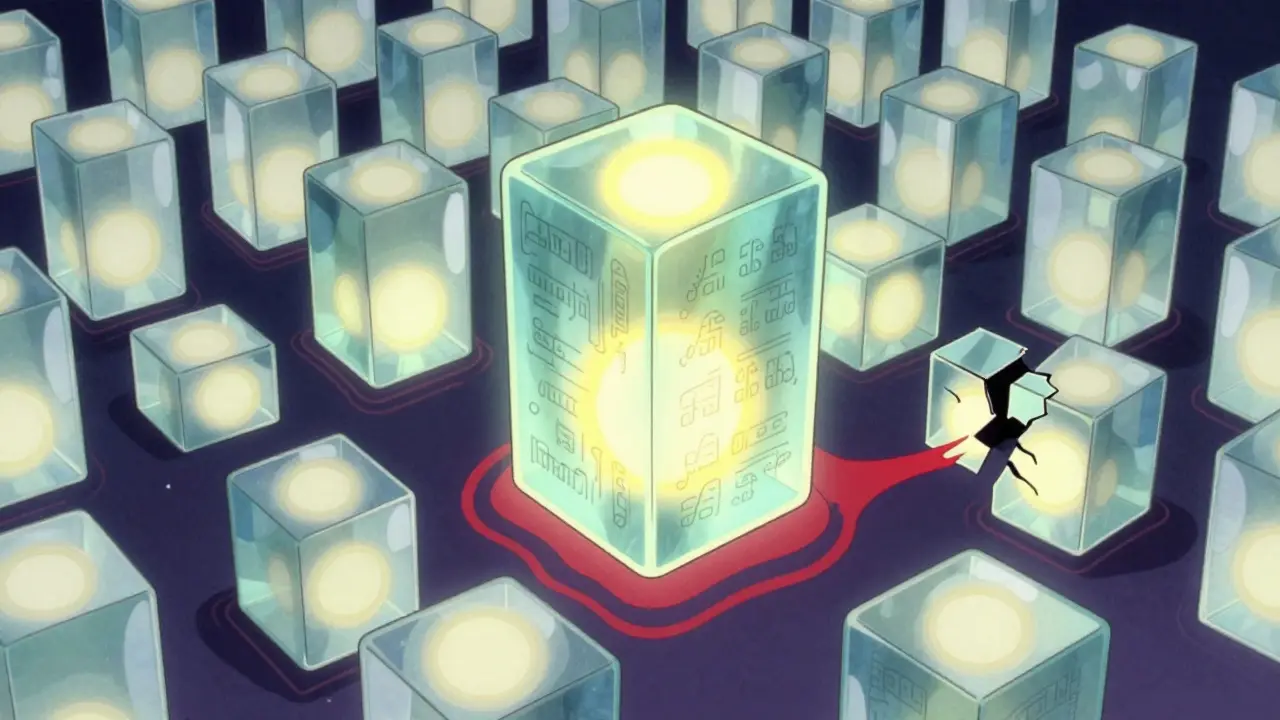

Every time you send Bitcoin or execute a smart contract on Ethereum, that transaction doesn’t just disappear into the ether. It gets locked into a blockchain block-a permanent, tamper-proof container that holds not just the transaction, but the entire history of how it connects to every other transaction before it. This isn’t like saving a file on your hard drive. It’s more like engraving the transaction into glass, then making thousands of copies of that glass and distributing them across the globe. If someone tries to change even one digit, every copy will know something’s wrong.

What’s Inside a Blockchain Block?

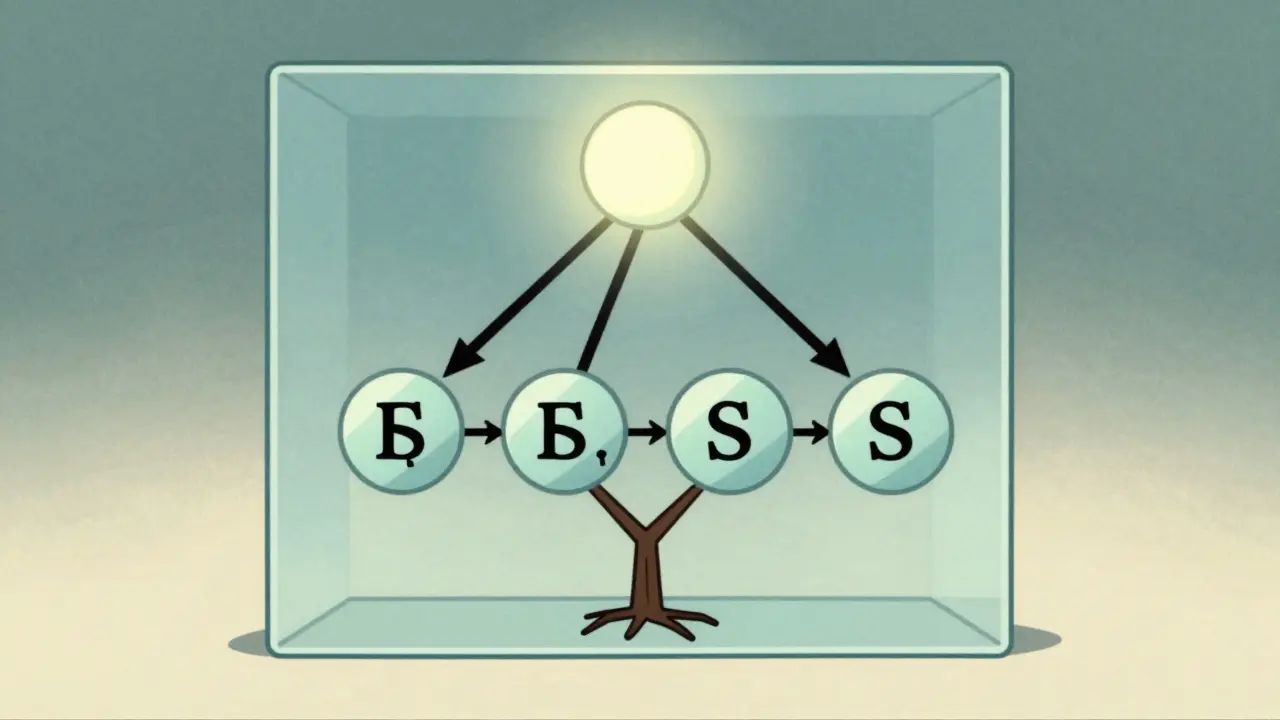

A blockchain block isn’t just a pile of transactions. It’s a carefully built structure with three main parts: the block header, the transaction counter, and the actual transaction data. The header is the glue that holds the chain together. It contains five key pieces of information: a hash of the previous block, a timestamp, a nonce, the Merkle root, and the version number. The hash of the previous block is what makes it a chain. Each new block includes the fingerprint of the one before it. Change one block? You break every block after it. That’s why altering data on a blockchain is nearly impossible without controlling more than half the network.The Merkle root is where the real magic happens for transaction storage. Instead of listing every transaction in the header (which would be huge), the system builds a tree of hashes. Each transaction gets hashed, then pairs of hashes get hashed together, and so on, until you end up with one single hash-the Merkle root. This one number represents every transaction in the block. If even one transaction changes, the entire Merkle root changes. That’s how nodes quickly verify that a block hasn’t been tampered with, without downloading every single transaction.

How Transactions Are Structured

Each transaction inside a block has its own set of data. In Bitcoin, that includes the sender’s address (a 160-bit string like1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa), the recipient’s address, the amount in satoshis (the smallest unit of Bitcoin), and a digital signature proving the sender owns the funds. Ethereum transactions are more complex: they include a gas price, gas limit, and sometimes extra data for running smart contracts. All of this is signed with elliptic curve cryptography-usually ECDSA-creating a 65-byte signature that can’t be forged without the private key.

These transactions are then bundled together and hashed using SHA-256 (for Bitcoin) or Keccak-256 (for Ethereum). The output is a unique 64-character hexadecimal string. Even changing a single comma in the transaction data produces a completely different hash. This is called the avalanche effect, and it’s why blockchain is so secure. It’s mathematically impossible to reverse-engineer the original data from the hash. And because every node on the network stores a copy of every block, any attempt to alter a transaction would require rewriting every block after it on more than half the network at once.

On-Chain vs Off-Chain Storage

Not everything needs to go on-chain. Storing large files-like images, videos, or PDFs-directly on a blockchain is expensive and slow. On Ethereum, storing 1KB of data costs about $10 as of late 2023. That’s why most NFTs, like Beeple’s $69 million artwork, only store a hash of the file on-chain. The actual JPEG lives on a server somewhere, often centralized. That creates a risk: if that server goes down, the NFT becomes just a link to nothing.That’s where off-chain storage comes in. Systems like IPFS and Filecoin let you store the real file on a decentralized network, then record only its cryptographic hash on the blockchain. The hash is 32 bytes long-tiny compared to a 20MB image. Now you get the security and proof of ownership from the blockchain, without the cost. Ethereum’s Dencun upgrade in early 2024 introduced blob transactions, which temporarily store large data off-chain while keeping the hash on-chain. This slashes storage costs by up to 90% and lets Ethereum handle far more transactions per second.

How Different Blockchains Handle Storage

Bitcoin’s blocks are limited to 1MB (or 4MB with SegWit), allowing about 3-7 transactions per second. That’s why fees spike during busy times. Ethereum, with its dynamic gas limit, can handle 15-30 transactions per second, but it’s still slow compared to traditional systems. Private blockchains like Hyperledger Fabric bypass these limits entirely. They don’t need global consensus-only permissioned nodes validate transactions. That lets them process up to 3,500 transactions per second, which is why banks and supply chain companies use them.But private chains sacrifice transparency. In public blockchains like Bitcoin and Ethereum, anyone can verify every transaction. In Hyperledger, only members of the network can see the data. Estonia’s KSI Blockchain uses a hybrid model: it stores hashes of health records on a public chain, but the actual patient data stays encrypted in secure government servers. This gives them auditability without exposing private information.

Why Immutability Is a Double-Edged Sword

Blockchain’s biggest strength-immutability-is also its biggest weakness. Once data is written, it can’t be erased. In July 2017, a bug in the Parity multisig wallet froze $300 million in Ether forever. No one could move it. No one could delete it. The code was correct. The logic was sound. But the damage was permanent. There’s no customer service line for blockchain. No “undo” button. That’s why developers spend months optimizing their code before deploying smart contracts. One misplaced variable can cost thousands in gas fees.Developer Alex V. on Ethereum Stack Exchange spent 17 hours fixing a contract that stored user profiles as strings instead of structs. The mistake inflated storage costs by 400%. For 1,000 users, that meant an extra $1,200 in gas. That’s not theoretical-it’s real money people lose because they don’t understand how blockchain storage works.

Storage Costs and Scalability Challenges

Bitcoin’s blockchain is now 475GB. Ethereum’s is over 1.2TB. Running a full node requires serious hardware: 2TB of SSD, 16GB RAM, and a fast internet connection. That’s why most users rely on third-party nodes. But that defeats part of the point of decentralization. NIST pointed out in 2020 that storing the same data across 10,000+ nodes is wildly inefficient. Traditional databases don’t do that. They replicate only where needed.Still, blockchain’s resistance to tampering makes it unbeatable for audits. University of Cambridge research found blockchain is 37 times harder to manipulate than traditional databases in financial records. That’s why companies like Maersk tried it for shipping docs-even though their TradeLens project eventually failed because not enough partners joined.

Today, 87 of the Fortune 100 are using blockchain for some kind of data storage, but mostly for specific tasks: verifying supply chain origins, logging financial transactions, or timestamping documents. They’re not replacing their entire ERP systems with blockchain. They’re using it as a verification layer.

What’s Next for Blockchain Storage?

The future isn’t bigger blocks. It’s smarter storage. Modular blockchains like Celestia and Avail separate the data layer from the execution layer. Celestia handles only data availability-making sure all transaction data is published and accessible-while other chains handle the computing. This lets them process 10,000 transactions per second with 10MB blocks. Filecoin’s FVM lets smart contracts interact directly with decentralized storage, turning Filecoin into a programmable hard drive.Zero-knowledge proofs are another game-changer. Projects like Aleo and StarkNet let you prove a transaction is valid without revealing any details. You can verify someone paid $5,000 without seeing who paid whom, or what the money was for. That’s privacy without sacrificing security.

By 2028, experts predict most enterprise use cases will be economically viable thanks to layer-2 solutions and data availability layers. But blockchain won’t replace your cloud storage. It won’t replace your database. It will replace the need to trust a single company to keep your records accurate. It’s not about storage capacity. It’s about trust.

Can blockchain data be deleted?

No, blockchain data cannot be deleted. Once a transaction is confirmed and added to a block, it becomes part of an immutable chain. Even if you own the private key to the address, you can’t remove the transaction from the ledger. The only way to "undo" it is to send a new transaction that reverses the effect-for example, sending funds back. But the original record still exists forever.

How do blockchain nodes verify transactions?

Each node checks three things: whether the digital signature matches the sender’s public key, whether the sender has enough balance, and whether the transaction follows the network’s rules (like gas limits or contract logic). Then, the node verifies the Merkle root by hashing all transactions in the block and confirming the result matches the one in the header. If all checks pass, the node accepts the block. If even one fails, it rejects it.

Why is the Merkle root important?

The Merkle root lets nodes verify the integrity of all transactions in a block without downloading every single one. It’s a single hash that represents thousands of transactions. If a malicious actor tries to change one transaction, the Merkle root changes, and every node will immediately detect the inconsistency. It’s a compact, efficient way to ensure data hasn’t been tampered with.

How much does it cost to store data on Ethereum?

Storing 1KB of data directly on Ethereum costs about 0.0035 ETH, which was around $10 in late 2023. That’s because every byte stored increases the size of the blockchain, requiring more storage from every node. For large files, it’s far cheaper to store them off-chain (like on IPFS) and only record the hash on-chain-costing less than a penny.

Can blockchain be hacked?

The blockchain itself has never been hacked. No one has altered a confirmed transaction on Bitcoin or Ethereum’s main chain. But smart contracts have been exploited, wallets have been stolen, and exchanges have been breached. The blockchain only guarantees that once data is written, it can’t be changed. It doesn’t protect bad code, weak private keys, or centralized services connected to it.

What’s the difference between Bitcoin and Ethereum block storage?

Bitcoin blocks are simple: they store only transaction data with a fixed size limit. Ethereum blocks store transactions plus smart contract code, state changes, and execution results. Ethereum uses a more complex data structure called the Merkle Patricia Trie to track account balances and contract storage, making its blockchain larger and more complex. Bitcoin’s focus is peer-to-peer cash; Ethereum’s is a programmable world computer.

What Should You Do Next?

If you’re thinking about using blockchain for data storage, ask yourself: Do you need proof that data hasn’t changed? Do you need it to be transparent and verifiable by strangers? If yes, blockchain makes sense. If you just need to store files cheaply, use Dropbox or S3. If you need to audit financial records or prove document authenticity across organizations, blockchain is powerful. But don’t force it where it doesn’t fit. The best applications use blockchain as a trust layer-not a database.Start small. Store a hash of a contract on Ethereum or Polygon. Test how much it costs. Learn how to write a simple smart contract that records data. Watch how the network validates it. Then scale from there. The technology is here. The tools are getting better. The cost is falling. But the rules haven’t changed: if you don’t understand how the block stores data, you’ll end up paying for mistakes you didn’t know you were making.

8 Comments

Interesting breakdown. I’ve been working with Merkle trees in my node setup, and the efficiency still blows my mind-especially how you can verify a single transaction out of 5,000 without downloading the whole block. It’s like having a library where you can prove a specific page exists without pulling every book off the shelf.

Still, I worry about how many full nodes are left. I run one on a Raspberry Pi 4, but even that’s starting to strain with Ethereum’s chain size. Decentralization feels more theoretical than practical these days.

They say blockchain is immutable but who really controls the nodes? The big mining pools? The cloud providers hosting most of the infrastructure? It’s all a illusion of decentralization

They’re just moving trust from banks to tech giants with data centers in Nevada and Singapore

And don’t get me started on how ‘off-chain’ storage is just corporate data hoarding with a fancy hash sticker on it

The real power isn’t in the chain-it’s in who owns the servers that host the IPFS gateways

They want you to think you’re free but you’re just renting space in their digital prison

It is, indeed, a matter of considerable concern that the architectural design of blockchain systems continues to be misapplied in contexts where traditional, centralized databases would offer superior efficiency, scalability, and cost-effectiveness.

The notion that blockchain constitutes a panacea for data integrity is not merely overstated-it is demonstrably erroneous in the majority of enterprise applications.

One must exercise rigorous intellectual discipline when evaluating technological solutions; the allure of novelty should never supersede the imperative of functional appropriateness.

It is regrettable that so many organizations, seduced by buzzwords, are now burdened with bloated, underperforming systems that serve more as marketing props than operational tools.

Just read this after my dev team deployed a new contract. We stored user metadata as strings instead of structs like Alex V. mentioned. Cost went from $0.02 to $0.10 per user. Ouch.

Lesson learned: always profile storage before deploying. Gas isn’t just a fee-it’s a design constraint.

Also, IPFS + ENS for NFTs is the way. Never put JPEGs on-chain. Ever.

Block size limits are not the problem. The problem is that people think blockchain should store everything. It is not a hard drive. It is a notary public. You do not put your entire house in a notary’s safe. You put the deed. The rest is elsewhere.

Bitcoin is for money. Ethereum is for contracts. IPFS is for files. Use each tool for what it was made for.

Also, if you are storing data on Ethereum, you are paying for global replication. That is expensive. That is intentional. It is not a bug. It is a feature.

bro why are we even doing this blockchain thing anymore like its 2017

everyone’s just putting hashes on chain like its some kind of magic talisman

the real data is still on amazon s3 and no one cares if the hash matches

we’re just paying gas to feel like we’re crypto bros

also who the hell stores 1kb for $10 that’s robbery

also i saw a video of a guy who lost 20k because he forgot to check the gas limit and now his contract is frozen

we’re all just playing russian roulette with smart contracts and calling it innovation

Hey everyone-just wanted to say thank you for this thread. I’m new to blockchain dev and I’ve been terrified of making a costly mistake like freezing funds or overpaying gas. This has been so helpful.

One thing I didn’t realize: even if you ‘delete’ a contract, the code and all its history still live on-chain. It’s like sending a letter and then burning the paper-the post office still has a copy.

Start small. Test on Goerli. Use Etherscan to check storage. And please, please-don’t store images on-chain. I learned that the hard way with my first NFT project. My wallet still hurts 😅

Modular blockchains are the future, no question. Celestia separates data availability from execution-that’s the key innovation. Why should every node compute every contract just to verify a transaction? That’s like making every librarian read every book just to check if the ISBN is correct.

Zero-knowledge proofs are even more revolutionary. You can prove you’re over 18 without showing your ID. Prove you paid rent without revealing the amount. That’s not just privacy-it’s dignity.

And yes, Ethereum’s Dencun upgrade was a game-changer. Blob transactions cut costs by 90% while preserving security. This isn’t scaling-it’s reimagining.

But let’s be honest: most enterprise ‘blockchain’ projects are just databases with a crypto veneer. The real value isn’t in replacing ERP systems-it’s in creating trust layers between competitors who refuse to share data. That’s where the magic happens.