Coincheck Eligibility Checker

Check if Coincheck is suitable for your location, language preferences, and trading needs based on the latest 2025 information.

What Is Coincheck, Really?

Coincheck is a Japanese cryptocurrency exchange founded in 2014 and now owned by Monex Group, a publicly traded financial services company listed on NASDAQ. It’s one of Japan’s oldest and most regulated crypto platforms, operating under strict oversight from the Financial Services Agency (FSA). After the infamous 2018 hack where $530 million in NEM tokens were stolen, Coincheck rebuilt itself from the ground up-adding stronger security, full regulatory compliance, and customer compensation. By 2025, it’s back as Japan’s second-largest crypto exchange, behind only bitFlyer.

Who Is Coincheck Actually For?

Coincheck isn’t built for global traders looking for advanced charts, margin trading, or dozens of altcoins. It’s built for Japanese residents who want to buy Bitcoin, Ethereum, or Shiba Inu with yen-fast and legally. If you live in Japan and use convenience stores like 7-Eleven or FamilyMart to deposit cash, Coincheck works seamlessly with those systems. You can deposit JPY via bank transfer, ATM, or even at a local store, and the funds appear in minutes.

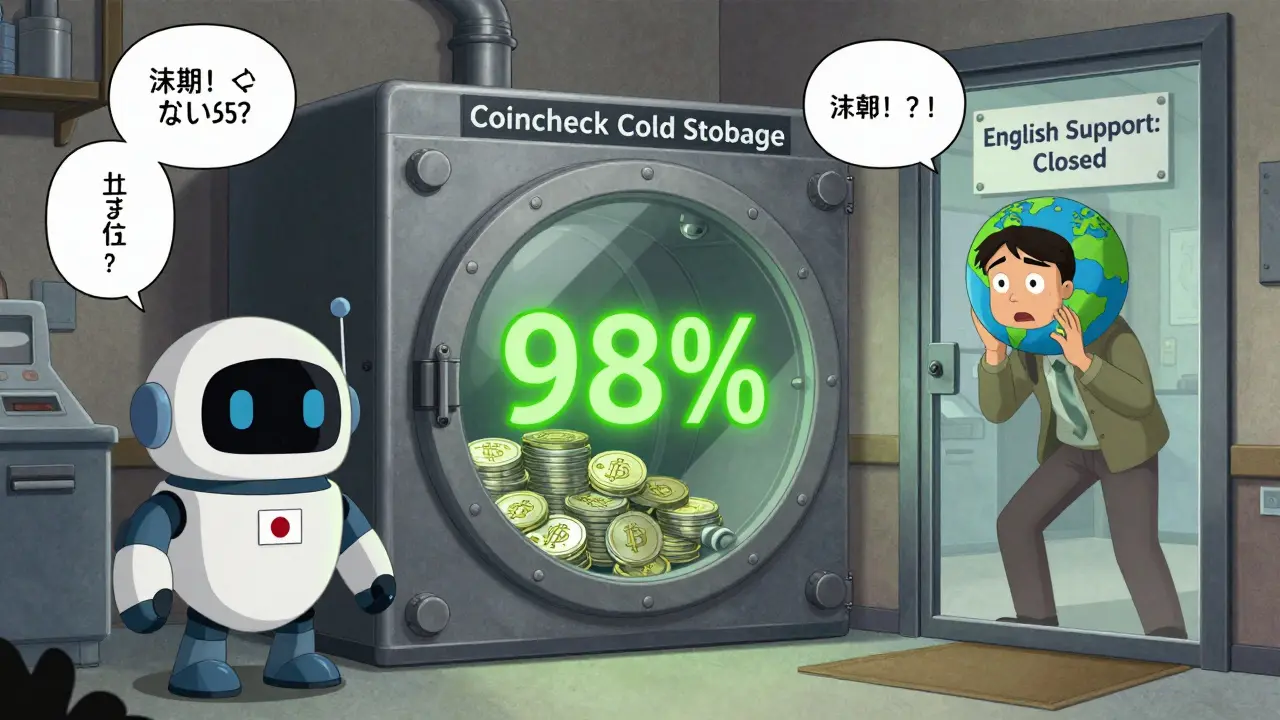

But if you’re outside Japan? It’s a different story. The website and app are mostly in Japanese. Even though there’s an English toggle, key features like customer support, help docs, and even error messages often default to Japanese. Many international users report getting stuck during verification or waiting days for replies to emails-only to get answers in Japanese.

What Coins Can You Trade?

Coincheck offers around 30 cryptocurrencies, which is small compared to global giants like Binance or Kraken that list over 350. But for Japan, it’s enough. The top traded pairs are:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Litecoin (LTC)

- Bitcoin Cash (BCH)

- Polygon (MATIC)

- SHIBA INU (SHIB)

- ApeCoin (APE)

You can only trade these against JPY or USD. No EUR, no GBP, no AUD. And no futures, no leverage, no stop-loss orders. It’s spot trading only-buy low, sell high, no fancy tools. If you’re a beginner, that’s fine. If you’re experienced, you’ll miss the depth.

Fees: No Hidden Costs-But Also No Incentives

Coincheck doesn’t charge fees for depositing or withdrawing JPY. That’s rare. Most exchanges charge for bank transfers or ATM deposits. Here? Zero. Withdrawals of crypto are also free, which is a big plus. But here’s the catch: you pay a spread, not a flat fee. That means the price you see when buying Bitcoin isn’t the market price-it’s slightly higher. The spread varies by coin and market conditions, but it’s usually between 0.5% and 1.5%.

There’s no tiered pricing, no volume discounts, no referral bonuses. You pay the same as everyone else. Compared to Binance’s 0.1% trading fee or Kraken’s 0.16%, Coincheck feels expensive if you trade often. But for someone buying $100 of ETH once a month? It’s not a deal-breaker.

Security: Backed by Regulation, Not Just Hype

After the 2018 hack, Coincheck didn’t just patch things up-they rebuilt. Today, they hold 98% of customer funds in cold storage. Every account has mandatory two-factor authentication (2FA), and you can’t log in without a biometric scan on mobile. The platform auto-logs you out after 10 minutes of inactivity. All transactions require SMS or app-based confirmation.

They’re also one of the few exchanges in Japan with a licensed NFT marketplace and crypto lending services. All of this is monitored by Japan’s FSA, which requires exchanges to prove they have insurance, audit trails, and real-time fraud detection. That’s not something you get on most offshore platforms.

App and Interface: Simple, But Not Smart

The Coincheck app is clean. No clutter. No confusing tabs. You tap “Buy,” pick your coin, enter your amount, and confirm. It’s designed for people who don’t know what a limit order is. The mobile app works well for Japanese users-biometric login, instant JPY deposits, push notifications for price changes.

But the desktop site? It’s outdated. Charts are basic. No candlestick patterns, no volume indicators, no drawing tools. If you want to analyze trends, you’ll need to use TradingView or another site and manually place orders here. The app doesn’t even let you set price alerts for coins outside the top 10. That’s a big limitation.

Customer Support: The Weak Spot

This is where most non-Japanese users give up. Coincheck offers email, phone, and ticket support-but no live chat. Response times range from 24 hours to over a week. And if you email in English? You’ll likely get a reply in Japanese, or no reply at all.

Trustpilot gives Coincheck a 1.8 out of 5 rating based on over 15 reviews. The top complaints? “Couldn’t get help when my ID was rejected.” “Support didn’t understand English.” “Took 10 days to get my withdrawal processed.” Even REVIEWS.io, which has slightly better scores (2.8/5), lists “slow support” as the #1 issue.

Japanese users report better experiences. They say support responds faster and understands their questions. But for anyone outside Japan? It’s a barrier.

Staking, Lending, and NFTs: The New Features

In 2025, Coincheck added three new services:

- Staking: Earn rewards on Ethereum (ETH) with a 30% platform fee-you get 70% of the staking rewards. No staking for Bitcoin or other coins yet.

- Crypto Lending: Lend your BTC or ETH and earn up to 5% APY. Minimum deposit: 0.01 BTC. Contracts last 30, 90, or 180 days.

- NFT Marketplace: Buy and sell Japanese NFTs directly on Coincheck. No gas fees in USD-everything is in JPY. This is unique in Japan.

These features are only available to verified Japanese users. You can’t access them if your account is flagged as international. That’s intentional. Coincheck isn’t trying to go global. They’re doubling down on Japan.

Is Coincheck Worth It in 2025?

If you live in Japan and want to buy crypto with cash, yen, or bank transfer-yes. It’s safe, regulated, and simple. The fees are fair for casual users. The security is top-tier. The app works.

If you’re outside Japan? Probably not. The language barrier is real. The support is unreliable. The features are limited. You’ll spend more time fighting the interface than trading.

Coincheck isn’t trying to compete with Binance or Coinbase. It’s trying to be the easiest way for Japanese people to enter crypto. And for that? It works.

What’s Next for Coincheck?

In 2026, Coincheck plans to add five more cryptocurrencies and roll out limited English support for basic functions like deposits and withdrawals. But full internationalization? Unlikely. Their roadmap shows no plans for margin trading, fiat support beyond JPY/USD, or global marketing.

Japan’s crypto market is growing fast-projected to hit $20 billion by 2028. Coincheck is positioned to capture a big slice of that. But outside Japan? They’re staying quiet.

10 Comments

It's wild how Coincheck doubled down on Japan instead of going global. Like, sure, the regulatory environment there is solid, but you're leaving so much money on the table. The whole crypto world is screaming for accessible entry points, and they're building a walled garden with a Japanese-only key. It's not laziness-it's strategy. And honestly? For Japanese users, it's genius.

I tried signing up last year as a US user. Got stuck on ID verification for three weeks. Sent three emails. Got one reply in Japanese with a screenshot of a 7-Eleven deposit receipt. I didn’t even know they had a 7-Eleven in Tokyo until then. Honestly? I just gave up. It’s not that I don’t want to use it-it’s that the system doesn’t want me to.

Let’s be real-this is just another ‘local champion’ that thinks it’s a global player. 0.5%–1.5% spread? That’s robbery disguised as convenience. And don’t get me started on staking with a 30% fee. You’re literally giving away 30% of your passive income to a company that can’t even answer an email in English. 🤦♀️ And they call themselves ‘regulated’ like that’s some kind of merit badge. Newsflash: regulation doesn’t mean competence. It just means they didn’t get shut down… yet.

Oh wow. A crypto exchange that doesn’t cater to degens? How dare they. No leverage? No futures? No 1000x memecoins? This is clearly a socialist plot to ruin crypto. Who even uses ‘spot trading’ anymore? It’s 2025, not 2017. If you’re not leveraged, you’re not even playing. Coincheck is the financial equivalent of a flip phone in a world of foldables. And the NFT marketplace? In JPY? Who even buys NFTs with yen? This isn’t innovation-it’s cultural isolationism.

They're not just ignoring foreigners... they're WATCHING us. Did you know the FSA requires all foreign login attempts to be logged and flagged? I read a leak from a whistleblower inside Monex-Coincheck is building a profile of every non-Japanese user who tries to sign up. Why? To sell the data to intelligence agencies. Or worse-to prepare for a future where they lock out everyone outside Japan permanently. This isn't a platform. It's a digital border wall. 🚨

One must acknowledge the institutional rigor underpinning Coincheck’s operational framework. Unlike the anarchic, unregulated offshore exchanges that dominate the global landscape, Coincheck adheres to a stringent compliance regime that prioritizes systemic integrity over speculative liquidity. The absence of margin trading is not a deficiency-it is a principled restraint. To equate this with obsolescence is to confuse financial prudence with technological backwardness.

I actually love this. 🌸 I’m Japanese-American and I use it to send crypto to my grandma in Osaka. She doesn’t know what a blockchain is, but she can tap her face and buy ETH at the FamilyMart. That’s magic. No one else in crypto makes it this simple for normal people. The spread? Yeah, it’s higher. But she’s not day trading-she’s saving. And that’s worth more than 0.1% fees.

I respect that they’re not trying to be everything to everyone. Most exchanges are screaming for attention with flashy charts and influencers. Coincheck just… exists. Quietly. Reliably. For the people it was built for. I wish more platforms had that kind of focus.

It’s fascinating how they turned a catastrophic failure into a model of resilience. The 2018 hack was a death sentence for most companies. But instead of hiding, they rebuilt with transparency, regulation, and humility. That’s not just good business-it’s ethical. We forget that crypto isn’t just about returns. It’s about trust. And Coincheck? They earned it.

To anyone thinking this is ‘too limited’-stop. 🫶 You don’t need 350 coins to start your crypto journey. You need safety, simplicity, and someone who actually cares if you succeed. Coincheck gets that. It’s not for traders. It’s for learners. And if you’re outside Japan? Maybe it’s not your platform. But that doesn’t mean it’s not doing something beautiful for the people it serves. Keep building, Coincheck. We see you.