RWA Crypto: Real-World Assets on Blockchain Explained

When you hear RWA crypto, real-world assets tokenized on blockchain networks to create tradable digital equivalents. Also known as tokenized real-world assets, it turns physical things like property, bonds, or commodities into digital tokens you can buy, sell, or earn yield from—without needing a bank or broker. This isn’t sci-fi. It’s happening right now, with companies locking up billions in actual assets like office buildings, farmland, and even government debt, then slicing them into tiny pieces anyone can own.

Tokenized assets rely on three big pieces: the real-world asset, a physical item with measurable value like a building, loan, or commodity. Also known as physical asset, it’s the foundation of the whole system. Then there’s the blockchain, a secure, transparent ledger that records ownership and transfers of the digital tokens. Also known as distributed ledger, it’s what makes the system trustless and verifiable. And finally, the token, a digital representation of a share in that asset, often built as an ERC-20 or similar standard. Also known as asset-backed token, it’s what you hold in your wallet. Together, they let you own a piece of a Manhattan skyscraper from your phone, or earn interest from a U.S. Treasury bond without dealing with Wall Street.

Why does this matter? Because traditional finance is slow, expensive, and closed off. RWA crypto opens access. A farmer in Kenya can invest in U.S. farmland. A student in Brazil can earn yield from European rental properties. It cuts out middlemen, reduces friction, and makes markets more liquid. But it’s not risk-free. Legal gray areas still exist. Custodians hold the real assets—so if they fail, your token might be worthless. Regulation is catching up fast, and not all projects are legit. That’s why you need to know what you’re buying.

The posts below dig into exactly that. You’ll find breakdowns of real projects turning real estate, bonds, and even carbon credits into crypto tokens. You’ll see how DeFi platforms are integrating them for yield, what’s working, and what’s a trap. No fluff. No hype. Just clear, practical info on how RWA crypto is changing what ownership means—and how you can use it safely in 2025.

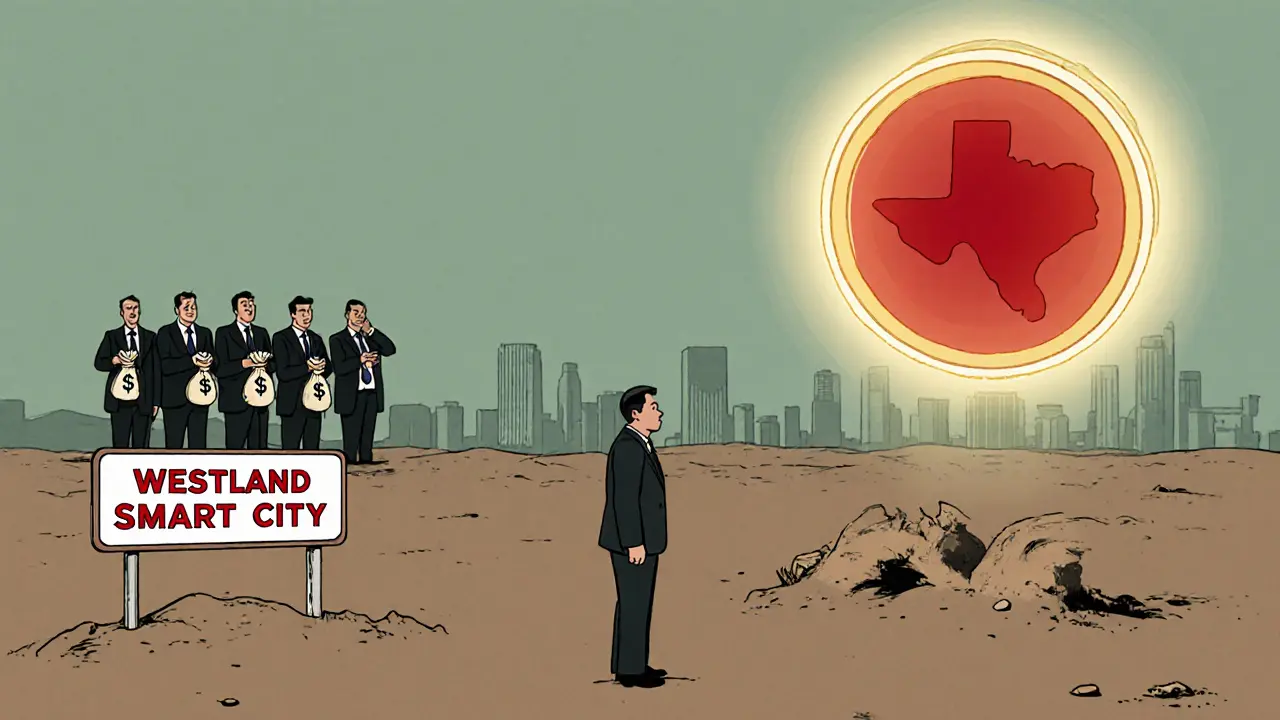

What is WESTLAND SMART CITY (WLSC) crypto coin? Red flags and reality check

WLSC is marketed as a real estate-backed crypto token, but its $342M market cap with only 47 holders and zero trading volume raises serious red flags. Experts call it a scam. Here's what you need to know.

© 2026. All rights reserved.