ZK-Rollup Fee Calculator

How ZK-Rollups Reduce Costs

ZK-rollups compress transaction data by 80-90%, drastically reducing Ethereum's on-chain costs. The calculator below shows how much you could save by using a ZK-rollup instead of the main Ethereum network.

Based on article data: ZK-rollups reduce on-chain data by 80-90%, resulting in fees of $0.02-$0.15 per transaction vs. $1.50-$50 on Ethereum mainnet during congestion.

Imagine sending a transaction on Ethereum that costs less than a cup of coffee, finishes in seconds, and still benefits from the same security as the main network. That’s what ZK-rollups do. They’re not just a tech buzzword-they’re the most promising way Ethereum can scale without giving up its core promise: security and decentralization.

What Exactly Are ZK-Rollups?

ZK-rollups are Layer 2 solutions that handle thousands of transactions off Ethereum’s main chain, then bundle them into a single proof that gets verified on-chain. The "zero-knowledge" part means they prove the transactions are valid without revealing the details of each one. Think of it like sending a signed receipt that says, "I did 500 transactions, and they all follow the rules," instead of listing every single purchase.

They rely on cryptographic proofs-either ZK-SNARKs or ZK-STARKs-to verify correctness. These proofs are tiny compared to the data they represent. A single proof can cover 1,000 transactions, but only takes up a few kilobytes on Ethereum. That’s why fees drop so dramatically. On Ethereum mainnet, you might pay $10 to swap tokens. On zkSync Era, it’s $0.05.

The architecture has three parts: an on-chain verifier contract (which checks the proof), an off-chain execution environment (where transactions happen), and a Merkle tree that tracks account states. This keeps everything secure and verifiable, even if the off-chain system is run by a single company.

How They Compare to Other Scaling Solutions

There are other Layer 2 options, but they trade off security for simplicity.

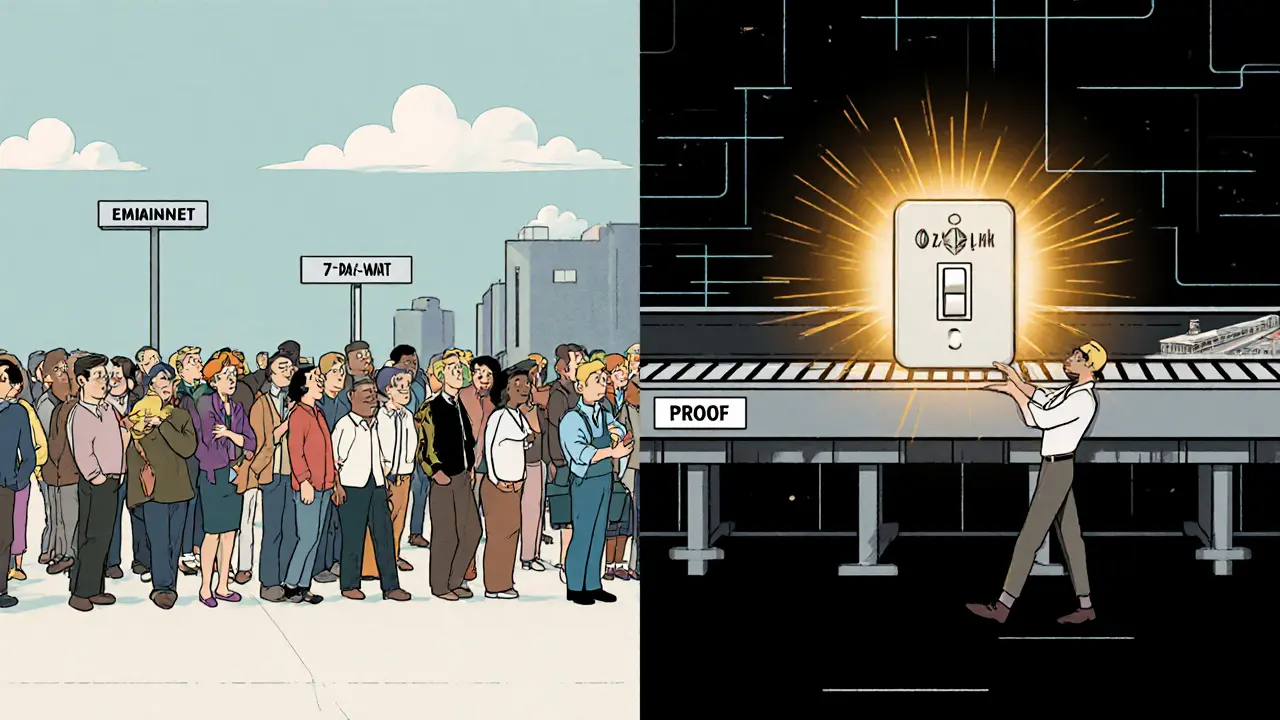

Optimistic Rollups (like Arbitrum and Optimism) assume transactions are valid unless someone challenges them within a 7-day window. That means if you want to withdraw funds, you wait a full week. ZK-rollups don’t need that wait-they prove validity upfront. Finality is 15-30 minutes, not 7 days.

Sidechains (like Polygon PoS) have their own validators. If those validators get hacked or go offline, your funds are at risk. ZK-rollups inherit Ethereum’s security. Even if the sequencer (the entity that orders transactions) is compromised, the cryptographic proof still blocks invalid state changes.

State channels (like Raiden) work for two-party payments but fall apart at scale. ZK-rollups handle thousands of users at once.

So why aren’t everyone using ZK-rollups yet? Because they’re harder to build.

Performance Numbers You Can Actually Use

As of November 2023, here’s what’s real:

- Throughput: zkSync Era handles up to 2,000 transactions per second. Ethereum mainnet? 12-15.

- Fees: $0.02-$0.15 per transaction on ZK-rollups vs. $1.50-$50 on Ethereum during congestion.

- Data compression: ZK-rollups reduce on-chain data by 80-90%. Polygon zkEVM compresses transactions 100x.

- TVL: ZK-rollups hold $5.2 billion in total value locked-15% of Ethereum’s Layer 2 ecosystem.

That’s not theoretical. Uniswap on zkSync processed $4.2 billion in volume in September 2023. dYdX moved its entire exchange to StarkEx and now handles $1.2 billion daily.

Why Developers Are Struggling

ZK-rollups aren’t plug-and-play. Writing a smart contract for Ethereum is one thing. Writing one for a ZK-rollup requires understanding constraint systems, circuit design, and specialized languages like Cairo (for Starknet) or Zinc (for zkSync).

Developers report it takes 3-6 months to become proficient. Even then, proof generation fails often-68% of developers in Starkware’s survey hit this wall. Generating a proof needs serious hardware: 64GB+ RAM, multiple high-end CPU cores. Most devs don’t have that.

And the tooling? Mixed. zkSync’s documentation scores 4.2/5. Starknet’s? 3.5/5-riddled with gaps because it’s changing fast. Community support varies too. zkSync’s Discord has 45,000 members and responds in minutes. Starknet’s forum? Sometimes days.

That’s why most ZK-rollup apps right now are either built by crypto-native teams or are simple token swaps. Complex DeFi protocols-like lending or derivatives-are still rare.

Real User Experiences

Users love the cost savings. On Reddit, one trader wrote: "I paid $0.07 for a swap that would’ve cost $28 on Ethereum." That’s the norm, not the exception.

But there are pain points:

- Bridging delays: Users report 4-6 hour waits to move funds from Ethereum to Starknet during NFT mints-even though it’s advertised as "15 minutes."

- Liquidity fragmentation: You can’t just hold ETH in one wallet and use it everywhere. You need separate balances on zkSync, Starknet, and mainnet. That’s a nightmare for portfolio tracking.

- Documentation gaps: Trustpilot reviews for zkSync show 3.8/5 overall, but only 2.9/5 for documentation clarity.

One user on Discord summed it up: "I love the speed and fees, but I’m spending more time troubleshooting bridges than trading."

What’s Changing in 2024

The biggest game-changer coming is proto-danksharding (EIP-4844), scheduled for Q2 2024. This Ethereum upgrade will make data cheaper to post on-chain by 90%. Since ZK-rollups already compress data so well, this will slash their costs even further.

On the development side:

- zkSync 3.0 (Q3 2024) will add native account abstraction-letting users pay gas in any token, not just ETH.

- Starknet 1.0 (Oct 2023) cut proof generation time by 40%.

- zkSync’s Hyperchains let teams build their own Layer 3 networks with shared security-think custom blockchains that still inherit Ethereum’s trust.

Enterprise adoption is accelerating. JPMorgan’s Onyx division is testing a permissioned ZK-rollup for interbank settlements. Accenture is using Starknet for cross-border payments in Europe.

Are ZK-Rollups the Future?

Vitalik Buterin called them "the only trust-minimized scaling solution that will survive long-term." That’s not hype-it’s a technical reality. ZK-rollups don’t rely on honest actors. They rely on math.

But they’re not perfect. Centralized sequencers are still a single point of failure. All major ZK-rollups (zkSync, Starknet, Polygon zkEVM) use them. That’s a decentralization trade-off.

And quantum computing? ZK-STARKs are considered quantum-resistant. ZK-SNARKs aren’t. So if you’re building long-term, STARK-based systems like Starknet have an edge.

The data says it all: ZK-rollups grew 550% in TVL from Q1 to Q4 2023. Gartner predicts they’ll handle 40% of Ethereum transactions by 2026. Delphi Digital says 50% by 2027.

They’re not the easiest path. But they’re the only one that scales without sacrificing security. If Ethereum wants to handle billions of users, ZK-rollups aren’t just an option-they’re the only viable path forward.

What You Should Do Now

If you’re a user: Try zkSync Era or Starknet. Bridge a small amount of ETH. Do a swap. Feel how fast and cheap it is. Then compare it to mainnet. You’ll see the difference.

If you’re a developer: Start with zkSync’s documentation. It’s the most beginner-friendly. Use their CLI and testnet. Build a simple token transfer. Then try writing a ZK circuit. It’s hard-but the tools are getting better every month.

If you’re an investor: Look at the projects with the strongest teams and fastest development. zkSync and Starknet are leading. Polygon zkEVM is catching up fast. Avoid anything without a public proof system or clear roadmap.

ZK-rollups are the quiet revolution. No flashy ads. No celebrity endorsements. Just math, code, and real results. And that’s why they’ll win.

Are ZK-rollups safer than Optimistic Rollups?

Yes, ZK-rollups are more secure. Optimistic Rollups assume transactions are valid unless challenged within a 7-day window, meaning you must trust that someone will monitor the chain. ZK-rollups use cryptographic proofs that mathematically guarantee validity before the transaction is accepted. No waiting. No trust needed.

Can I use MetaMask with ZK-rollups?

Yes. MetaMask supports zkSync Era and Starknet through network addition. You can switch between Ethereum mainnet and ZK-rollups directly in the wallet. Just add the custom RPC endpoint for the rollup you want to use-most are listed in the official documentation.

Why are ZK-rollup fees so low?

Because they only post a tiny cryptographic proof and a small amount of state data to Ethereum-instead of the full transaction details. This cuts on-chain data usage by 80-90%. Ethereum’s cost is based on data size, so less data = much lower fees.

Do ZK-rollups support DeFi apps like lending and borrowing?

Yes, but adoption is still growing. Platforms like dYdX (on StarkEx) and SyncSwap (on zkSync) offer lending, swaps, and margin trading. However, complex protocols are harder to build on ZK-rollups due to technical constraints. Expect more DeFi apps to launch in 2024 as tooling improves.

What’s the biggest drawback of ZK-rollups?

The biggest drawback is complexity. Generating cryptographic proofs requires heavy computing power and specialized knowledge. Most developers aren’t trained in zero-knowledge cryptography. This slows down app development and limits the number of projects that can launch on ZK-rollups.

Will ZK-rollups replace Ethereum mainnet?

No. Ethereum mainnet will remain the settlement layer-the trusted anchor. ZK-rollups will handle the bulk of transactions, but they’ll always rely on Ethereum to verify their proofs. Think of mainnet as the vault and ZK-rollups as the high-speed delivery trucks.

Are ZK-rollups quantum-resistant?

ZK-STARKs (used by Starknet) are quantum-resistant because they rely on hash functions, not elliptic curve cryptography. ZK-SNARKs (used by zkSync and Polygon zkEVM) are not. If quantum computing advances, STARK-based systems will remain secure longer. This is a key reason why Starknet is favored for long-term applications.

6 Comments

ZK-rollups are the closest thing we’ve got to a mathematical guarantee of scalability without sacrificing decentralization. The fact that you can compress 1,000 transactions into a few kilobytes and still prove their validity with zero-knowledge cryptography is mind-blowing. It’s not just an optimization-it’s a paradigm shift in how we think about blockchain verification. Ethereum’s base layer was never meant to be a global state machine handling millions of transactions per second; it was meant to be a trust anchor. ZK-rollups finally let it fulfill that role without being drowned in data. The math doesn’t lie: if you’re building anything long-term on Ethereum, you’re building on ZK-rollups. Everything else is a temporary patch.

They’re not safer-they’re just more opaque. You think you’re getting security, but you’re just trusting a black box that runs on expensive hardware only a few companies can afford. Who’s verifying the verifiers? The same centralized sequencers that could disappear tomorrow. This isn’t freedom-it’s corporate crypto with fancy math.

What’s being missed here is the ontological shift: ZK-rollups don’t scale Ethereum-they reconstitute it. The mainnet becomes a proof oracle, a cryptographic公证处, while execution becomes a distributed, verifiable computation lattice. This isn’t Layer 2-it’s Layer 1.5, where consensus is no longer about agreement among nodes but about the verifiability of a mathematical statement. The sequencer isn’t a bottleneck-it’s a coordinator in a decentralized proof network. We’re not optimizing for throughput; we’re redefining trust as a computational invariant. The real innovation isn’t the proof-it’s the epistemological frame that makes trust computable.

They’re using ZK to make you forget that your funds are still controlled by a single company’s server. Starknet? zkSync? All of it’s just a fancy frontend for a centralized database with a math tattoo. Wait till the sequencer gets hacked-or gets a subpoena. Then watch how fast your ‘secure’ transactions vanish.

I tried zkSync last week. Paid 3 cents for a swap. Felt like a wizard. Then I tried to bridge back-4 hours. No updates. No error. Just… nothing. I spent more time refreshing my wallet than I did trading. And don’t get me started on the docs. Half the time I’m Googling ‘how does a Merkle tree even work’ while trying to deploy a token. It’s beautiful, but it’s not for beginners. I love the speed, but I hate the mental load. It’s like owning a Ferrari that only runs on moonlight and quantum foam.

550% growth? That’s because everyone’s dumping into the hype. Look at the real numbers: 15% of Layer 2 TVL? That’s nothing. Optimistic rollups still handle 80% of volume. And don’t even get me started on how many ZK projects are just rebranded sidechains with a whitepaper full of equations. The ‘only viable path’? More like the most expensive, developer-hostile path. Give me a break.