Secure Crypto Platform: What Makes a Crypto Exchange Truly Safe in 2025

When you hear secure crypto platform, a digital service designed to store, trade, or manage cryptocurrency with protections against theft, fraud, and regulatory risk. Also known as a trusted crypto exchange, it should give you control without compromising safety. But here’s the truth: most platforms calling themselves "secure" are just good at marketing. Real security isn’t about flashy logos or AI-powered trading bots—it’s about what’s underneath.

A decentralized exchange, a peer-to-peer trading system that doesn’t hold your funds or require identity verification like Tokenlon or Merchant Moe can feel safer because you keep control of your wallet. But that doesn’t mean it’s secure. No custody doesn’t equal no risk—low liquidity, smart contract bugs, and fake tokens can still wipe you out. Meanwhile, regulated platforms like those in the UAE or Nigeria now follow strict crypto regulation, government rules that force exchanges to verify users, report transactions, and protect assets. These aren’t just paperwork—they’re layers of accountability that make theft harder and scams easier to trace.

Then there are the traps. Platforms like FutureX Pro and VOOX Exchange claim to be secure, but they hide behind fake licenses, inflated volume, and impossible promises. A real no-KYC exchange, a platform that doesn’t ask for personal documents to trade isn’t automatically shady—some privacy-focused users need it. But when a no-KYC exchange also has no public team, no audit history, and zero user reviews? That’s not freedom. That’s a warning sign.

Security isn’t one thing. It’s a mix of regulation, transparency, code integrity, and user awareness. The UAE’s removal from the FATF grey list didn’t just look good—it forced exchanges to prove they could stop money laundering. India’s 1% TDS tax doesn’t make trading safer, but it forces traders to track every move, reducing anonymity that scammers love. Even countries with bans, like Tunisia, show that people still find ways to trade—but they pay a price in risk and trust.

What you’ll find below aren’t just reviews. They’re real-world case studies of what works and what explodes. From dead coins like EDRCoin and Rivetz to legit DeFi tools like SundaeSwap and DODO, this collection cuts through the noise. You’ll see how scams mimic real platforms, how regulation shapes safety, and why the most secure crypto platform isn’t always the one with the biggest ad budget. It’s the one that doesn’t need to scream to prove it’s safe.

Ostable Crypto Exchange Review: Why It Doesn't Exist and What to Look for Instead

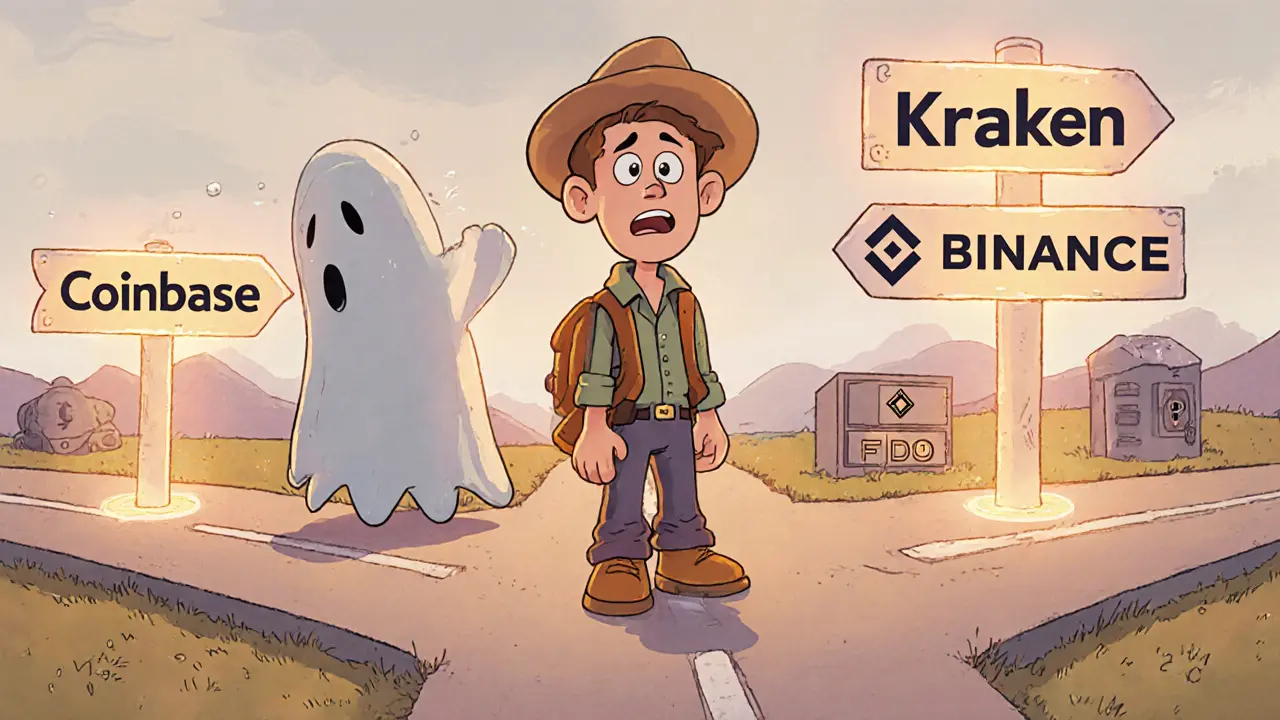

Ostable is not a real crypto exchange. This guide explains why it doesn't exist and shows you how to spot safe, regulated platforms like Coinbase and Kraken instead.

© 2026. All rights reserved.