Real Estate Token: What It Is and How It’s Changing Property Ownership

When you hear real estate token, a digital asset that represents ownership in a physical property, often divided into fractions. Also known as tokenized real estate, it lets you buy a share of a building, apartment, or land without needing millions in cash. This isn’t science fiction—it’s happening right now, with projects turning office towers in New York and warehouses in Texas into blockchain-based assets you can trade like stocks.

Real estate tokens work by breaking down a property into hundreds or thousands of digital shares, each backed by legal rights to the asset. These shares are usually built on Ethereum or Polygon using standards like ERC-20 or ERC-721, making them easy to transfer, track, and verify. Unlike traditional real estate, where buying a single unit can take months and require lawyers, banks, and notaries, a real estate token can be bought in minutes with a crypto wallet. You’re not just investing in bricks and mortar—you’re investing in a system that removes middlemen and opens ownership to people who could never afford a whole property before.

But it’s not all smooth sailing. Tokenized real estate still faces legal gray areas. Who holds the deed? What happens if the property gets damaged or sued? Some platforms use smart contracts to automate rent collection and payouts, but others rely on off-chain agreements that could vanish overnight. That’s why many real estate token projects pair their digital shares with real-world legal structures—like LLCs or trusts—to keep things enforceable. And while NFT real estate projects grab headlines for virtual land in the metaverse, the real action is in physical properties with actual tenants and cash flow.

What you’ll find in this collection are real examples of how people are using real estate tokens today: some projects failed because of bad contracts, others succeeded by partnering with actual landlords. You’ll see how fractional ownership works in practice, what risks you can’t ignore, and which platforms actually deliver on their promises. No hype. No fluff. Just what’s real, what’s risky, and what’s worth your attention.

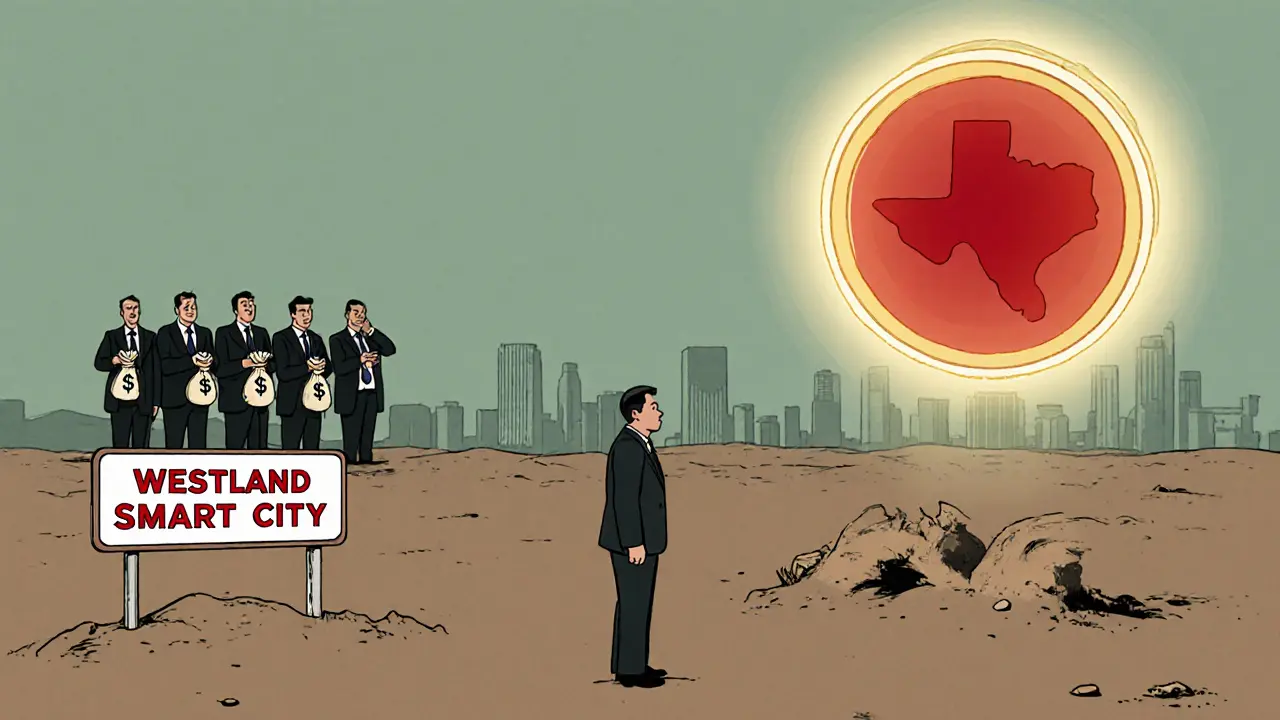

What is WESTLAND SMART CITY (WLSC) crypto coin? Red flags and reality check

WLSC is marketed as a real estate-backed crypto token, but its $342M market cap with only 47 holders and zero trading volume raises serious red flags. Experts call it a scam. Here's what you need to know.

© 2026. All rights reserved.