Micro-Cap Crypto: What It Is, Why It’s Risky, and What You Need to Know

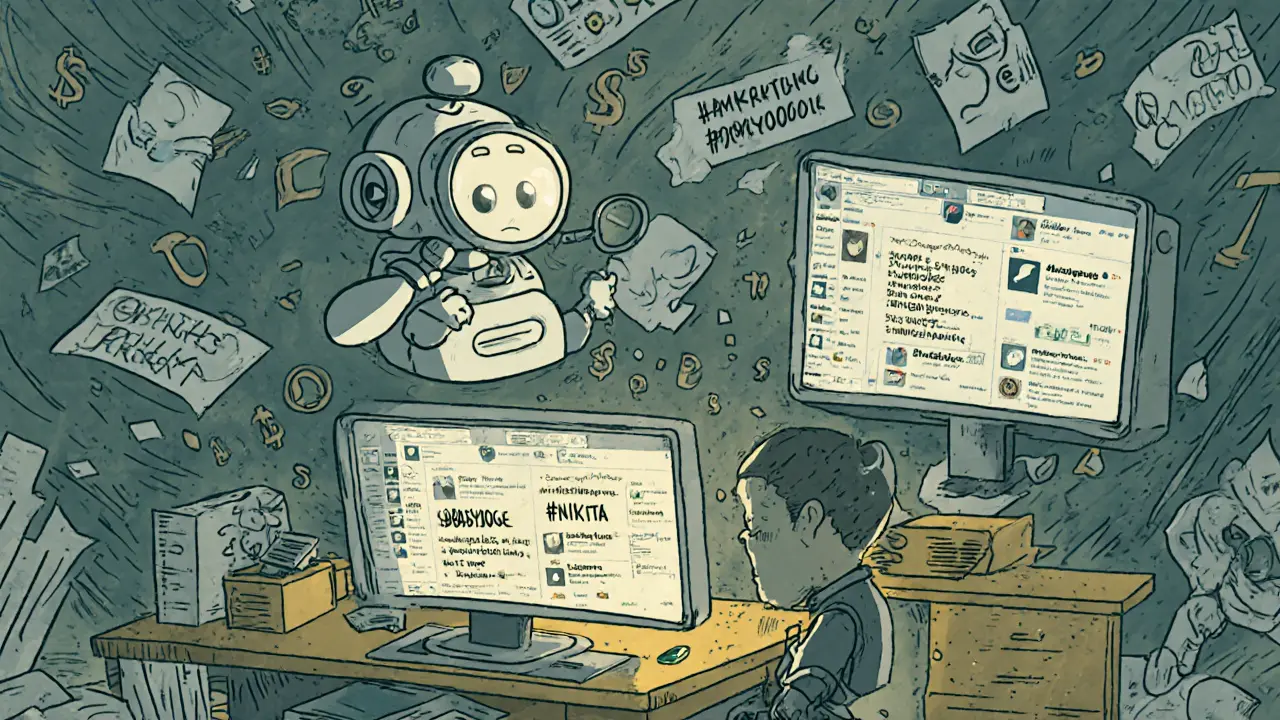

When people talk about micro-cap crypto, cryptocurrencies with market values under $50 million, they’re talking about the wild west of digital assets. These aren’t Bitcoin or Ethereum. They’re obscure tokens, often launched with little more than a Discord server and a tweet. Some explode overnight. Most vanish without a trace. The crypto airdrops, free token distributions meant to build early communities you see promoted on Twitter? Half of them are just ways to drain your wallet. And the crypto scams, fraudulent projects designed to trick new investors into buying worthless tokens? They thrive in this space because no one’s watching.

Micro-cap crypto isn’t about fundamentals. It’s about momentum, hype, and timing. Take TROLL (SOL) — a Solana meme coin with no team, no roadmap, and no utility. It jumped 130,000% in months, then crashed 85%. That’s not investing. That’s gambling with a blockchain label. EDRCoin and Rivetz? Dead projects with zero trading volume and no development since 2017 or 2021. They’re digital ghosts, still listed on shady exchanges because someone’s still clicking "Buy." And then there’s the flip side: legitimate micro-caps like SUNDAE on Cardano or STX on Bitcoin — tokens with real use cases, active teams, and actual adoption. The difference? One has transparency. The other has noise.

The biggest trap? Assuming low price means low risk. A $0.001 token isn’t "cheap" — it’s fragile. A single whale selling 10% of their holdings can wipe out 50% of the value. And with no regulation, no liquidity, and no oversight, there’s no safety net. India’s 1% TDS tax, Vietnam’s 0.1% transaction tax, or Nigeria’s VASP licensing rules? They don’t protect you. They just make it harder to exit. The only thing that matters is whether the project has real users, not just traders chasing the next 10x.

What you’ll find here isn’t a list of "next moonshots." It’s a collection of real stories — the ones that made money, the ones that got people ripped off, and the ones that vanished into thin air. You’ll see how a fake airdrop for PlayerMon PYM tricks people into connecting wallets. How QB crypto exchange isn’t even real — it’s a GTA mod with a website. How EDRCoin and Rivetz are zombie coins, still floating around because bots keep listing them. These aren’t theoretical risks. These are live examples of what happens when you ignore the basics.

If you’re looking for a quick win in micro-cap crypto, you’re already behind. But if you want to understand why some succeed while most fail — and how to spot the difference before you lose your money — you’re in the right place.

What is Nikita (NIKITA) crypto coin? Real use, risks, and why most traders avoid it

Nikita (NIKITA) is a micro-cap crypto token tied to an AI tool that scans Crypto Twitter. It has almost no liquidity, extreme price volatility, and unverified utility. Most traders avoid it due to high risk and near-zero trading volume.

© 2026. All rights reserved.