto interoperable. Instead, they became the perfect tool for evasion.

Why 2024 Was Different

In 2023, illicit crypto volume was higher - $21.9 billion in sanctioned inflows, according to TRM Labs. But in 2024, the total illicit volume dropped 24%. So why did sanctioned activity stay high? Because the nature of the crime changed. More money came from countries. Less from individual scammers. Pig butchering scams - where people are tricked into investing in fake crypto projects - dropped 58%. Fraud-related inflows fell 40%. That’s good news. But the money that replaced it? It’s more dangerous. It’s state-backed. It’s organized. It’s designed to undermine global financial systems. Iran didn’t just use crypto to avoid sanctions. It used crypto to keep its economy running. When Western banks cut off access, Iran’s government turned to crypto exchanges as unofficial banks. That’s not a loophole. That’s a strategy.The Enforcement Gap

The U.S. Treasury sanctioned 13 crypto addresses in 2024 - the second-highest number in seven years. But here’s the catch: OFAC can list a wallet. They can freeze it. But they can’t stop someone from sending money to it. All they can do is tell exchanges: “Don’t touch this address.” But what if the user isn’t on an exchange? What if they’re using a self-custody wallet? Or a peer-to-peer app? Or a non-KYC service in a country that doesn’t cooperate with the U.S.? Then enforcement stops. The total crypto transaction volume in 2024 hit $10.6 trillion. That’s 56% more than 2023. Trying to track $15.8 billion in bad money within that ocean? It’s like finding a single drop of ink in a swimming pool - and the pool keeps getting bigger. Chainalysis admits their estimates grow by 25% each year as they find new illicit addresses. That means the $15.8 billion we know about? It’s probably just the tip. The rest is still hidden.

What’s Next?

The race isn’t over. It’s accelerating. Regulators are building AI tools to spot patterns faster. They’re sharing data across countries. The EU, UK, and U.S. are starting to align on sanctions lists. But criminals are building better tools too. Privacy coins are improving. New cross-chain protocols are launching. DeFi apps are adding “anti-sanction” features. And countries like Iran and Russia are building their own crypto ecosystems - with local exchanges, local stablecoins, and local blockchain networks that don’t connect to the rest of the world. The real question isn’t whether we can stop these transactions. It’s whether we’re willing to sacrifice privacy, speed, and decentralization to try.Key Takeaways

- $15.8 billion in sanctioned crypto transactions in 2024 was mostly Bitcoin and Ethereum, not privacy coins.

- Iran and Russia drove most of the activity - not individual scammers.

- Garantex and Nobitex handled over 85% of inflows to sanctioned entities.

- DeFi and cross-chain bridges made evasion easier than ever.

- Enforcement can freeze wallets, but can’t stop transactions - especially outside regulated exchanges.

How did OFAC identify the $15.8 billion in sanctioned crypto transactions?

OFAC didn’t track the money directly. Blockchain analytics firms like Chainalysis and TRM Labs used transaction patterns, wallet clustering, and known address associations to trace funds linked to sanctioned entities. They combined on-chain data with real-world intelligence - like exchange registrations, IP addresses, and leaked documents - to link wallets to individuals or governments under sanctions. OFAC then used those findings to issue designations and pressure exchanges.

Why are Bitcoin and Ethereum used more than privacy coins in sanctioned transactions?

Privacy coins like Monero are harder to trace, but they’re also harder to trade. Most exchanges don’t list them. Banks won’t convert them. Bitcoin and Ethereum, on the other hand, are liquid, widely accepted, and easy to move through bridges or exchanges. Criminals prefer convenience over anonymity when they need to cash out. Stablecoins like USDT, built on Ethereum, let them move value without price swings - making them ideal for large-scale laundering.

Can you really stop crypto sanctions evasion with wallet blacklists?

Not really. Blacklisting works on centralized exchanges - if they comply. But if someone uses a non-KYC wallet, a peer-to-peer app, or a decentralized exchange, there’s no one to block. Once funds leave a regulated platform, they can hop across chains, mix with clean funds, or sit in a wallet for years. Blacklists are a starting point, not a solution.

Why do different analytics firms report different numbers for sanctioned crypto?

Each firm uses different criteria. Some count any wallet that ever interacted with a sanctioned address. Others only count direct transfers. Some include DeFi transactions. Others exclude them. Some use AI to predict new addresses. Others rely on manual verification. There’s no global standard. That’s why the range goes from $2.7 billion to $15.8 billion - all of them are “right” within their own methodology.

Is crypto becoming a tool for state-sponsored sanctions evasion?

Yes. In 2024, nearly 60% of illicit crypto volume came from sanctioned countries, not individual criminals. This isn’t just about hackers or scammers anymore. It’s about governments using crypto as an alternative financial system - bypassing SWIFT, freezing bank accounts, and international trade restrictions. Iran and Russia are building their own crypto infrastructure. This is a geopolitical shift, not just a tech issue.

10 Comments

It's wild how everyone acts like crypto is this wild west when the truth is, it's just capitalism with extra steps. The fact that Iran and Russia are using it as a workaround doesn't mean crypto is broken-it means the old financial system is brittle. We're treating digital money like it's supposed to behave like banks, but it never was meant to. The real failure is clinging to centralized control in a decentralized world.

And don't even get me started on the analytics firms. They're not reporting data-they're selling narratives. $2.7 billion vs $15.8 billion? That's not a discrepancy, that's a business model.

The $15.8 billion figure is a myth constructed by firms that profit from fear. Chainalysis and TRM Labs have a vested interest in inflating numbers so governments keep funding them. The real illicit volume? Probably under $5 billion. Most of that 'sanctioned' activity is just people in Iran buying groceries online with USDT because their banks got frozen. Calling that 'state-sponsored evasion' is propaganda.

i think people forget that crypto is just code. it dont care who uses it. if u make something open, someone will use it for bad stuff. thats not the fault of the tech. its the fault of the system that made people need it in the first place. iran and russia are using crypto because they have no other choice. the west cut them off. now theyre building their own. its not evil. its survival.

Honestly, I think the whole narrative around crypto sanctions is being manipulated to justify more surveillance and control. We keep hearing about $15.8 billion, but nobody ever talks about how much legitimate commerce is being blocked because exchanges are over-complying. People are getting their accounts frozen for sending $20 to a wallet that once interacted with a sanctioned address five years ago. That’s not enforcement-that’s digital McCarthyism. And the worst part? It’s not even working. The bad actors are still getting their money through bridges and P2P apps, while regular folks are stuck in limbo. We’re punishing the innocent to chase ghosts.

usdt is the real hero here. people think bitcoin is the main one but no, its usdt. why? cause its stable. if you got ransomware cash and you need to pay your crew, you dont want it to drop 30% in a week. usdt on ethereum is like digital cash. easy to move, hard to trace if you know how. also, most people dont realize that 90% of these wallets are just reused addresses. its not magic, its just bad habits.

Let’s be clear: this isn’t about ‘enforcement gaps.’ This is about sovereign nations deliberately weaponizing financial infrastructure to undermine the West. Iran and Russia aren’t ‘bypassing sanctions’-they’re conducting economic warfare. And the fact that we’re still treating this like a technical problem instead of a geopolitical crisis is beyond negligent. If your enemy is building a parallel financial system using your own open-source technology, you don’t just ‘blacklist addresses.’ You respond with policy, alliances, and real consequences. Instead, we’re stuck arguing over whether Chainalysis’s numbers are accurate. Pathetic.

The key issue here is liquidity. Bitcoin and Ethereum dominate because they’re the only blockchains with deep enough markets to move large sums without slippage. Privacy coins are useless if you can’t cash out. No exchange will take Monero and turn it into USD without triggering a flag. But USDT on Ethereum? That’s the bridge to the real economy. The real story isn’t about anonymity-it’s about accessibility. Criminals don’t want to hide. They want to spend.

I think we need to step back and ask what we’re really trying to protect. Are we protecting financial stability? Or are we protecting the privilege of centralized control? Crypto’s strength is its openness. But that openness is being used against us. Maybe the answer isn’t more blacklists, but better education, international cooperation, and designing systems that don’t rely on trust in single institutions. It’s not about stopping the money-it’s about changing the conditions that make it necessary.

Let’s be real. The entire crypto enforcement narrative is a circus. We’re spending billions chasing digital ghosts while our own banking system is a dumpster fire of money laundering, shell companies, and offshore accounts that never get touched. And yet? We’re out here banning wallets like they’re the root of all evil. Meanwhile, hedge funds are moving $50 billion in crypto through compliant exchanges, paying zero taxes, and nobody bats an eye. The hypocrisy is staggering. We’re not fighting crime-we’re fighting the wrong enemy because it’s easier than fixing the system.

This is why we need AI to take over. Humans are too slow. Too biased. Too lazy. The blockchain doesn’t lie. Let the bots track every single movement, flag every cluster, auto-freeze every suspicious wallet. We’re still using spreadsheets in 2024? 😅 Come on. If we let AI run enforcement, we’d catch 10x more. And no, I don’t care if it’s ‘creepy.’ If your money’s clean, you got nothing to hide.