Mining Pool: How Crypto Mining Pools Work and Why They Matter

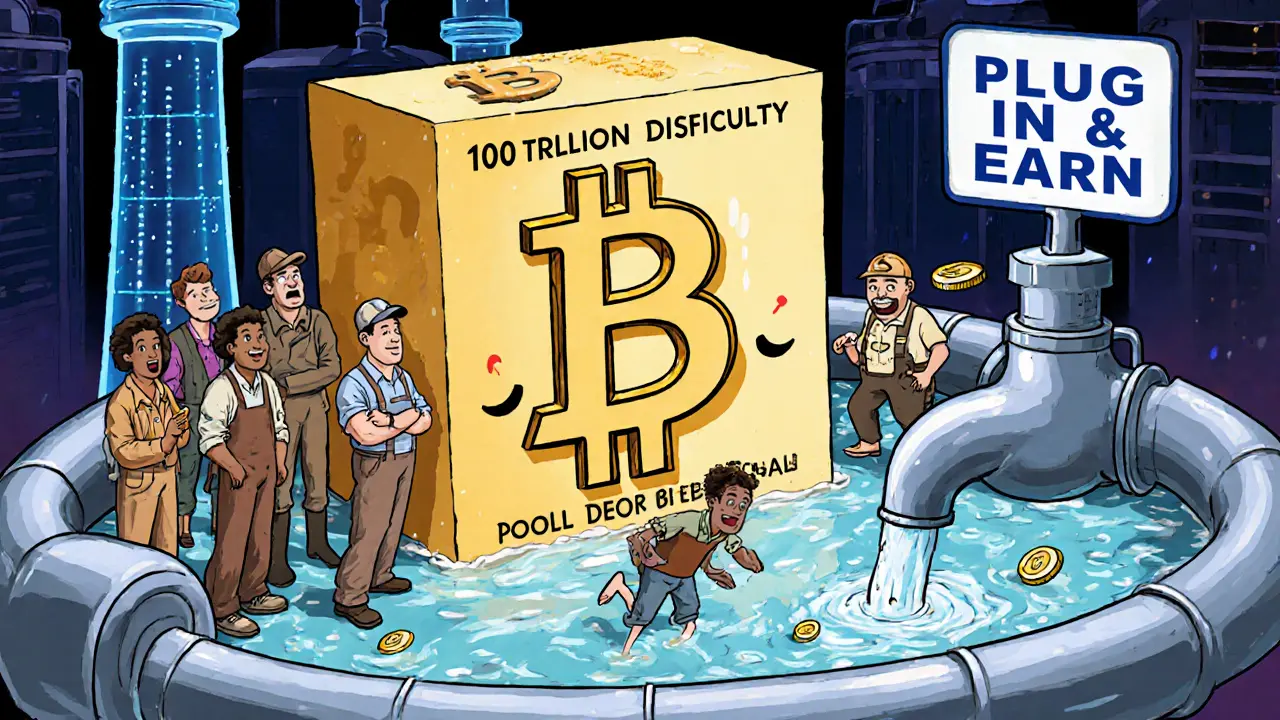

When you hear about someone earning Bitcoin from mining, they’re probably part of a mining pool, a group of miners who combine their computational power to solve blockchain puzzles and share rewards. Also known as mining consortium, it’s how most people actually earn crypto today—not by going solo, but by teaming up. Solo mining for Bitcoin is practically impossible now. The network’s difficulty is too high, and the hardware needed is too expensive. A single miner with a top-tier ASIC might take years to find a block alone. But in a mining pool, hundreds or thousands of miners contribute their hash power, and when the group finds a block, rewards are split based on how much work each person contributed. It’s like buying a lottery ticket with a hundred friends—you’re less likely to win big alone, but you win smaller amounts more often.

Not all mining pools are the same. Some focus on Bitcoin, others on Ethereum Classic, Dogecoin, or other proof-of-work coins. The best ones have low fees, reliable payouts, and transparent tracking tools. You’ll want to check their payout structure—PPLNS (Pay Per Last N Shares) or FPPS (Full Pay Per Share)—because that affects how much you actually take home. Some pools even let you mine multiple coins at once and auto-swap to the most profitable one. But watch out for pools that are too big. If one pool controls over 50% of a network’s hash power, it could theoretically manipulate transactions. That’s why decentralization matters, even in mining.

Behind every mining pool is proof-of-work, the consensus mechanism that secures blockchains by requiring real computational effort to validate transactions. This is what makes mining possible—and why you need powerful mining hardware, specialized machines like ASICs or high-end GPUs built to run cryptographic calculations nonstop. Without these, you can’t compete. But hardware alone isn’t enough. You also need stable electricity, good cooling, and a reliable internet connection. Most serious miners run their rigs in warehouses or data centers, not their garages. And even then, profit margins are tight. Many miners join pools not just to earn more consistently, but to survive the rising costs and competition.

The rise of mining pools changed everything. Before 2013, most Bitcoin miners worked alone. Today, over 90% of Bitcoin mining happens through pools. Some of the biggest—like Foundry USA, F2Pool, and AntPool—control massive shares of the network. That’s why regulators and crypto purists keep an eye on them. If one pool goes down or gets hacked, it can ripple across the whole network. That’s also why newer blockchains are moving away from proof-of-work entirely. Ethereum switched to proof-of-stake. But for coins still using proof-of-work, mining pools aren’t just convenient—they’re essential.

What you’ll find in this collection are real-world breakdowns of mining pools, from the big players to the obscure ones. You’ll see how much you can actually earn, which hardware makes sense today, and which pools are worth your time—or best avoided. No fluff. No hype. Just what works, what doesn’t, and why.

Future of Mining Pool Industry: Trends, Tech, and Competition Through 2025

The future of the mining pool industry in 2025 is defined by competition, tech innovation, and miner-focused services. Leading pools now offer staking, AI-driven tools, and compliance certifications-not just lower fees.

© 2026. All rights reserved.