China Bitcoin Ban Impact Calculator

How China's Ban Affects Bitcoin Value

This calculator estimates potential value changes for Bitcoin holdings if China lifted its complete crypto ban. Based on the article, China's ban could cause a 50-100% price surge if lifted.

China doesn’t allow Bitcoin. Not as money. Not as an asset. Not even as a curiosity you can trade in private. Since 2021, the government has shut down every legal pathway for cryptocurrency activity - exchanges, mining, banking services, even overseas platforms that try to serve Chinese users. And yet, millions of people still hold Bitcoin. What happens to them now?

What China Actually Banned (And What It Didn’t)

China’s crypto ban isn’t a single law. It’s a layered system of enforcement that started in 2013 and tightened every year until 2021. By then, the rules were absolute: no exchanges, no mining, no financial institutions handling crypto, no ICOs, no derivatives. Banks can’t open accounts for crypto traders. Payment apps like Alipay and WeChat Pay are required to block any transaction linked to Bitcoin. Internet companies must filter out crypto-related content - forums, Telegram groups, even YouTube videos that mention trading.

But here’s the twist: owning Bitcoin isn’t technically illegal. The government never said, "Don’t hold it." They said, "Don’t trade it. Don’t mine it. Don’t use it to move money." That’s a loophole - and millions of people are using it. You can still have Bitcoin in a wallet. You can still receive it. You can still store it. But if you try to cash out through a Chinese bank, you’ll hit a wall. The system is built to detect and block anything tied to crypto.

How the Ban Changed Bitcoin Mining

Before 2021, China controlled over 70% of the world’s Bitcoin mining. The country had cheap electricity, especially in provinces like Sichuan and Inner Mongolia. Miners set up huge farms with thousands of machines humming 24/7. Then, in May 2021, the government ordered a complete shutdown. Mining was labeled "high energy consumption, low efficiency" - a threat to national carbon goals.

The crackdown was brutal. Power supplies were cut. Mining licenses were revoked. Equipment was seized. Within months, most farms shut down. Many miners sold their hardware at a loss and moved overseas - to Kazakhstan, the U.S., and Russia. Today, China’s mining share is below 1%. The country didn’t just stop mining. It erased an entire industry overnight.

For Bitcoin holders, this meant less supply pressure from Chinese miners dumping coins on the market. But it also meant the network became more decentralized - and more resilient. The ban didn’t kill Bitcoin. It just moved its heart.

What Happens If You Own Bitcoin in China?

If you’re a Chinese citizen holding Bitcoin, you’re in a gray zone. The government doesn’t arrest people for owning it. But they make it extremely hard to do anything useful with it.

- You can’t sell it on local exchanges - they’re all gone.

- You can’t use it to pay for goods - merchants can’t accept it without risking fines.

- You can’t convert it to yuan through a bank - any attempt triggers automated alerts.

- If you try to wire money abroad to buy Bitcoin, your bank will freeze the transaction.

Most people who still hold Bitcoin in China use peer-to-peer (P2P) platforms or offshore wallets. Some trade privately through WeChat or QQ groups. Others use VPNs to access foreign exchanges like Binance or Kraken - even though those platforms are officially banned from serving Chinese users. Enforcement is patchy. Some people get caught. Others never do.

The real danger isn’t losing your coins. It’s losing access to the rest of the financial system. If you’re flagged for crypto activity, your bank account could be frozen. Your credit score might drop. You could be denied loans, mortgages, even jobs in finance.

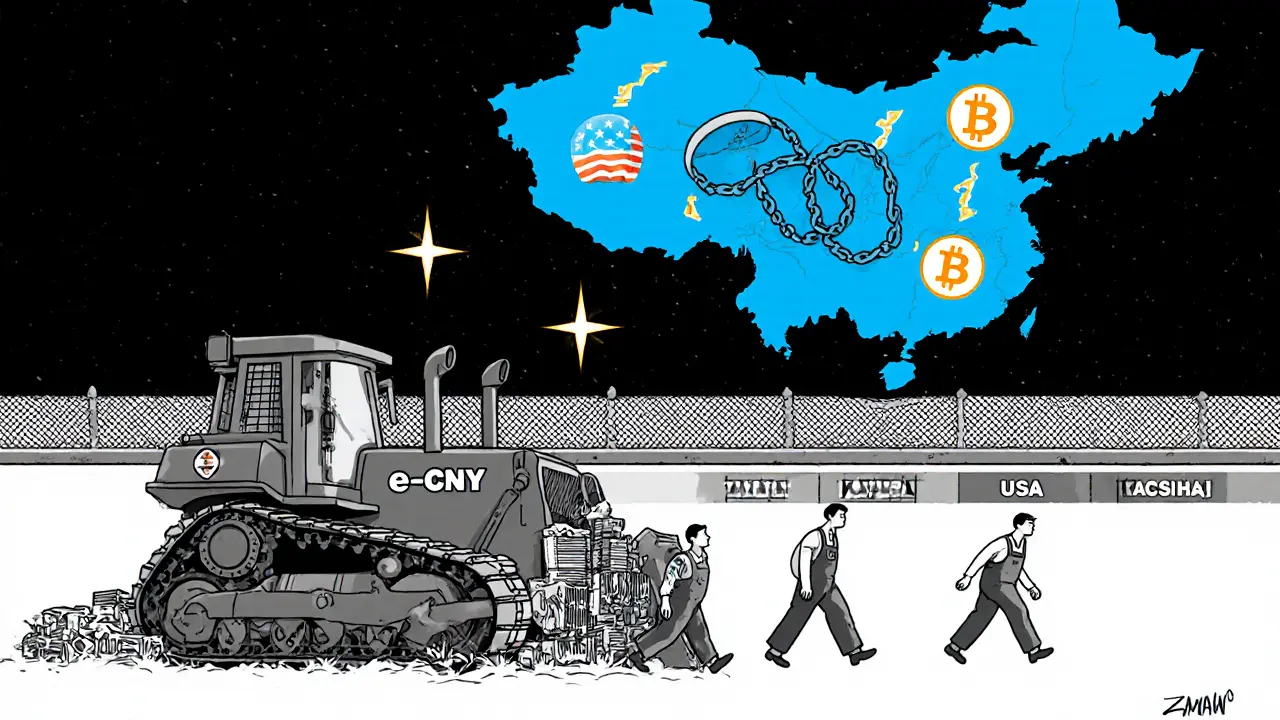

The Digital Yuan Is the Real Goal

China isn’t banning crypto because it hates technology. It’s banning it because it wants to control the future of money - and it’s building its own version: the Digital Yuan, or e-CNY.

The People’s Bank of China has been testing the e-CNY since 2020. It’s not blockchain-based. It’s not decentralized. It’s a government-controlled digital cash system where every transaction is tracked. You can’t hide it. You can’t anonymize it. You can’t use it to bypass capital controls.

This isn’t just about convenience. It’s about power. With the Digital Yuan, the government can monitor spending in real time, restrict payments to certain businesses, or even set expiration dates on cash. It’s the opposite of Bitcoin - total control instead of decentralization.

That’s why China won’t back down. Bitcoin represents freedom from state control. The Digital Yuan represents absolute control. The two can’t coexist in the same system. So the government chose its side.

The Myth of the 2025 Ban

Every year, rumors explode online: "China is banning Bitcoin again!" In 2025, the same thing happened. A fake post claimed China had launched a new crackdown on personal Bitcoin holdings. It spread fast - on Elon Musk’s X, on financial Telegram channels, even on news sites that didn’t check their sources.

It was false. There was no new ban. No new law. No new enforcement. Just noise.

These rumors aren’t accidents. They’re market manipulation. When people believe China is about to ban crypto again, panic selling happens. Prices drop. Then, the same people who spread the rumor buy low. It’s a classic pump-and-dump scheme, fueled by fear and misinformation.

China’s rules haven’t changed since 2021. The ban is already total. There’s nowhere left to ban.

Can You Still Access Bitcoin From China?

Yes - but with serious risk.

If you’re a Chinese citizen and you want to hold Bitcoin, you have to operate outside the system. Use a hardware wallet like Ledger or Trezor. Store your keys offline. Don’t link your real name to any exchange. Avoid using Chinese IP addresses when accessing foreign platforms. Don’t transfer money from your bank account to buy crypto - use third-party intermediaries, if you must.

But even then, you’re not safe. The government’s surveillance network is powerful. If you’re flagged - maybe because you used a VPN to access a crypto site, or your friend sent you Bitcoin - your activity could be logged. You might not get arrested. But you might get audited. Your assets could be frozen. Your future could be affected.

Many Chinese Bitcoin holders now treat it like cash hidden under a mattress. It’s not for spending. It’s for holding. For long-term bets. For escape. For those who believe the system will change - or that they’ll one day leave China.

What This Means for Global Bitcoin Markets

China’s ban didn’t kill Bitcoin. It reshaped it.

Before 2021, Chinese traders were some of the biggest buyers. When the ban hit, prices dropped. But global demand picked up. The U.S., Europe, and Latin America absorbed the shock. Bitcoin became less dependent on any single country.

But the threat still lingers. If China ever lifted its ban - even partially - it could trigger a massive surge. Imagine millions of Chinese investors suddenly allowed to buy Bitcoin legally. The demand could push prices up 50%, 100%, or more.

That’s why traders around the world watch China like a hawk. Every speech by a government official. Every hint of policy change. Every rumor. They all matter.

Right now, the door is closed. But the key is still in the lock.

Final Reality Check

China’s crypto ban is one of the most extreme policies in the world. It’s not about stopping technology. It’s about stopping freedom. It’s about controlling money so tightly that no one can escape the system.

For Bitcoin holders in China, the path is narrow. You can hold. You can wait. You can hope. But you can’t trade. You can’t spend. You can’t rely on the system to protect you.

For everyone else, China’s ban is a warning. If governments decide digital money must be controlled, they will crush decentralized alternatives. Bitcoin’s value isn’t just in its code. It’s in the fact that no single government can shut it down.

China tried. And failed.

Bitcoin still exists.

And it’s still growing - just not inside China’s borders.

6 Comments

They're not banning Bitcoin because it's dangerous. They're banning it because it's the only thing that can't be tracked, taxed, or controlled. The Digital Yuan is their new surveillance tool, and Bitcoin is the ghost in the machine they can't erase. Don't believe the rumors about 2025? Good. Because the real war is already over, and they lost.

Let's not romanticize this. China didn't 'fail' to kill Bitcoin - they just relocated its infrastructure. The mining farms moved, the traders went offshore, and the network became more decentralized, yes - but that doesn't mean the ban was ineffective. It forced Bitcoin into the shadows, made it harder for retail users to participate, and accelerated the shift toward institutional custody models. The real story isn't resilience - it's adaptation under duress. And honestly? Bitcoin's price didn't explode because of China's ban. It exploded because the Fed printed trillions and people needed a hedge. Don't confuse correlation with causation.

The ontological tension here is between sovereign monetary authority and decentralized epistemic autonomy. China's e-CNY represents a top-down, Hegelian synthesis of capital and control - a dialectical negation of individual financial sovereignty. Bitcoin, in contrast, is a post-sovereign artifact: a cryptographic assertion of non-interference, an algorithmic protest against the totalizing logic of the state. The ban isn't merely regulatory - it's metaphysical. The state cannot permit a parallel monetary ontology. It must erase it. And yet, the ledger persists. Not because it's robust, but because it is irreducible. The blockchain doesn't care if you ban it. It just keeps appending.

I mean, I get why people think China's 'failed' to kill Bitcoin, but honestly? It's not about killing it - it's about making it useless to normal people. You can't buy coffee with it. You can't pay rent. You can't even get your kid's tuition paid without getting flagged by the bank. So yeah, the coins are still there. But what good is a diamond if you can't sell it? And now the government has this thing where they can see every single yuan you spend? That's not progress. That's a prison with better Wi-Fi.

The whole 'Bitcoin is growing outside China' narrative is pure fantasy. Most of the 'global demand' that supposedly absorbed the shock was just American retail investors FOMOing into ETFs. Meanwhile, Chinese holders are sitting on billions in illiquid assets, scared to move them. The real impact? Reduced liquidity, higher volatility, and more reliance on offshore OTC desks controlled by shady actors. And let’s not pretend the Digital Yuan isn’t already being used to track dissidents and limit spending. This isn't a tech battle - it's a human rights crisis wrapped in a whitepaper.

in india we also have strict rules but still people use crypto through p2p... china ban is harsh but i think its not about tech its about control... if you have bitcoin in china you are not criminal but you are invisible in system... its sad but real... stay safe, use hardware wallet, dont talk much online