Institutional Crypto Custody Comparison Tool

Evaluate the best custody solution for your institution based on your specific requirements. Input your key parameters below to see which custody model (bank-led, FinTech, or hybrid) best matches your needs.

Recommended Custody Model

Bank-Led

$8.2/1042% support for DeFi protocols

$500M insurance coverage

$1.2M+ training investment

Best for strict regulatory environments

FinTech

$9.5/1092% support for DeFi protocols

$250M insurance coverage

$500K-$2M implementation cost

Best for innovation-focused institutions

Hybrid

$8.7/1075% support for DeFi protocols

$500M insurance coverage

$1.5M+ implementation cost

Best for balanced approach

Why this match? Based on your input:

- $500M+ assets require bank-level insurance

- EU jurisdiction needs MiCA compliance

- Security is your top priority

Hybrid models provide the best balance of compliance and technology for your needs

When a hedge fund manages $500 million in Bitcoin, they don’t just store it in a wallet on a laptop. One mistake-lost key, hacked server, insider error-and that entire sum vanishes forever. Blockchain transactions are irreversible. There’s no customer service line to call when your private key is gone. That’s why institutional crypto custody isn’t optional anymore-it’s the foundation of any serious digital asset strategy.

Why Institutions Need Specialized Custody

Traditional banks have spent decades building systems to protect stocks, bonds, and cash. Digital assets don’t fit those systems. Cryptocurrencies are bearer instruments: whoever holds the private key owns the asset. No middleman. No account number. No password reset. If you lose the key, you lose everything. And institutions aren’t dealing with small amounts. In 2024, over 60% of hedge funds, pension funds, and asset managers held digital assets-up from 40% just a year earlier. That’s trillions in value needing protection. The risks aren’t theoretical. In 2024, hackers stole $2.2 billion from crypto platforms globally. The Ronin Network breach alone took $625 million. Three Arrows Capital lost $29 million in 2023 because their custody setup was outdated. These aren’t startup mistakes-they’re institutional failures. And when a pension fund loses client money, the fallout isn’t just financial. It’s reputational. Legal. Existential. That’s why custody isn’t about software anymore. It’s about trust. It’s about insurance. It’s about compliance. It’s about having layers of protection so deep that even if one fails, the others hold.How Institutional Custody Works: The Core Layers

Modern institutional custody isn’t a single tool. It’s a stack of security technologies working together. First, cold storage. About 85% of institutional custodians keep the vast majority of assets offline. Private keys are stored in air-gapped hardware devices, physically disconnected from the internet. These are kept in secure vaults-sometimes in multiple countries-to guard against natural disasters, political instability, or targeted attacks. Then comes multi-signature (multi-sig). Instead of one key unlocking a wallet, you need multiple. State Street’s 2025 report shows 92% of institutional custodians require at least a 3-of-5 signature for transactions over $1 million. That means no single employee can move funds. It requires coordination between compliance, treasury, and operations teams. This isn’t just security-it’s internal control. The newest breakthrough is multi-party computation (MPC). Unlike multi-sig, where keys are split and stored separately, MPC allows keys to be generated and used without ever existing in full form anywhere. Think of it like a safe that only opens when five people each turn a different dial at the same time-but none of them ever see the full combination. ChainUp’s 2025 data shows 68% of institutional custodians now use MPC. It’s faster than multi-sig, more secure than traditional HSMs, and reduces key compromise incidents by 63% since 2023. All of this runs on FIPS 140-2 Level 3 certified hardware-military-grade security modules that physically resist tampering. Systems are audited quarterly. Geographically distributed. Backed by insurance policies averaging $500 million per client for bank-led providers.The Three Custody Models: Banks, FinTechs, and Hybrids

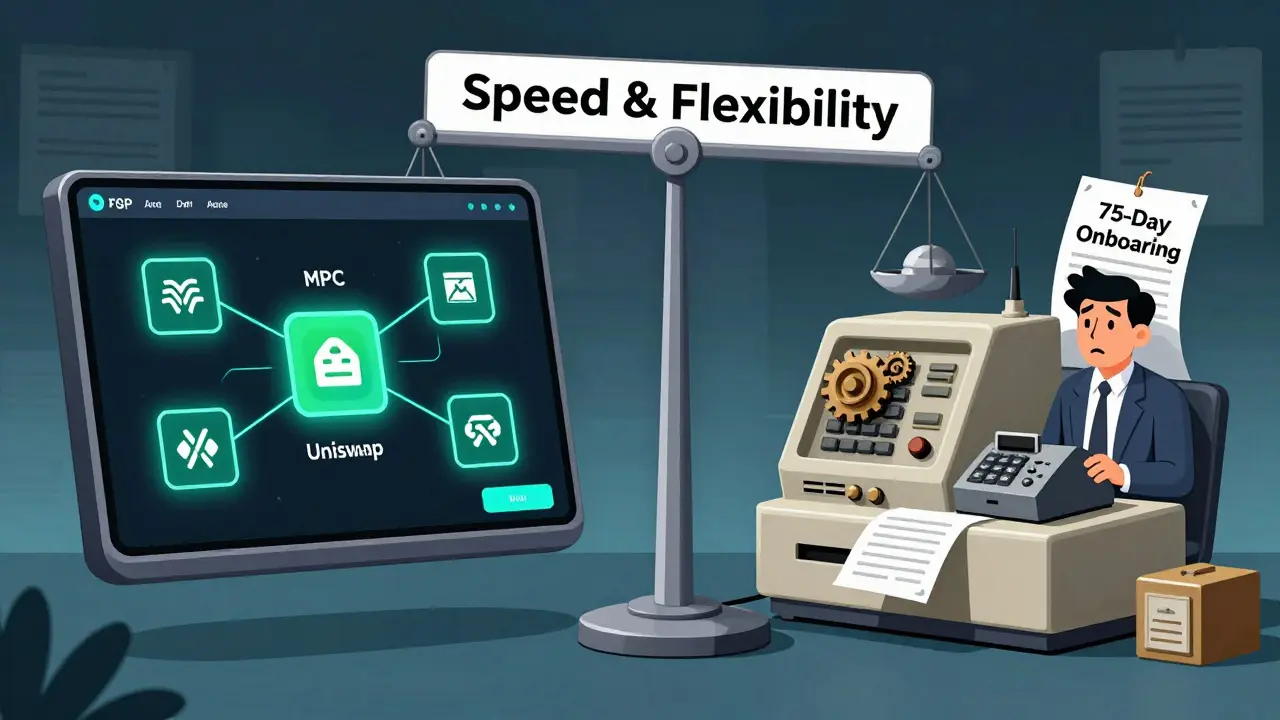

There are three main paths institutions take. Bank-led custody-think State Street, U.S. Bank, BNY Mellon-holds about 35% of the market. Their advantage? Regulatory clarity. They’re already licensed to hold client assets under SEC and MiFID II rules. They offer integrated reporting with traditional portfolios. Insurance is strong. But their tech lags. Only 42% support DeFi protocols. Their systems were built for ETFs, not blockchains. Onboarding takes 75-120 days. Transaction speeds are slow. And their user interfaces? Outdated. Specialized FinTech custodians-Fireblocks, Coinbase Custody, Anchorage-control 45% of the market. They’re faster. More flexible. Fireblocks’ MPC network lets institutions interact with DeFi protocols like Aave and Uniswap without exposing private keys. Transaction processing is 2-3x faster than bank solutions. Their APIs integrate cleanly with modern portfolio systems. But their insurance is lower-around $250 million. And in some countries, regulators don’t recognize them as licensed custodians. That’s a dealbreaker for pension funds in the EU or Japan. Hybrid models-like BNY Mellon partnering with Fireblocks-make up the remaining 20%. They combine bank oversight with FinTech speed. You get the compliance of a bank and the tech of a startup. But they’re complex. Pricing is opaque. Integration requires two vendors, two contracts, two support teams. They’re the middle ground-and the most expensive.

What Institutions Actually Say

A 2025 survey by the Institutional Crypto Investors Association found that 73% of institutions consider custody “critical” to their digital asset strategy. But only 54% were satisfied with their current provider. Why?- 57% complain about slow transaction speeds, especially during Ethereum network congestion.

- 71% hate the fee structures-hidden charges, tiered pricing, minimum balances.

- 83% of negative reviews on Trustpilot mention poor cross-chain support. If you hold Bitcoin, Ethereum, and Solana, you shouldn’t need three separate custody accounts.

- Integration with legacy systems like Bloomberg PORT or FactSet is a nightmare. 67% of users report reconciliation issues between blockchain ledgers and traditional accounting software.

Implementation: It’s Not Just Tech-It’s People

Most institutions think custody is a software purchase. It’s not. It’s a transformation. The average implementation takes 45 to 120 days. Bank solutions take longer because of compliance checks. FinTechs move faster but still require deep integration work. You need more than a blockchain engineer. You need:- A compliance officer who understands crypto regulations across jurisdictions

- A treasury team trained in key management workflows

- A portfolio manager who can reconcile on-chain data with traditional reporting

Market Trends and What’s Coming

The global institutional custody market hit $1.87 billion in 2024. By 2027, it’s projected to hit $5.34 billion. That’s a 41.2% annual growth rate. Regulation is tightening. The EU’s MiCA framework requires all custodians to hold at least €1.5 million in capital starting January 1, 2026. The SEC’s proposed Custody Rule Update would force quarterly third-party audits. 68% of jurisdictions now require specific licenses. New tech is emerging. Fireblocks launched "Institutional MPC 3.0" in February 2025 with quantum-resistant cryptography. State Street integrated tokenized U.S. Treasury bonds into its custody platform in April 2025. The Digital Asset Custody Consortium is releasing a standardized API in Q3 2025 to fix interoperability across platforms. The big question: Who wins long-term? - 63% of traditional finance execs believe bank-led custody will dominate by 2028. - 78% of crypto-native execs think FinTechs will serve niche markets while banks handle mainstream custody. - 54% predict hybrid models will become standard. The trend is clear: custody is no longer just about storage. It’s about integration. Institutions want one platform that handles stocks, bonds, Bitcoin, and tokenized real estate-all with unified reporting, compliance, and security.What to Look For in a Custody Provider

If you’re evaluating providers, ask these questions:- Do they use MPC or just multi-sig? (MPC is the future)

- What’s their insurance coverage per client? (Aim for $500M+)

- Do they support the blockchains you use? (Bitcoin, Ethereum, Solana, etc.)

- Can they integrate with your existing portfolio system? (Ask for API specs)

- What’s their response time for critical incidents? (24/7 support is non-negotiable)

- Are they licensed in your jurisdiction? (Check with local regulators)

- How do they handle key recovery? (73% of losses come from lost keys, not hacks)

The Bottom Line

Institutional crypto custody isn’t a vendor you pick. It’s a strategic pillar. The right solution doesn’t just protect assets-it enables growth. It lets you access DeFi. It lets you tokenize real-world assets. It lets you report to investors with confidence. The wrong one? It’s a liability waiting to explode. The market is evolving fast. Banks are catching up. FinTechs are scaling. Regulations are locking in. The window for early adopters is closing. If you’re managing institutional capital and haven’t secured your digital assets properly-you’re already behind.What’s the difference between retail and institutional crypto custody?

Retail custody is like keeping cash in a wallet-simple, fast, but risky. Institutional custody is a fortress. It uses multi-signature, cold storage, MPC, insurance, compliance, and audit trails. Retail users might use a software wallet like MetaMask. Institutions use systems that require five people to approve a single transaction. It’s not just security-it’s governance.

Can I use a regular exchange wallet for institutional assets?

No. Exchange wallets are not custodial solutions-they’re hot wallets owned by the exchange. If the exchange gets hacked, goes bankrupt, or freezes accounts (as happened with FTX), your assets are at risk. Institutional investors require segregated, insured, third-party custody where the custodian holds the keys-not the exchange. Regulators explicitly prohibit using exchange wallets for institutional holdings.

How much does institutional crypto custody cost?

Costs vary widely. Implementation can run $500,000 to $2 million for enterprise integration. Ongoing fees are typically 0.1% to 0.5% of assets under custody annually. Bank-led solutions often have higher minimums and hidden fees. FinTechs may charge lower base fees but add charges for DeFi access or cross-chain transfers. Always ask for a full fee schedule-including withdrawal fees, API usage, and reporting charges.

Are institutional custody solutions safe from quantum computing?

Current systems use ECC and RSA cryptography, which quantum computers could break in the future. NIST estimates this threat is 12-15 years away. But leading providers like Fireblocks are already deploying quantum-resistant algorithms in their new MPC 3.0 systems. If you’re planning long-term holdings (5+ years), prioritize custodians actively upgrading to post-quantum cryptography. Don’t assume your current solution will be safe in 2030.

What happens if a custodian goes bankrupt?

Your assets should remain yours. Legitimate institutional custodians hold client assets in segregated accounts-separate from their own balance sheet. If they go bankrupt, your crypto isn’t part of their liquidation. But you still need proof. Always verify that the custodian is regulated, insured, and uses independent auditors. Check if they’re registered with the SEC or equivalent. If they’re not, your assets could be treated as general creditors’ claims-and you might not get them back.

Do I need custody for NFTs and tokenized assets?

Yes-if you’re an institution. NFTs and tokenized real estate, art, or commodities are still digital assets with private keys. Most institutional custody providers now support them, but not all. Only 18% of traditional bank custodians supported NFT custody as of early 2025. If you’re holding these assets, confirm your provider has specific infrastructure for non-fungible tokens, including metadata storage, provenance tracking, and royalty enforcement.

How do I know if my custodian is compliant with MiCA or SEC rules?

Ask for their regulatory license number and jurisdiction. For MiCA compliance in the EU, they must be licensed by a national authority like Germany’s BaFin or France’s AMF. For the SEC, they must be registered as a broker-dealer or custodian under Rule 15c6-1. Request their latest audit report from a Big Four firm. If they can’t produce this, they’re not compliant. Don’t take their word for it-verify with the regulator’s public database.

What’s the biggest mistake institutions make with custody?

Assuming custody = security. Many institutions pick a provider because it’s “big” or “well-known,” then assume they’re protected. But 73% of asset losses come from lost or compromised keys-not hacks. The real failure is poor internal controls: one person having too much access, no approval workflows, no key rotation, no training. Custody tech is only as strong as the people using it. Invest in culture as much as in software.

10 Comments

Okay but let’s be real - if your custody solution can’t handle Solana transactions under 2 seconds during peak NFT minting, you’re already late to the party. I’ve seen funds lose millions because their ‘enterprise-grade’ platform was still on Ethereum 1.0 speed. MPC is cool, but if your UI looks like it was designed in 2017 and your support team sleeps through US market open, you’re just fancy wallpaper for your portfolio. Also, why does every bank custodian charge $5k just to log in? 🤡

They’re all lying. Every single one. The real reason they use cold storage? So they can secretly sell your BTC when you’re not looking. They don’t want you to know they’ve got backdoors in the MPC systems. I’ve seen the leaks. Quantum resistance? LOL. The NSA already cracked it. They’re just making you pay $2M for a vault that’s got a hidden USB port. Wake up. This isn’t finance - it’s a pyramid scheme with better logos.

I appreciate the depth of this breakdown. It’s rare to see such clear explanations of custody layers without the hype. Just wish more firms would prioritize transparency over marketing.

Only Americans think you need five people to sign a transaction. In China, we use one blockchain, one government, one key. No drama. No audits. No $500M insurance policies. Just trust the state. You guys turn security into a Broadway musical. Meanwhile, real nations just… hold the keys. Your ‘hybrid models’ are just expensive therapy for trust issues.

Wait - so if MPC keys never exist in full form, how do you even recover them if someone dies? 😅 I’m just asking because my uncle’s crypto wallet is still locked and he forgot the password. (He was 82 and thought ‘seed phrase’ was a type of tea.) Also, can someone explain why Fireblocks gets 4.7/5 but every bank gets 3.2? Is it because one has a chatbot that says ‘hi’ and the other has a fax machine? Just curious. No judgment. Probably.

USA thinks they invented security. Bro, India’s RBI has been doing blockchain custody since 2019 - no fancy MPC, no $2M integration fees. Just a damn ledger and a lot of chai. You pay $10k for ‘audit reports’ while our system runs on 10 engineers and 3000 hours of overtime. Stop romanticizing Western tech. We don’t need your ‘FIPS-certified’ drama. We have discipline.

It’s funny how we treat custody like it’s some mystical fortress, when really it’s just a reflection of how we organize trust in the first place. We built banks to hold money because we didn’t trust individuals. Now we’re building crypto custody because we don’t trust banks. The tech changes, but the fear stays the same. Maybe the real solution isn’t more layers - it’s learning to trust differently. Or at least, to trust less.

Multi-sig is dead. MPC is the future. End of story. Anyone still using HSMs is running a 2018 blog. Also why are you paying for insurance when you could just use a multisig with geographically distributed signers? You’re being scammed by marketing departments. And yes I’ve audited 12 of these platforms. You’re welcome.

Let’s cut the BS. The only reason hybrid models exist is because banks are too slow to innovate and FinTechs are too scared of regulators. The real winner? The one who gets regulators to write rules that lock out competitors. That’s not custody. That’s regulatory capture dressed in blockchain pajamas. Also, ‘quantum-resistant’ is just a buzzword until someone breaks it. Don’t be fooled.

Frankly, the entire institutional custody ecosystem is a performance art piece designed to extract fees from people who don’t understand cryptography. You don’t need MPC. You don’t need FIPS-3 certified vaults. You need one person who knows what they’re doing - and a paper wallet tucked under a mattress in a Swiss bunker. Everything else is just consultancy fees disguised as security. Also, your ‘$500M insurance’? That’s only good if the insurer hasn’t already been bought by the same bank that’s holding your keys. How’s that working out for you?