Travel Rule Compliance Calculator

The Travel Rule requires reporting of transactions over $3,000. Use this calculator to determine if your mining payouts or transactions trigger reporting requirements. Based on the GENIUS Act and FinCEN regulations.

If you're sending crypto to an exchange, wallet service, or other VASP, you may need to provide identity information for transactions over $3,000. Non-compliance can result in fines up to $100,000 per violation.

When you start mining cryptocurrency, you’re not just setting up hardware and paying electricity bills-you’re stepping into a legal minefield. In 2025, the rules have changed. What used to be a gray area is now a tightly regulated space, especially in the United States. If you’re mining Bitcoin, Litecoin, or any Proof-of-Work coin, you need to understand exactly what the law expects of you-or risk fines, asset seizures, or worse.

Proof-of-Work Mining Is Now Legally Clear (Thank the SEC)

The biggest shift happened on March 20, 2025, when the SEC’s Division of Corporation Finance issued a formal statement: Proof-of-Work mining does not violate securities laws. This wasn’t a suggestion. It wasn’t a loophole. It was a binding clarification that applies to Bitcoin, Dogecoin, Litecoin, and any other coin that uses mining to secure its network. Before this, the SEC had spent years chasing crypto companies with enforcement actions, often treating tokens as unregistered securities. But mining? That was different. The SEC now says mining is a technical function-like running a power grid or maintaining a highway. You’re not selling a security. You’re earning rewards for contributing computational power to keep the network alive. This distinction matters. If you’re mining alone or in a pool, and you’re not marketing your rewards as an investment, you’re not a securities issuer. The SEC’s Acting Chairman Uyeda called this a "restart" of their approach. Commissioner Peirce said it was the first time the agency had clearly explained its position without threatening legal action. That’s huge.The GENIUS Act Changed Everything

In March 2025, Congress passed the GENIUS Act-the first comprehensive federal crypto law ever signed into law. It didn’t just legalize mining. It created a clear legal framework for the entire industry. The GENIUS Act officially recognizes cryptocurrency mining as a legitimate business activity under federal law. It prevents states from banning mining outright. It sets baseline rules for energy use reporting. And it requires federal agencies to coordinate their oversight instead of working in silos. Before this law, you could be mining legally in Texas but get shut down in New York. Now, federal law overrides conflicting state bans. That doesn’t mean all state rules disappear-but it does mean you can’t be prosecuted under a law that contradicts federal recognition of mining as a protected economic activity.Anti-Money Laundering Rules Apply-Even to Miners

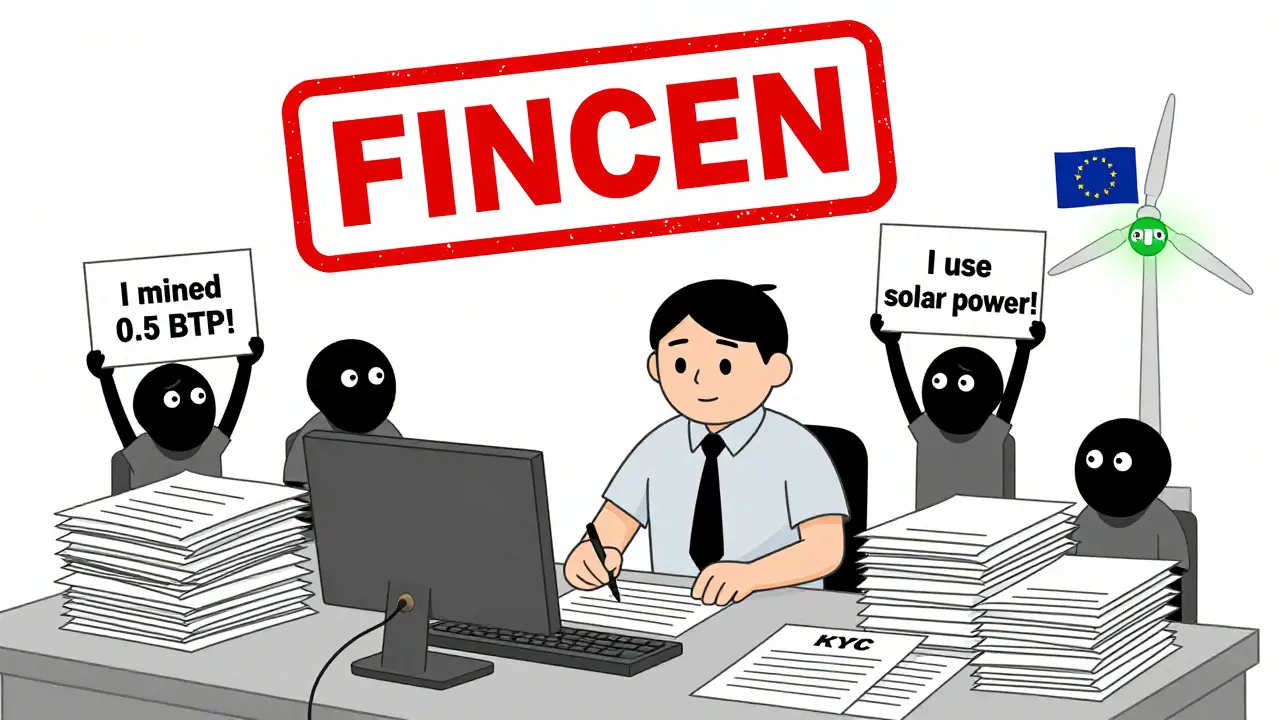

Here’s where most miners get caught off guard: you’re a financial institution under the Bank Secrecy Act. That’s not a joke. If you’re earning crypto rewards and then converting them to fiat, sending them to exchanges, or pooling them with others, you’re considered a Virtual Asset Service Provider (VASP) by FinCEN. That means you must follow AML/KYC rules. You need to verify your identity when you cash out. You need to keep records of every transaction. And if you send more than $3,000 in crypto to another wallet, you’re required to report the sender’s and receiver’s full names, addresses, wallet IDs, and transaction details under the Travel Rule. This rule applies whether you’re a solo miner or part of a pool. If your mining pool pays out $5,000 in Bitcoin to your wallet, and you then send $4,000 to a centralized exchange, that triggers the Travel Rule. The exchange will ask you for your info. If you don’t have it documented, you’re in violation. Most miners don’t track this. They think, "I just mined coins-I didn’t do anything illegal." But the law doesn’t care about your intent. It cares about your transactions. If you’re not keeping logs of who sent what and where it went, you’re already non-compliant.

What About Mining Pools?

Mining pools are the most common way people mine today. Instead of waiting months to find a block alone, you team up with others. The pool operator handles the coordination, pays out rewards, and often takes a 1-3% fee. But here’s the catch: pool operators are legally responsible for compliance. If your pool sends out $3,500 in Bitcoin to 50 miners, the operator must collect and store PII for each of those 50 recipients. If they don’t, the entire pool can be fined by FinCEN. Many small pools ignore this. They use open-source software that doesn’t collect identities. That’s fine for hobbyists-but if you’re running a pool that pays out regularly, you’re legally required to implement identity verification. Some operators now use KYC-integrated payout systems like Coincover or BitGo to automate this. If you’re joining a pool, ask: "Do you comply with the Travel Rule?" If they say "no," you’re taking on legal risk every time you get paid.State Laws Still Matter-Even With Federal Law

The GENIUS Act stops states from banning mining. But it doesn’t stop them from taxing it, regulating energy use, or requiring local permits. In Texas, you can mine with no restrictions. In New York, you need an energy impact review if your setup uses over 1 megawatt. In Washington, you can’t use hydropower for mining during droughts. In California, you must report carbon emissions if your operation exceeds 500 kW. If you’re mining across state lines, you’re dealing with a patchwork of rules. A single mining rig in Colorado might need a business license. The same rig in Oregon might need an environmental permit. You can’t assume federal law covers everything. Keep a list of every state where you’re mining. Check your state’s Department of Revenue and Environmental Protection Agency websites every six months. Laws change fast.

Europe’s MiCAR Rules Affect You Too

Even if you’re in the U.S., if you’re sending crypto to EU-based exchanges, wallets, or services, you’re subject to the Markets in Crypto-Assets Regulation (MiCAR), which fully took effect in December 2024. MiCAR requires all crypto service providers in the EU to be licensed. If you send mining rewards to a European exchange that’s not licensed, you’re facilitating an illegal transaction. The EU doesn’t care where you’re from-they care where the transaction ends. Worse, MiCAR now includes crypto mining in its sustainability taxonomy. Banks and institutional investors in Europe can’t fund mining operations that don’t meet strict energy efficiency standards. If you’re mining with coal-powered electricity, you’re effectively cut off from European capital markets. This isn’t just a European problem. If you want to sell your mined coins to EU-based buyers, or use EU-based custody services, you need to prove your operation is clean and compliant. That means tracking your energy source and emissions.What You Need to Do Right Now

Here’s a simple checklist for 2025 compliance:- Document every payout-record the date, amount, wallet address, and recipient name for every transaction over $3,000.

- Verify your identity with any exchange or custodian you use. If they ask for ID, don’t refuse.

- Know your energy source-track whether you’re using renewable, grid, or fossil fuel power. Save receipts or screenshots from your utility provider.

- Check your state’s rules-visit your state’s government website and search for "crypto mining regulations."

- Use a compliant pool-if you’re mining in a pool, make sure they collect KYC data from members.

- Keep records for 5 years-FinCEN can audit you anytime. If you can’t produce logs, you’re guilty by default.

What’s Coming Next

The GENIUS Act was just the beginning. In late 2025, the CFTC is expected to finalize rules for mining hardware import controls. The IRS is preparing new guidance on how to report mining income-likely treating it as ordinary income, not capital gains. And Congress is already drafting the next bill: the Crypto Tax Transparency Act, which would require exchanges to report all mining payouts to the IRS automatically. The era of "figure it out later" is over. In 2025, legal compliance isn’t optional. It’s the cost of doing business. The miners who succeed aren’t the ones with the most powerful rigs-they’re the ones who understand the rules before they break them.Is crypto mining legal in the United States in 2025?

Yes, crypto mining is legal in the U.S. as of 2025. The GENIUS Act, signed into law in March 2025, formally recognizes mining as a protected economic activity under federal law. However, it’s not unregulated. Miners must still comply with AML/KYC rules, the Travel Rule, state energy regulations, and tax reporting requirements.

Do I need to report my crypto mining income to the IRS?

Yes. The IRS treats mined cryptocurrency as ordinary income at its fair market value on the day you receive it. You must report this on Form 1040, Schedule 1. If you later sell or trade the coins, you may also owe capital gains tax. Keep records of the date, value, and wallet address of each payout.

What happens if I don’t comply with the Travel Rule?

Non-compliance with the Travel Rule can lead to civil penalties of up to $100,000 per violation from FinCEN. In cases involving money laundering or repeated violations, criminal charges are possible. Exchanges may freeze your account or refuse to process your transactions if you can’t provide required originator and beneficiary information.

Can I mine crypto in my state if it’s banned elsewhere?

The GENIUS Act prevents states from banning mining outright. However, states can still impose energy use restrictions, require permits, or tax mining operations. For example, New York requires environmental reviews for large-scale mining, and Washington limits hydropower use during droughts. Always check your state’s specific rules-even if mining is legal, it may be heavily regulated.

Do I need a license to mine cryptocurrency?

You don’t need a federal license to mine as an individual. But if you operate a mining pool, run a commercial mining facility, or act as a VASP (like a custodian or exchange), you may need to register with FinCEN as a Money Services Business (MSB). Some states also require local business licenses for crypto-related activities.

Does the SEC regulate mining like it regulates trading?

No. The SEC clarified in March 2025 that Proof-of-Work mining is not a securities activity. You’re not selling an investment contract-you’re earning rewards for securing a decentralized network. This applies to Bitcoin, Litecoin, and similar coins. However, if you’re mining tokens that are classified as securities (like some newer projects), different rules may apply. Stick to well-established PoW coins to avoid SEC scrutiny.

How does MiCAR affect U.S. miners?

MiCAR doesn’t directly regulate U.S. miners, but it affects anyone doing business with EU-based entities. If you send mined crypto to an EU exchange, wallet, or custody provider, that provider must be licensed under MiCAR. If you’re mining with high-carbon energy, you may be blocked from EU markets because of the EU’s sustainability taxonomy. To trade with EU partners, you need to prove your mining is energy-efficient and compliant.

What’s the easiest way to stay compliant?

Use a regulated exchange or custodian that handles KYC and Travel Rule compliance for you. Keep digital logs of every mining payout, including date, amount, and wallet address. Track your energy source with screenshots or utility bills. Avoid sending large amounts to unverified wallets. And consult a crypto-savvy accountant or attorney annually. Compliance isn’t glamorous-but it’s cheaper than a fine.

9 Comments

Bro, I just bought a new ASIC and my electricity bill went from $120 to $480 in one month. But hey, at least I’m not breaking the law anymore thanks to the GENIUS Act. Still, I’m terrified every time I send a payout to Binance. Did you know FinCEN can come after you even if you didn’t know the rules? 😅 I’ve started saving screenshots of every transaction like my life depends on it. Also, my pool says they’re ‘compliant’ but they don’t ask for ID. Should I be worried? 🤔

THEY’RE LYING. THE SEC IS A COVER FOR THE FED. THEY LET MINING SLIP THROUGH SO THEY CAN TRACK EVERY WALLET AND FREEZE YOUR ASSETS LATER. I SAW A GUY ON YOUTUBE GET KNOCKED OFF HIS PROPERTY BECAUSE HE MINED IN TEXAS. THE GOVT WANTS YOUR HASHRATE AND YOUR CASH. THEY’RE USING THE GENIUS ACT TO MAKE YOU THINK YOU’RE SAFE WHILE THEY BUILD THE DATABASE. DON’T TRUST THE SYSTEM. DELETE YOUR WALLET. GO CASH ONLY. 🚨

I appreciate the clarity in this post. I’ve been mining as a side hobby and never realized how many layers of compliance exist. I’ll start tracking my energy usage and keeping transaction logs. Thanks for the checklist-it’s a good reminder that legality isn’t just about permission, it’s about responsibility.

Why are we even talking about this like it’s complicated? The U.S. government passed a law to protect American miners-that’s it. If you’re too lazy to log your transactions or scared of the IRS, don’t mine. But don’t act like you’re being oppressed because you have to follow basic financial rules. Europe? Don’t care. MiCAR? Their problem. We have the GENIUS Act. Use it. Don’t whine about KYC. It’s not a conspiracy, it’s finance.

Wait, so if I mine in my garage and cash out $2,500 every week, I’m fine? But if I do $3,100 once, I need to verify my identity? That’s wild. I mean, it’s like the government drew a line in the sand and said ‘this amount is suspicious but that amount is chill.’ And why does my pool need to know who I am if I’m just sending coins to myself? 😅 I’m gonna ask my pool if they use Coincover. If they say ‘nah we’re chill,’ I’m out. Gotta keep it legit, even if it’s annoying.

Oh wow, Americans think they invented crypto regulation? LOL. MiCAR has been running since 2024 and you’re just waking up? And you call this ‘legal clarity’? My cousin in Mumbai mines using solar and pays zero tax because India doesn’t care. Meanwhile, you’re logging energy usage like you’re NASA. Maybe the real problem isn’t the law-it’s your obsession with bureaucracy. Stop overthinking. Just mine. The world doesn’t need your receipts.

It’s fascinating how we’ve built this entire digital economy on trustless technology, yet we’re now forced to submit our identities to every node in the chain. The irony isn’t lost on me. Mining was supposed to be about decentralization, freedom, autonomy. Now we’re filling out forms, saving utility bills, and worrying about Travel Rule compliance. I don’t know if this is progress or surrender. But I do know one thing: if we want crypto to survive, we need rules. Just… maybe rules that don’t make us feel like criminals for turning on a machine.

Travel Rule is a joke. You mine 10 BTC, send 3 to an exchange, they ask for your name and address. So you lie? Or do you get flagged? Either way you lose. And who the hell is gonna audit some guy in Ohio mining with a used Antminer in his basement? Nobody. The system is rigged to scare small players so big players can dominate. Just mine quietly. Don’t report. Don’t care. They’ll never find you.

Let’s cut through the noise. The SEC’s statement on PoW mining was a technical clarification, not a policy win. The GENIUS Act is a federal preemption, not a deregulation. And the Travel Rule? It’s not optional-it’s codified under 31 CFR 1022.380. If you’re a VASP, you’re regulated. If you’re a solo miner, you’re not. But once you convert or transfer over $3,000, you trigger the definition. The confusion isn’t in the law-it’s in the interpretation. Stop treating compliance like a suggestion. It’s a legal obligation. And if you don’t know the difference between a Money Services Business and a hobbyist, you’re already in violation. Don’t blame the regulators. Know your status.