Mining Difficulty Explained: What It Is and How It Affects Crypto Mining

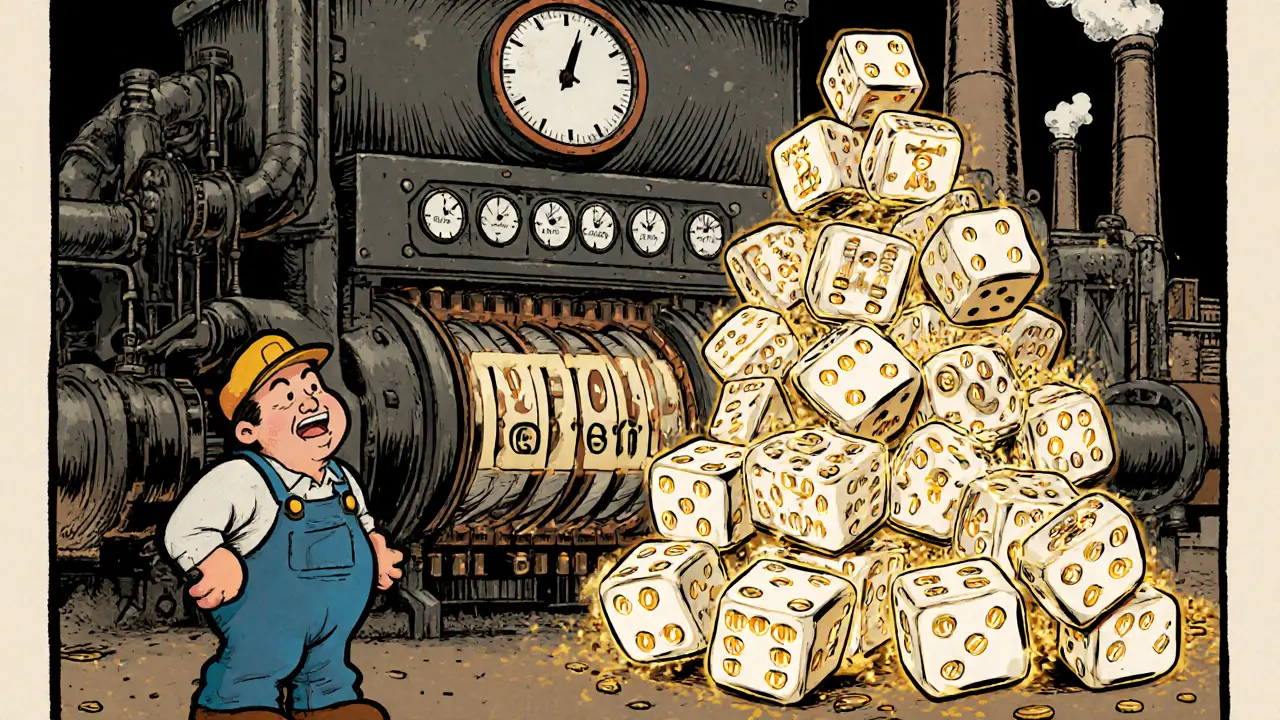

When you mine cryptocurrency, you're solving complex math problems to verify transactions and add them to the blockchain. The mining difficulty, a dynamic measure that adjusts how hard it is to find a valid block changes automatically to keep block times stable. For Bitcoin, that means a new block is found roughly every 10 minutes—no matter how many miners join the network. If more computing power comes online, the difficulty goes up. If miners leave, it drops. It’s not fixed. It’s self-correcting.

This system exists because of the hash rate, the total computing power used by miners to solve these problems. The higher the hash rate, the more competition there is. That’s why mining difficulty keeps rising on Bitcoin—it’s not because the network is getting smarter, it’s because more machines are competing. The blockchain network, the decentralized system that validates and records transactions doesn’t care who wins. It only cares that the next block arrives on time. This is why mining difficulty isn’t a choice—it’s a rule built into the code.

What does this mean for you? If you’re mining at home, rising difficulty means your rig might not be profitable anymore. A GPU that made money last year could now use more electricity than it earns in crypto. Big mining farms with cheap power and custom hardware survive. Smaller miners either upgrade, switch coins, or quit. Some miners move to newer blockchains with lower difficulty, like newer altcoins or proof-of-stake networks. But even there, competition grows fast. Mining difficulty isn’t just a technical detail—it’s a real-world economic signal. When it spikes, it tells you the network is healthy and attracting investment. When it drops suddenly, it might mean miners are fleeing because the price crashed or electricity costs jumped.

You’ll see mining difficulty mentioned in posts about Bitcoin’s energy use, the rise of ASIC miners, or why some crypto projects avoid proof-of-work entirely. It’s the hidden force behind every new block. It’s why mining isn’t just about buying hardware—it’s about timing, cost, and adapting to a system that never stops changing. Below, you’ll find real examples of how mining difficulty impacts miners, investors, and even entire countries trying to regulate crypto.

How Hash Rate Affects Mining Difficulty in Bitcoin

Hash rate and mining difficulty are locked in a balancing act that keeps Bitcoin’s blockchain stable. As more miners join, difficulty rises to maintain 10-minute block times. This system ensures security, fairness, and predictability.

© 2026. All rights reserved.