Solana Token: What It Is, How It Works, and What You Need to Know

When you hear Solana token, a digital asset built on the Solana blockchain that enables fast, cheap transactions and decentralized apps. Also known as SOL token, it’s the fuel behind one of the fastest blockchains in crypto—handling over 65,000 transactions per second without breaking a sweat. Unlike Ethereum, where fees spike during peak hours, Solana keeps costs near zero, which is why so many new projects pick it as their home base.

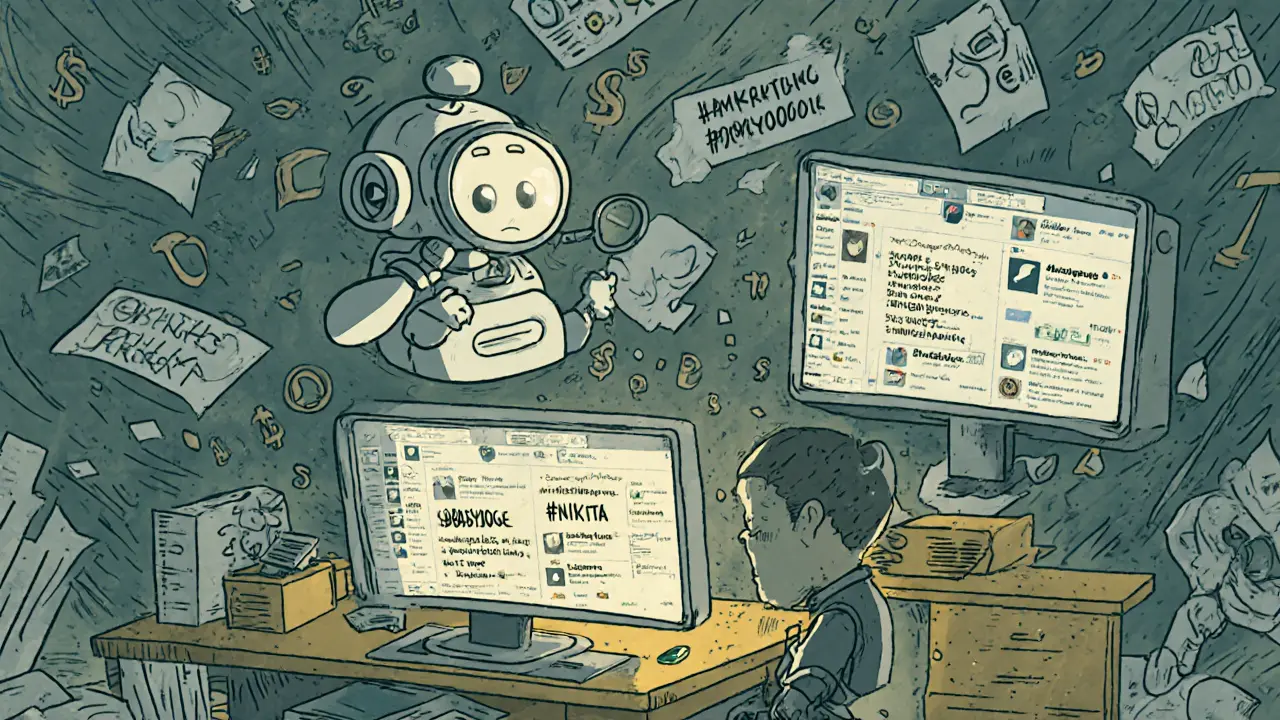

Most Solana tokens you’ll see aren’t just currency—they’re tools. Some power decentralized exchanges like Raydium, others represent NFTs in games like Star Atlas, and a huge chunk? They’re meme coins with no real purpose, like TROLL (SOL), a viral meme coin that surged 130,000% then crashed 85%, driven purely by social media hype. These tokens don’t solve problems—they ride trends. But that doesn’t mean they’re all trash. Tokens like SUNDAE, Cardano’s first AMM DEX token show how real utility can emerge on Solana too, even if the project started elsewhere. The key is knowing the difference between a token that adds value and one that’s just noise.

What makes Solana tokens risky? Speed. The same low fees and fast blocks that attract developers also make the network vulnerable to spam and outages. When it goes down, every token on it stops working. That’s why traders watch Solana’s uptime like a stock ticker. And because anyone can create a token in minutes, scams are everywhere. Fake airdrops, rug pulls, fake wallets—most of the posts you’ll find here are warnings, not guides. You won’t find a single post here saying "Buy this Solana token now." You’ll find ones like "What is TROLL (SOL)? The Full Story Behind the Solana Meme Coin" and "POTS Airdrop by Moonpot: What’s Real and What’s a Scam"—the kind of deep dives that cut through the hype.

Whether you’re holding SOL, trading meme coins, or just trying to avoid getting drained by a fake airdrop, the goal is the same: understand what you’re actually buying. Solana tokens aren’t magic. They’re code running on a network that’s fast, cheap, and fragile. The best ones have real users. The rest? They’re just gambling with a blockchain name attached.

What is Nikita (NIKITA) crypto coin? Real use, risks, and why most traders avoid it

Nikita (NIKITA) is a micro-cap crypto token tied to an AI tool that scans Crypto Twitter. It has almost no liquidity, extreme price volatility, and unverified utility. Most traders avoid it due to high risk and near-zero trading volume.

© 2026. All rights reserved.