By 2025, the energy sector isn’t just upgrading its wires and turbines-it’s rewriting its entire rulebook with blockchain. Forget the idea that blockchain is only about Bitcoin or crypto speculation. In the real world, it’s now quietly powering homes, balancing grids, and turning solar panels into mini-banks. From families in Texas selling excess sunlight to neighbors, to farmers in Kenya earning digital tokens for capturing carbon, blockchain is no longer a lab experiment. It’s operational infrastructure. And it’s growing fast.

How Blockchain Is Changing How Energy Moves

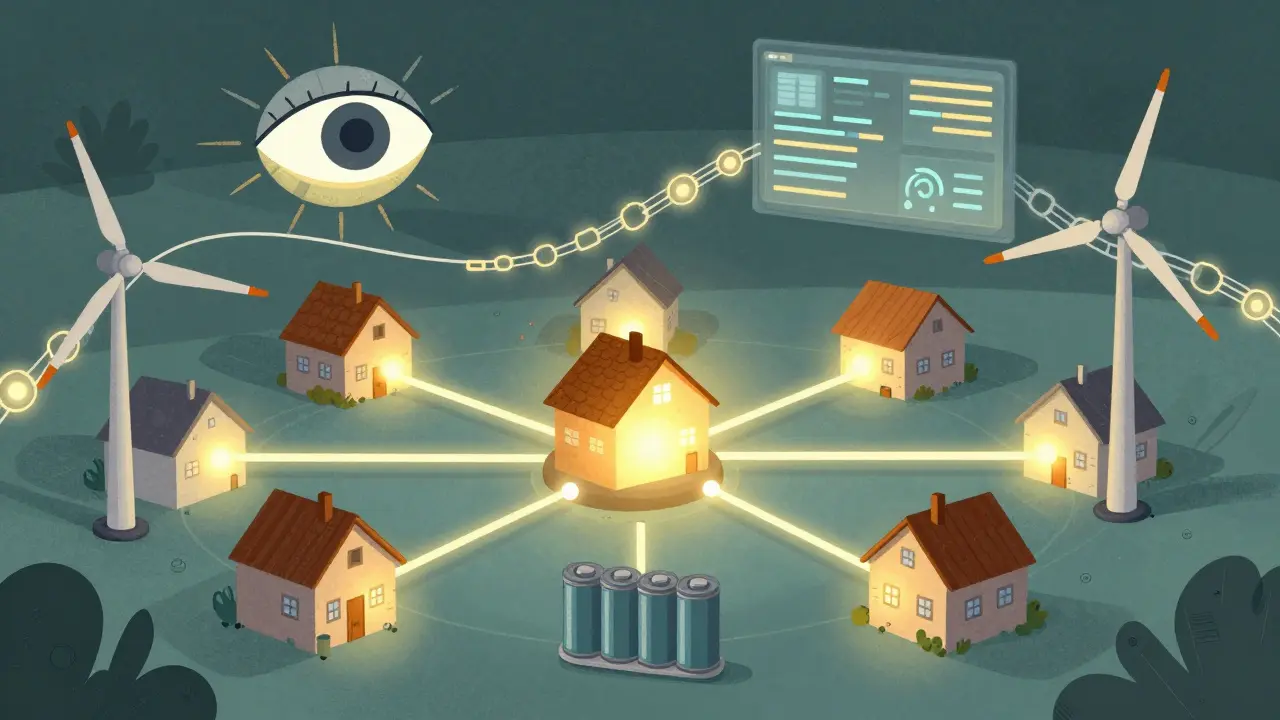

Traditional energy grids are centralized. Power flows one way: from big plants to homes. But with solar panels on rooftops and wind turbines in rural fields, that model is breaking. People aren’t just consumers anymore-they’re producers. And they want to trade energy directly, without middlemen. That’s where blockchain comes in. Blockchain acts like a digital ledger that everyone on the network can see but no one can alter. When a household generates 5 kWh of extra solar power, that amount gets recorded as a token on the blockchain. A neighbor who needs power at night can buy it instantly, with payment automatically processed via smart contract. No utility company. No billing delays. No disputes. Just clean, peer-to-peer energy trading. This isn’t theoretical. In Brooklyn, the TransActive Grid project lets residents trade solar energy using Ethereum-based smart contracts. In Australia, the Power Ledger platform has connected over 10,000 households in microgrids. These systems cut costs, reduce waste, and give people real control over their energy use.Carbon Credits Turned Into Digital Tokens

One of the biggest headaches in climate policy has always been verifying carbon reductions. Who’s really capturing CO2? How much? Can you trust the paperwork? Blockchain fixes that. Now, farmers, forest owners, and even small startups can use sensors and satellite data to prove they’ve removed tons of carbon from the atmosphere. That proof gets locked onto a blockchain as a token-each representing one metric ton of CO2 captured. These tokens can then be sold to companies trying to offset their emissions. In 2025, companies like Verdant and CarbonX are issuing blockchain-verified carbon credits that are traded on open platforms. Unlike old systems where credits were easily double-counted or forged, these tokens are traceable from creation to sale. A coffee chain in Berlin can buy a token from a reforestation project in Colombia and know exactly where it came from, who planted the trees, and how much carbon they locked away.Smart Grids That Think for Themselves

The electric grid is under more stress than ever. Heatwaves spike demand. Storms knock out lines. Renewable sources like wind and solar are unpredictable. Traditional grids can’t respond fast enough. Enter smart grids powered by blockchain and AI. Sensors on transformers, substations, and even individual homes send real-time data to a decentralized network. AI analyzes patterns-predicting surges, detecting faults, rerouting power before outages happen. Blockchain ensures that data can’t be tampered with. If a hacker tries to fake a reading, the system spots the inconsistency across multiple nodes. In Germany, the GridX platform uses this combo to stabilize local grids without relying on centralized control centers. In California, utilities are testing blockchain-triggered demand-response programs. When grid stress hits, homes with batteries automatically sell stored energy back to the network-no human intervention needed.Tokenizing Energy: Small Investments, Big Impact

You don’t need to be a billionaire to invest in solar farms. Thanks to blockchain, you can now buy a fraction of one. Companies like Renewable Tokens and Solara let people invest as little as $10 in a solar panel array in Arizona or a wind farm in Iowa. Each token represents ownership of a portion of the energy output. Investors earn returns based on actual electricity generated and sold. All transactions are recorded on-chain, so ownership is clear, transferable, and auditable. This opens up clean energy investment to people who were locked out before. It also creates a new kind of community ownership. Instead of big corporations controlling renewable projects, thousands of small investors become stakeholders-aligned with long-term sustainability, not short-term profits.

Tracking Batteries from Birth to Recycle

Electric vehicles and home batteries are exploding. But what happens when they die? Less than 5% of lithium-ion batteries are recycled properly today. Most end up in landfills, leaking toxic materials. Blockchain changes that. Every battery gets a digital ID at birth. Its materials, manufacturer, charge cycles, and location are logged on-chain. When it’s time to retire, recycling centers scan the ID and know exactly what’s inside-how much cobalt, nickel, or lithium it holds. That data helps them recover the most valuable components efficiently. In Sweden, the BatteryPass system tracks over 500,000 EV batteries. In Japan, utilities use the same tech to manage home storage units. The result? Recycling rates are climbing to 35%-and rising. Manufacturers are also redesigning batteries to be easier to disassemble, knowing their entire lifecycle will be tracked.Why Private Blockchains Dominate Energy

You might think public blockchains like Ethereum are the future. But in energy, they’re not the main players. About 65% of blockchain energy projects use private or permissioned chains. Why? Because energy companies need control. They need to know exactly who’s accessing data. They need compliance with regulations. They need speed and privacy. Public chains are too slow, too open, and too volatile for grid operations. Private blockchains-like those built on Hyperledger Fabric or Quorum-let utilities, regulators, and energy producers set rules. Only approved parties can transact. Data is encrypted. Access is logged. This makes them perfect for billing, grid coordination, and regulatory reporting. Meanwhile, public chains are finding their niche in consumer-facing apps: carbon credits, peer-to-peer trading, and tokenized assets. The two aren’t competing-they’re complementing each other.AI Is Making Blockchain Smarter

Blockchain alone can record data. But AI makes it act on it. AI analyzes blockchain data to predict energy demand spikes, detect fraud in trading, or optimize when to store or release power. Smart contracts, once rigid and rule-based, are now learning. They adapt based on weather forecasts, grid congestion, and user behavior. In Norway, an AI-driven blockchain system adjusts electricity prices in real time based on wind output and household usage patterns. In Texas, AI flags unusual trading patterns that might indicate market manipulation-all before a human even notices. This combo-blockchain for trust, AI for intelligence-is the new backbone of energy innovation. It’s not just automating tasks. It’s making decisions that humans can’t make fast enough.

Europe Leads, But the U.S. and Asia Are Catching Up

Europe owns the lead in blockchain energy adoption. With over 35% of the global market, countries like Germany, the Netherlands, and Sweden have created regulatory sandboxes, funded pilot projects, and mandated data transparency for grid operators. The U.S. market is smaller-around 16%-but growing fast. Even after the Inflation Reduction Act was dismantled, private investment in blockchain energy projects surged. Startups are building on modular blockchains like Polygon 2.0 and Celestia, cutting development time from years to months. China is playing a different game. It’s not focused on peer-to-peer trading. Instead, it’s using blockchain to track energy production across its massive state-run grid. The goal? Reduce reliance on imported oil and gas by optimizing renewable output and storage. Meanwhile, India and Southeast Asia are leapfrogging traditional infrastructure. In rural villages without reliable grids, blockchain-enabled microgrids powered by solar and battery storage are becoming the norm.Environmental Concerns Are Driving Better Tech

The biggest criticism of blockchain has always been its energy use. Bitcoin mining, for example, guzzles electricity. But in the energy sector, that’s not the story anymore. Modern blockchain energy systems use Proof-of-Stake, Proof-of-Authority, or other low-energy consensus methods. They’re not mining-they’re verifying. A single transaction on a modern energy blockchain uses less power than sending an email. Even better, many projects now run on excess renewable energy. In Iceland, data centers powering blockchain networks use geothermal electricity. In Brazil, hydro surplus is used to secure energy blockchains. The technology isn’t just helping decarbonize energy-it’s being powered by it.What’s Next? Scaling, Compliance, and Identity

The hype is over. The real work is just beginning. The next big challenges aren’t technical-they’re institutional. How do you get utilities to share data? How do you make sure blockchain systems comply with international energy laws? How do you verify who owns a solar panel or a battery in a digital system? Solutions are emerging. Digital identities tied to blockchain are being tested in the EU. Regulators are creating frameworks for tokenized energy assets. Cross-border energy trading via blockchain is being piloted between Canada and the U.S., and between Spain and Morocco. The goal isn’t to replace the grid. It’s to make it smarter, fairer, and more resilient. Blockchain doesn’t need to be everywhere. It just needs to be where it matters most: in the transactions between producers and consumers, in the tracking of clean energy, and in the automation that keeps the lights on when the wind drops or the sun sets.What You Can Do Today

If you’re a homeowner with solar panels, look into peer-to-peer trading platforms in your area. If you’re an investor, explore tokenized renewable energy funds. If you’re a policymaker or utility worker, start asking how blockchain can improve transparency in your grid operations. The future of energy isn’t about bigger power plants. It’s about smarter connections. And blockchain is the thread tying it all together.Can blockchain really make energy grids more reliable?

Yes. Blockchain improves grid reliability by enabling real-time, tamper-proof data sharing between sensors, utilities, and consumers. Combined with AI, it predicts outages, reroutes power automatically, and balances supply and demand faster than human operators can. Systems like GridX in Germany and smart grid pilots in California have already shown 20-30% reductions in downtime during peak stress events.

Is blockchain energy trading legal?

In many places, yes. The EU, Australia, parts of the U.S., and Singapore have created legal frameworks allowing peer-to-peer energy trading using blockchain. In the U.S., individual states regulate this-some allow it freely, others require utility approval. Always check local regulations before participating. The key is that blockchain doesn’t bypass laws-it enforces them with transparent, auditable records.

Do I need to understand crypto to use blockchain energy services?

No. Most consumer-facing platforms hide the blockchain entirely. You’ll see simple apps that show your solar production, let you sell excess power, or track your carbon credits-all in dollars or kilowatt-hours. You don’t need wallets, private keys, or cryptocurrency. The blockchain works behind the scenes to make transactions secure and automatic.

Are blockchain energy projects environmentally friendly?

Modern blockchain energy systems are designed to be low-energy. They use Proof-of-Stake or similar consensus methods that consume 99% less electricity than Bitcoin mining. Many run on excess renewable power-like solar surplus or wind energy that would otherwise go to waste. The carbon footprint of a blockchain energy transaction is now smaller than that of a single email.

Can blockchain help reduce my electricity bill?

Absolutely. If you have solar panels or a home battery, you can sell excess energy directly to neighbors at competitive rates, cutting out the utility’s markup. In pilot programs, users have saved 15-40% on annual energy costs. Even without generation, you can buy cheaper, locally produced renewable power through tokenized markets instead of relying on fossil-fuel-heavy grid supply.

What’s the biggest barrier to blockchain adoption in energy?

Regulation and legacy systems. Many utilities still rely on 50-year-old infrastructure and are slow to adopt new tech. Regulatory frameworks vary wildly by country and even by state. Until there’s standardization around data sharing, identity verification, and cross-border trading, adoption will remain patchy. But enterprise investment is growing fast-so change is coming.

5 Comments

Okay but let’s be real-this whole ‘blockchain energy revolution’ sounds like a Silicon Valley fantasy wrapped in eco-bling. I’ve seen these demos. They work great in Brooklyn with 10 neighbors and a WiFi signal stronger than my will to live. But try scaling this to a whole state? When the grid goes down during a heatwave, you think some smart contract is gonna save your AC? Nah. It’s just a fancy ledger for people who think ‘decentralized’ means ‘no one’s in charge’-which is exactly when you need someone in charge.

And don’t get me started on carbon credits. You’re telling me a farmer in Kenya gets paid in tokens while a CEO in Berlin buys them to keep polluting? That’s not sustainability. That’s greenwashing with blockchain glitter.

Also, who’s gonna pay for all these sensors? Who maintains them? Who fixes it when the blockchain node in some rural town loses power? Not the ‘community owners.’ It’ll be the same overworked utility worker they’re trying to replace. And they’re not even getting overtime for this digital babysitting.

Don’t get me wrong-I want clean energy. But this? This feels like trying to fix a leaky roof with duct tape and a TikTok trend.

While I appreciate the visionary tone of this piece, I must express my profound admiration for the ingenuity and ethical foresight embedded in these blockchain-powered energy initiatives. In Nigeria, where power outages are as predictable as the harmattan wind, the prospect of microgrids enabling households to trade surplus solar energy is nothing short of transformative.

Imagine a child in Enugu studying under LED lights powered not by diesel generators, but by the sunlight her neighbor’s rooftop captured hours earlier-each kilowatt recorded, verified, and exchanged with impeccable transparency. This is not merely technological innovation; it is economic liberation wrapped in cryptographic integrity.

Moreover, the integration of blockchain with carbon tokenization presents a rare alignment of environmental stewardship and financial inclusion. Smallholder farmers, often marginalized in global climate dialogues, are now granted agency, dignity, and measurable value for their ecological labor.

Let us not mistake the novelty of the medium for the triviality of the mission. This is not crypto speculation-it is the quiet, digital rebirth of energy democracy. The world must not look away.

With utmost respect and unwavering optimism,

Chidimma

Blockchain in energy? LOL. You really believe this isn’t just the CIA and Big Oil’s new way to track your every kilowatt? They’ve been trying to control energy for decades-now they just put it on a ‘decentralized’ ledger so they can say ‘look, it’s transparent!’ while quietly locking down every node.

And don’t tell me about ‘private blockchains’-that’s just corporate surveillance with a blockchain sticker on it. Hyperledger? Quorum? Those are just fancy names for permissioned spy networks. You think your solar panel data is safe? Nah. They’re logging your usage patterns, your battery charge cycles, your damn coffee maker’s power draw.

And the carbon credits? Please. The same people who sold you ‘clean coal’ are now selling you ‘verified tokens.’ It’s the same scam, just with more blockchain buzzwords and fewer actual trees.

Meanwhile, the real solution? Turn off your AC. Walk more. Live smaller. But no-that’s too simple. We need a digital ledger to feel like we’re doing something.

Wake up. This isn’t progress. It’s control with a crypto veneer.

Also, who funded this article? I’m betting it’s a VC with a wallet full of SOL.

Man, I’ve been following this stuff since 2021 when my cousin in Bangalore started trading solar power with his neighbors using a simple app. No crypto, no wallet, just a phone and a QR code.

It’s wild how much simpler this all is than people make it out to be. You don’t need to understand blockchain to use it-just like you don’t need to know how the internet works to send a text. The tech’s just doing its thing in the background.

My aunt in Tamil Nadu got her first payment from selling extra power last month. $12. Not life-changing, but it bought her grandson his first textbook. That’s the real win.

And yeah, private chains are the way to go for utilities. Public ones are too slow and noisy for grid stuff. But for small communities? Peer-to-peer is magic. I’ve seen villages skip the grid entirely. No poles, no wires from the city-just solar + blockchain + batteries.

It’s not perfect. But it’s working. And that’s more than I can say for half the ‘innovations’ we get sold every year. 😊

Keep it real, keep it local.

OH MY GOD. I JUST READ THIS AND I’M CRYING. LIKE, ACTUALLY CRYING. 🥹

This is the future I’ve been dreaming of since I was 14 and my dad installed solar panels on our shed. I used to sit there at night watching the meter spin backward and thinking, ‘WHAT IF WE COULD SELL THIS TO THE NEIGHBOR?’

AND NOW IT’S HAPPENING. IN AUSTRALIA. IN TEXAS. IN KENYA. IN MY DAMN HEART.

Blockchain isn’t about Bitcoin-it’s about TRUST. Real, unbreakable, tamper-proof, community-powered trust. And when you combine it with AI? It’s like giving the grid a brain. A kind, smart, eco-friendly brain that doesn’t sleep and doesn’t take bribes.

And the battery tracking? I used to work in e-waste recycling. I’ve seen the toxic nightmares. This? This is redemption. Every battery gets a story. A legacy. A second life.

Stop waiting for someone else to fix it. If you’ve got solar, get on a P2P platform. If you’ve got cash, invest in a tokenized farm. If you’ve got a voice-scream about this. The future isn’t coming.

It’s already here. And it’s beautiful. 💪🌞⚡