Getting a crypto exchange license from FINMA isn’t just paperwork-it’s a full-scale operational overhaul. If you’re thinking about launching a cryptocurrency exchange in Switzerland, you’re not just applying for a permit. You’re building a financial institution that answers to one of the world’s strictest and most respected regulators. And in 2026, the rules haven’t softened. They’ve gotten sharper.

Why FINMA Matters for Crypto Exchanges

Switzerland doesn’t treat crypto like a wild experiment. It treats it like finance. That’s why FINMA, the Swiss Financial Market Supervisory Authority, has built a licensing system that’s both clear and demanding. Unlike places that blur the lines between tokens, Switzerland draws hard distinctions: payment tokens, utility tokens, and asset tokens. Each has different rules. And if your platform touches any of them-especially asset tokens-you need a license.FINMA doesn’t care if your platform is “decentralized” in theory. If users deposit funds, trade, or hold assets through your interface, you’re a Virtual Asset Service Provider (VASP). And that means licensing. Even if your code runs on a blockchain, if humans interact with it to trade or custody crypto, FINMA sees you as a financial intermediary. That’s not a loophole-it’s the point. Switzerland wants to stop money laundering before it starts.

The Four Main License Types

Not all crypto exchanges are the same. FINMA breaks them down by what they actually do:- Crypto Exchange License: For platforms that let users trade crypto-to-crypto or crypto-to-fiat (like CHF or EUR). This is the most common license for trading platforms.

- Crypto Broker License: For intermediaries who match buyers and sellers but don’t hold custody of funds.

- Crypto Trading License: For entities that buy and sell crypto directly to clients, acting as a dealer.

- DLT Trading Venue License: The most advanced license, introduced in 2021 under the DLT Law. This lets you operate a full trading, clearing, settlement, and custody platform for tokenized assets-like stocks, bonds, or securities represented on blockchain.

The DLT Trading Venue license is where Switzerland leads the world. Only a handful of platforms globally hold it. The SIX Digital Exchange (SDX), launched in 2021, is the first and still one of the only ones. It’s not for small operators. It’s for institutional-grade players who want to trade tokenized bonds, ETFs, or private equity-all settled on-chain, in real time.

Company Structure and Capital Requirements

You can’t just register as a sole proprietor. FINMA requires you to incorporate as either an AG (Aktiengesellschaft) or a GmbH (Gesellschaft mit beschränkter Haftung).- AG: Minimum share capital of CHF 100,000 (about $110,000 USD). Required for DLT Trading Venues and larger exchanges.

- GmbH: Minimum share capital of CHF 20,000 (about $22,000 USD). Acceptable for smaller trading or brokerage platforms.

These aren’t just formalities. FINMA wants to see real financial skin in the game. You need to prove you can absorb losses, cover compliance costs, and survive market shocks. The capital must be fully paid in and held in a Swiss bank account before application.

The Application Process: 4 to 8 Months of Hard Work

The timeline isn’t fast. It’s deliberate. Here’s what it looks like:- Company incorporation (3-4 months): Registering your AG or GmbH with the Swiss Commercial Register. This includes notarization, tax registration, and opening a corporate bank account.

- Documentation package (1-2 months): You’ll submit a business plan, financial projections, AML/KYC policies, organizational charts, and proof of management competence.

- Security architecture: FINMA demands multi-signature wallets (3-of-5), cold storage for 95% of client assets, and annual penetration tests by FINMA-approved auditors.

- Operational resilience: Your systems must recover from failure within 4 hours (RTO) and lose no more than 15 minutes of data (RPO).

- License review (1-4 months): FINMA assigns a case officer. Expect detailed feedback at each stage. They’ll ask about your staffing, vendor contracts, and even your CEO’s background.

Most applicants underestimate the time. One founder told me his team spent 18 months just preparing the security architecture documentation before even submitting. Don’t rush it.

Compliance: It’s Not a One-Time Check

Getting the license is just the start. You’re now under continuous supervision.- AML/KYC: You must verify every user’s identity, source of funds, and purpose of transaction. For transactions over CHF 1,000, you must comply with the Travel Rule-sending and receiving counterparty data. That’s new since January 2025 under the revised AMLA.

- Reporting: Monthly transaction reports, quarterly AML audits, and annual financial statements go to FINMA.

- Staffing: The average FINMA-licensed exchange employs 3.2 full-time compliance officers. You need people who understand Swiss law, FATF guidelines, and blockchain tech.

- Banking: This is the biggest hurdle. Swiss banks are cautious. 62% of applicants struggle to open a corporate banking relationship. You’ll need to prove your compliance infrastructure is bulletproof before any bank will touch you.

Costs: It’s Not Cheap

Total costs range from CHF 20,000 to over CHF 100,000. Here’s the breakdown:- Government fees: CHF 5,000-15,000

- Legal and compliance consultants: CHF 8,000-15,000 per month during application

- Security infrastructure setup: CHF 15,000-50,000 (wallets, audits, cold storage)

- Banking setup and legal incorporation: CHF 10,000-25,000

And that’s just to get started. Ongoing compliance costs can eat 25-40% more than projected. A 2024 COREDO survey found most licensees underestimated their annual compliance spend by at least a third.

How Switzerland Compares to Other Jurisdictions

Switzerland isn’t the fastest. It’s not the cheapest. But it’s the most trusted.| Region | Processing Time | Min. Capital | Key Advantage | Key Drawback |

|---|---|---|---|---|

| Switzerland (FINMA) | 4-8 months | CHF 20,000-100,000 | Global institutional trust, clear rules | Slow, expensive, strict on DeFi |

| EU (MiCA) | 3-6 months | €125,000 | Passporting across 27 countries | Less flexibility for innovation |

| Singapore (MAS) | 6-8 weeks | USD 100,000 | Fast approvals, tech-friendly | Less institutional credibility in Europe |

| Wyoming, USA | 2-4 months | USD 100,000 | State-level clarity, crypto-friendly laws | No EU recognition, limited global reach |

| Liechtenstein | 4-6 months | CHF 50,000 | Blockchain-specific laws, good for DeFi | Small market, low trading volume |

Switzerland still leads in institutional adoption. According to a 2024 PwC survey, 78% of all institutional crypto transactions in Europe flow through FINMA-licensed platforms. Hedge funds, family offices, and asset managers trust Swiss regulators more than any other jurisdiction.

DeFi and the Hard Wall

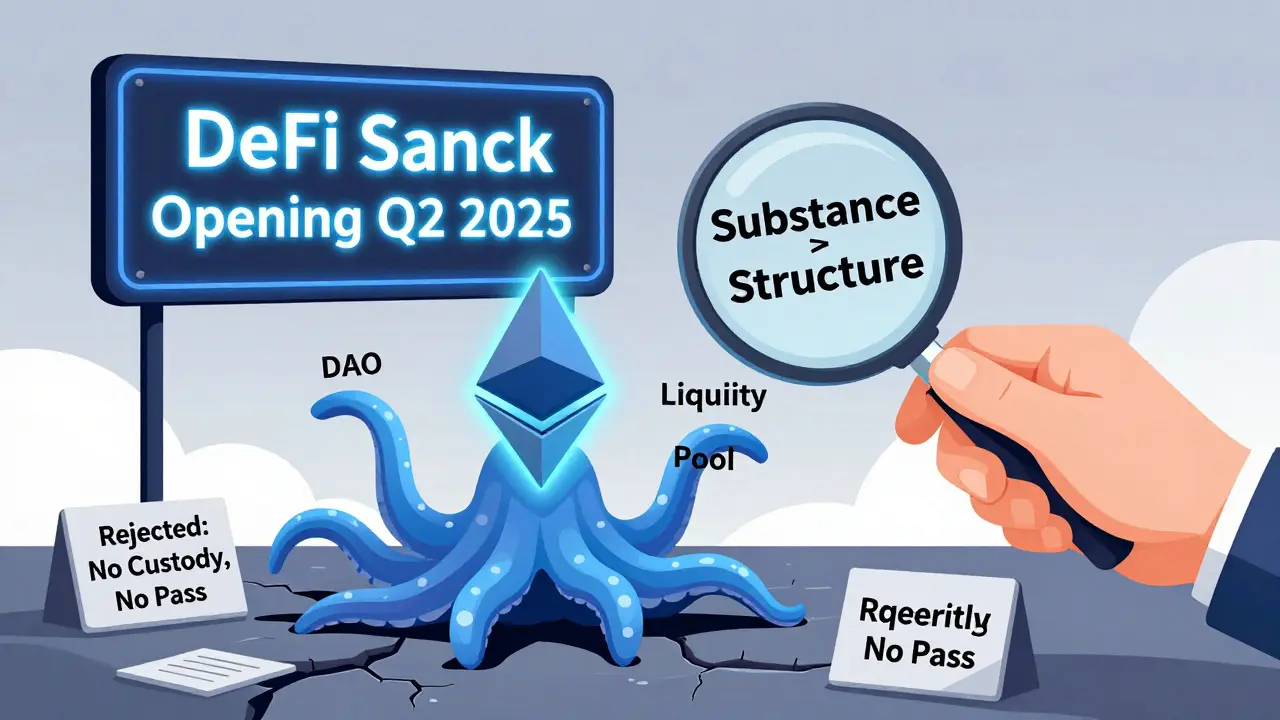

If you’re building a decentralized exchange (DeFi) and think you can slip under FINMA’s radar-think again.In December 2023, FINMA issued explicit guidance: if users can deposit, trade, or withdraw crypto through your protocol, you’re a VASP-even if it’s coded on Ethereum. Governance tokens, DAOs, and automated liquidity pools don’t get a pass. FINMA looks at substance, not structure.

One founder in Zurich had his application rejected because his governance token distribution didn’t meet FINMA’s “professional basis” threshold. He was shocked-his model was identical to one approved in Liechtenstein. But FINMA doesn’t care about comparisons. It cares about control.

That’s changing in 2025. FINMA is launching a DeFi sandbox in Q2, allowing non-custodial protocols to test under relaxed capital rules. But even that’s not a free pass. You’ll still need to prove user protection, audit trails, and exit mechanisms.

Who Succeeds? Who Doesn’t?

The data tells a clear story. In 2024, FINMA approved 68% of well-prepared applications. The rest failed for three reasons:- Weak AML/KYC policies: Too vague, no real monitoring tools.

- Unrealistic financial projections: Underestimating compliance costs by 30% or more.

- No banking relationship: No Swiss bank willing to open an account.

Success stories? Bitcoin Suisse, Sygnum Bank, and SEBA Bank-all licensed before 2020, now profitable, growing, and trusted by European institutions. Their secret? They hired FINMA ex-staffers. They didn’t try to game the system. They built it from the ground up to meet FINMA’s expectations.

On Reddit, users who succeeded say: “FINMA’s case officers are helpful if you’re honest.” One founder said he got written feedback within 10 business days every time. That’s rare in global finance.

But the cost? High. The wait? Long. The risk? Real.

What’s Next for Switzerland’s Crypto Scene?

Switzerland isn’t resting. In 2025, the revised AMLA kicks in, requiring full Travel Rule compliance for all transactions over CHF 1,000. That’s stricter than the EU’s MiCA rules.The SIX Digital Exchange processed CHF 1.2 billion in tokenized securities in Q2 2024 alone. That’s not crypto trading-it’s the future of finance. And FINMA is building the infrastructure to support it.

By 2027, PwC predicts Swiss crypto trading volume will grow at 14.3% annually. But growth isn’t coming from retail. It’s coming from institutions that want to trade bonds, real estate, and private equity on blockchain-with full legal backing.

If you’re building for retail traders, Switzerland might not be for you. If you’re building for banks, asset managers, and institutional investors? Then FINMA isn’t a hurdle. It’s your competitive advantage.

Can I operate a crypto exchange in Switzerland without a FINMA license?

No. If your platform allows users to deposit, trade, or custody cryptocurrency, you are legally required to hold a FINMA license. Even decentralized platforms (DeFi) fall under this rule if users interact with them directly. Operating without a license risks criminal penalties, asset seizure, and permanent bans from Swiss financial markets.

How long does the FINMA crypto license process take?

On average, it takes 4 to 8 months. The first 3-4 months are for company incorporation (AG or GmbH). Then comes 1-4 months for FINMA’s review, depending on how complete your application is. Well-prepared applicants with strong legal and compliance teams can sometimes finish in 4 months. First-time applicants often take 6-8 months.

What’s the minimum capital needed for a FINMA crypto license?

For a GmbH (limited liability company), you need at least CHF 20,000 (about $22,000 USD). For an AG (joint-stock company) or a DLT Trading Venue, you need CHF 100,000 (about $110,000 USD). This capital must be fully paid in and held in a Swiss bank account before you apply.

Can I use a non-Swiss bank for my exchange’s funds?

No. All client funds and company capital must be held in Swiss banks. FINMA requires full jurisdictional control over your assets. You’ll need to open a corporate bank account in Switzerland before applying. Many applicants fail because Swiss banks refuse to work with them due to perceived AML risk.

Does FINMA approve decentralized exchanges (DeFi)?

Not yet-unless they’re in the new DeFi sandbox launching in Q2 2025. Normally, FINMA rejects DeFi platforms because they see them as VASPs if users can deposit or withdraw crypto. Even if the code is decentralized, if humans interact with it through a front-end interface, FINMA treats it like a traditional exchange. The sandbox may offer relief for non-custodial models, but it’s not a free pass.

What happens if my FINMA license application is rejected?

You can reapply. But you must fix the specific issues FINMA identified. Common reasons for rejection include weak AML policies, insufficient capital proof, or lack of qualified compliance staff. Many applicants hire former FINMA staff or Swiss financial lawyers to revise their application. Reapplying without changes almost always leads to another rejection.

Are there any alternatives to FINMA licensing in Switzerland?

No. FINMA is the only authority that issues crypto exchange licenses in Switzerland. Some companies try to operate as “consultants” or “wallet providers” to avoid licensing, but FINMA has cracked down on these workarounds. If you’re handling crypto assets for others, you’re regulated. There are no gray areas.

How many crypto exchanges are currently licensed by FINMA?

As of September 2024, there are 37 FINMA-licensed crypto exchanges in Switzerland. Major names include Bitcoin Suisse, Sygnum Bank, and SEBA Bank. There are also 22 active VASP license applications under review. Approval rates are around 68% for well-prepared applications.

8 Comments

Just finished setting up my GmbH last week and the banking part is brutal. Took three banks saying no before one finally opened an account after I showed them my full AML flow and hired a Swiss compliance consultant. FINMA doesn't make it easy, but if you're serious, it's worth the headache.

Don't skip the penetration tests. I thought I could DIY it. Nope. They rejected my first submission because the cold storage logs weren't timestamped properly. Turns out, even a 30-second gap counts as a vulnerability.

And yes, the compliance officers are actually helpful if you're transparent. One even emailed me a template for the organizational chart after I asked. That doesn't happen everywhere.

Just remember: this isn't a startup sprint. It's a marathon with a notary.

Good luck to everyone trying this. You're not crazy. You're just building something real.

FINMA is just the Fed’s little puppet with a Swiss watch lol

They dont care about crypto they care about controlling money flow

Watch them shut down the DeFi sandbox the second it gets popular

Theyre scared of real decentralization

they want you to think you’re free while they watch every transaction

trust no one

the banks are watching

the code is a lie

theyll take your assets when you least expect it

theyre not regulators theyre gatekeepers

and you’re the cattle

It’s funny how we treat regulation like a barrier instead of a mirror.

Switzerland isn’t stopping innovation-it’s asking: who are you protecting?

When you build a system where people can lose everything in a click, you don’t get to hide behind ‘decentralized’ like it’s a magic shield.

The real question isn’t ‘can I get a license?’

It’s ‘do I deserve one?’

Because if your business model relies on ignorance, volatility, and opacity-you’re not a financial innovator.

You’re a casino with a whitepaper.

FINMA doesn’t punish ambition.

It rewards responsibility.

And if you can’t see the difference between those two-you’re not ready for finance.

You’re just another speculator hoping the next bubble will cover your sins.

Let’s be real-Switzerland’s crypto scene is the financial equivalent of a Swiss Army knife made of platinum.

You got the precision, the durability, the fucking elegance-but it costs more than your firstborn and takes six months to assemble.

Meanwhile, Singapore’s rolling out licenses like Starbucks gives out free coffee on Tuesdays.

And Wyoming? They’ve got crypto-friendly laws and a population that thinks ‘blockchain’ is a new kind of yoga.

But here’s the kicker: nobody trusts Singaporean crypto. Nobody trusts Wyoming. But when a Swiss bank says ‘we’ve cleared this asset,’ the entire EU exhales.

So yeah, it’s expensive.

It’s slow.

It’s a bureaucratic nightmare.

But if you want to move institutional capital? You don’t pick the fastest lane.

You pick the one where the cops don’t pull you over.

And that’s Switzerland.

Stop whining. Start building.

The entire FINMA framework is a Hegelian dialectic of financial modernity.

Thesis: decentralized finance as a liberatory force.

Antithesis: centralized regulatory capture as institutional inertia.

Synthesis: the DLT Trading Venue-a hybrid ontology where blockchain’s immutability is subsumed under sovereign legal personhood.

Switzerland isn’t regulating crypto.

It’s performing a ritual of financial transubstantiation-turning speculative tokens into fiduciary instruments under the gaze of the Kantian categorical imperative.

The capital requirements? Not about solvency.

They’re about ontological commitment.

Can you bear the weight of legal personhood?

Or are you just a smart contract whispering into the void?

FINMA doesn’t ask for compliance.

It asks for existential legitimacy.

And if you can’t answer that-you’re not a VASP.

You’re a ghost in the machine.

Switzerland thinks it’s so special because it has banks and snow.

Meanwhile, the rest of the world is building real systems.

Why should I pay $100K to some Swiss lawyer so I can play by their rules?

They’re not innovating-they’re gatekeeping.

And now they want to police DeFi too?

Go ahead.

Keep your fancy licenses.

We’ll build without you.

And when the world moves on-you’ll be stuck with your gold bars and your slow-ass banking system.

I read all this and thought: why am I even here?

Just hire a lawyer, pay the fees, and move on.

It’s not that complicated.

Stop overthinking it.

FINMA isn’t magic.

It’s paperwork with a fancy name.

And if you’re spending 18 months on security docs?

You’re doing it wrong.

Just get it done.

You don’t need to be the biggest. You just need to be the most trustworthy.

I watched a startup go from rejected application to licensed exchange in 5 months.

They didn’t have fancy tech.

They didn’t have VC backing.

They had one thing: a founder who showed up to every meeting with a notebook, listened to every feedback point, and fixed everything-no excuses.

FINMA doesn’t reward hustle.

They reward humility.

And if you’re still arguing about decentralization vs regulation?

You’re not ready.

But if you’re ready to build something that lasts?

Switzerland isn’t a wall.

It’s a foundation.