Mining Pool Competition: How Crypto Miners Compete for Rewards

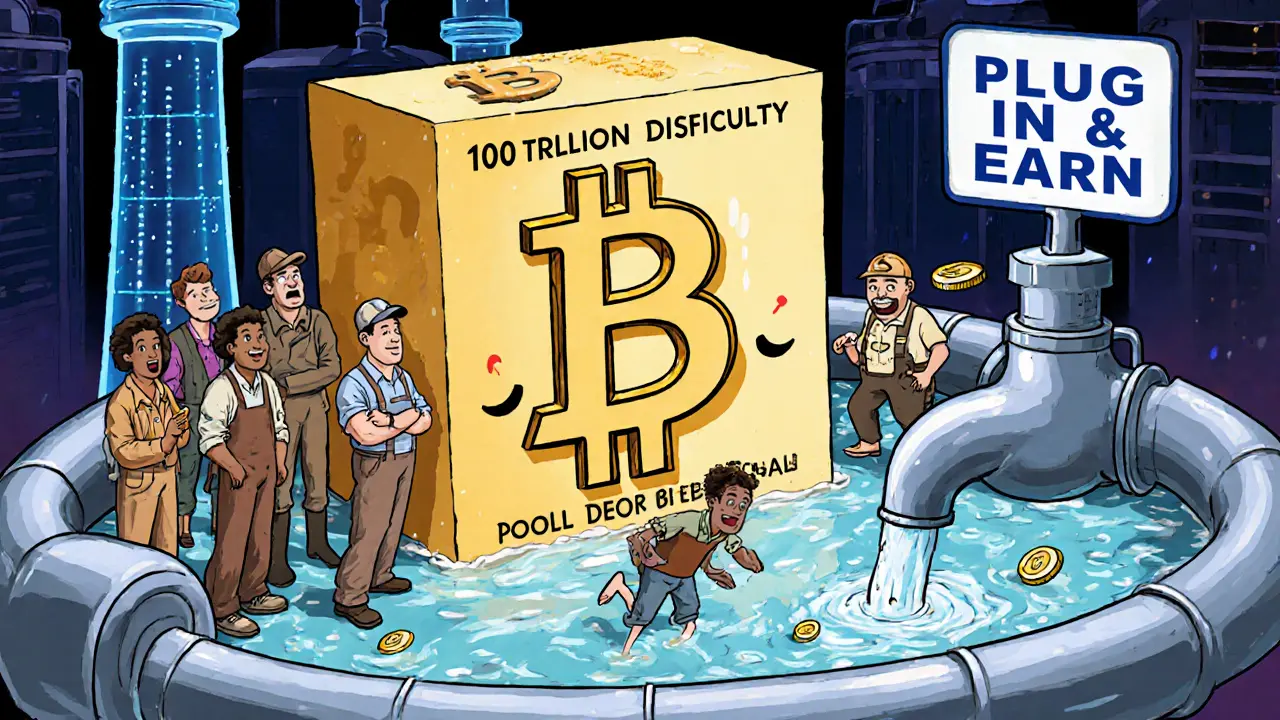

When you mine crypto, you’re not just solving math problems—you’re in a mining pool competition, a race where groups of miners combine computing power to earn block rewards more consistently than solo miners. This isn’t theory—it’s how Bitcoin, Ethereum Classic, and other proof-of-work coins actually get mined today. Without pools, most miners would wait months or years for a single reward. Pools fix that by sharing payouts based on work contributed, turning mining from a lottery into a steady income stream.

But here’s the catch: not all pools are equal. Some take higher fees, others have worse uptime, and a few even get hacked. The biggest pools—like F2Pool, AntPool, and Slush Pool—dominate because they’re reliable, well-funded, and have global miners trusting them. Smaller pools exist too, often run by communities or niche teams, but they struggle to stay competitive when hash rates shift. This mining pool competition, the ongoing battle for dominance among mining groups affects everything: how fast blocks are found, how much you earn per day, and even how secure the network feels.

Behind every mining pool is proof-of-work, the system that forces miners to spend real electricity and hardware to validate transactions. The more hash power a pool controls, the more likely it is to find the next block. But if one pool gets too big—say, over 50% of the network’s total hash rate—it risks making the whole blockchain vulnerable to attacks. That’s why miners often switch pools, not just for better payouts, but to keep the system balanced. This constant movement is the hidden engine of mining rewards, the digital coins miners earn for their computational labor—it’s not handed out randomly. It’s earned through collective effort, divided by algorithm, and distributed by trust.

And it’s not just about Bitcoin. Ethereum Classic, Dogecoin, and even newer coins like Ravencoin still rely on this model. If you’re mining any of them, you’re already part of this competition—even if you don’t realize it. The tools you use, the pool you join, and even the time of day you mine can change your earnings. Some miners use software to auto-switch pools when payouts drop. Others track hashrate trends and join new pools before they get crowded. It’s not magic—it’s strategy.

What you’ll find in the posts below aren’t just random crypto guides. They’re real-world stories about what happens when mining pools rise, fall, or disappear. You’ll see how a single pool’s failure can wipe out a community’s income, how new mining hardware changes the balance of power, and why some coins are moving away from proof-of-work entirely. These aren’t predictions. They’re lessons from people who’ve been in the trenches. Whether you’re mining now or just trying to understand how crypto actually gets created, this collection gives you the unfiltered truth behind the numbers.

Future of Mining Pool Industry: Trends, Tech, and Competition Through 2025

The future of the mining pool industry in 2025 is defined by competition, tech innovation, and miner-focused services. Leading pools now offer staking, AI-driven tools, and compliance certifications-not just lower fees.

© 2026. All rights reserved.