Blockchain Difficulty Explained: What It Is and Why It Matters

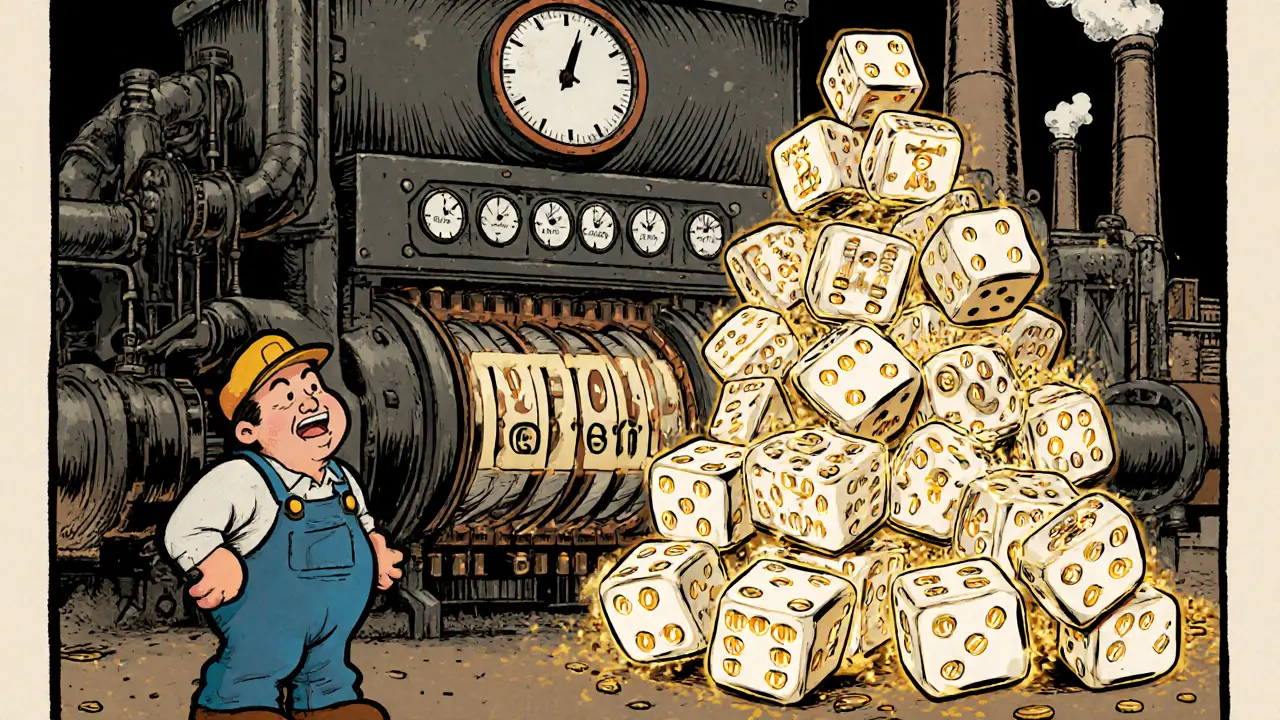

When you hear about blockchain difficulty, the automatic adjustment that controls how hard it is to mine new blocks on a proof-of-work network. It's not a setting someone picks—it's a live, self-correcting system built into Bitcoin and other crypto networks to keep block times steady. Think of it like a digital tuning knob that gets turned up or down based on how much computing power is being thrown at the network. If more miners jump in, difficulty rises. If miners leave, it drops. This keeps Bitcoin blocks coming roughly every 10 minutes, no matter what.

It’s not just about Bitcoin. Any coin using proof of work, a consensus method where miners compete to solve complex math puzzles to validate transactions. Also known as mining, it is the backbone of security for networks like Bitcoin and Litecoin. depends on this. Without difficulty adjustments, blocks could flood out in seconds during a mining boom, or take hours during a dip—making the network slow, unreliable, and easy to attack. The whole point is to make tampering expensive and time-consuming. That’s why difficulty isn’t just a technical detail—it’s the reason your crypto stays secure.

Every 2,016 blocks on Bitcoin, the network checks how long it took to mine them. If it took less than two weeks, difficulty goes up. If it took longer, it goes down. This happens automatically, without any central authority. That’s what makes it trustless. You don’t need to believe in a company or a government—you just need to trust the math. And because of this, even when miners in one country shut down due to regulation or power costs, the network adapts. It doesn’t break. It just recalibrates.

What does this mean for you? If you’re mining, difficulty tells you if it’s still worth it. High difficulty means you need better hardware or cheaper electricity to stay profitable. If you’re just holding crypto, it means the network is healthy. A rising difficulty often signals more miners believe in the coin’s future. A sudden drop? That could mean trouble—miners are leaving because it’s no longer profitable.

And it’s not just about mining. Difficulty affects transaction fees, block confirmation times, and even how fast new coins enter circulation. When difficulty spikes, miners might prioritize higher-fee transactions, slowing down smaller ones. When it drops, the network gets faster but might become more vulnerable to attacks—unless other protections kick in.

Below, you’ll find real-world examples of how blockchain difficulty plays out—not in theory, but in the messy, changing world of crypto. From Bitcoin’s steady climb to obscure coins that crashed when miners vanished, you’ll see how this invisible force shapes everything from your wallet to global mining hubs.

How Hash Rate Affects Mining Difficulty in Bitcoin

Hash rate and mining difficulty are locked in a balancing act that keeps Bitcoin’s blockchain stable. As more miners join, difficulty rises to maintain 10-minute block times. This system ensures security, fairness, and predictability.

© 2026. All rights reserved.