On November 4, 2021, BitOrbit (BITORB) launched its token on BSCPad, promising early supporters a share of its airdrop and IDO allocation. Three years later, the project’s market cap sits at just $2,830 - a fraction of the $290,000 it raised. What went wrong? And what can you learn from BitOrbit’s story if you’re considering the next big airdrop?

How the BitOrbit Airdrop Actually Worked

BitOrbit didn’t just hand out free tokens. Its airdrop was part of a six-phase fundraising structure that included private sales, public sales, and community rewards. To qualify for the airdrop, users had to complete specific tasks: join Telegram, follow Twitter, refer friends, and hold BSCPad’s native token (BSP). Only after completing these steps were wallets whitelisted for token allocation. The token distribution wasn’t instant. At launch, only 10% of total tokens were released. The remaining 90% were locked behind a one-month cliff, then released linearly over four months. This structure was meant to prevent a dump - but it didn’t work. Why? Because the project had no clear use case. No product. No roadmap beyond vague promises of a "decentralized social platform." Investors bought into the hype of an IDO on BSCPad, not the tech. And when the first 10% of tokens hit the market, there was no demand to support the price.Why BSCPad Was the Right Platform - But Not Enough

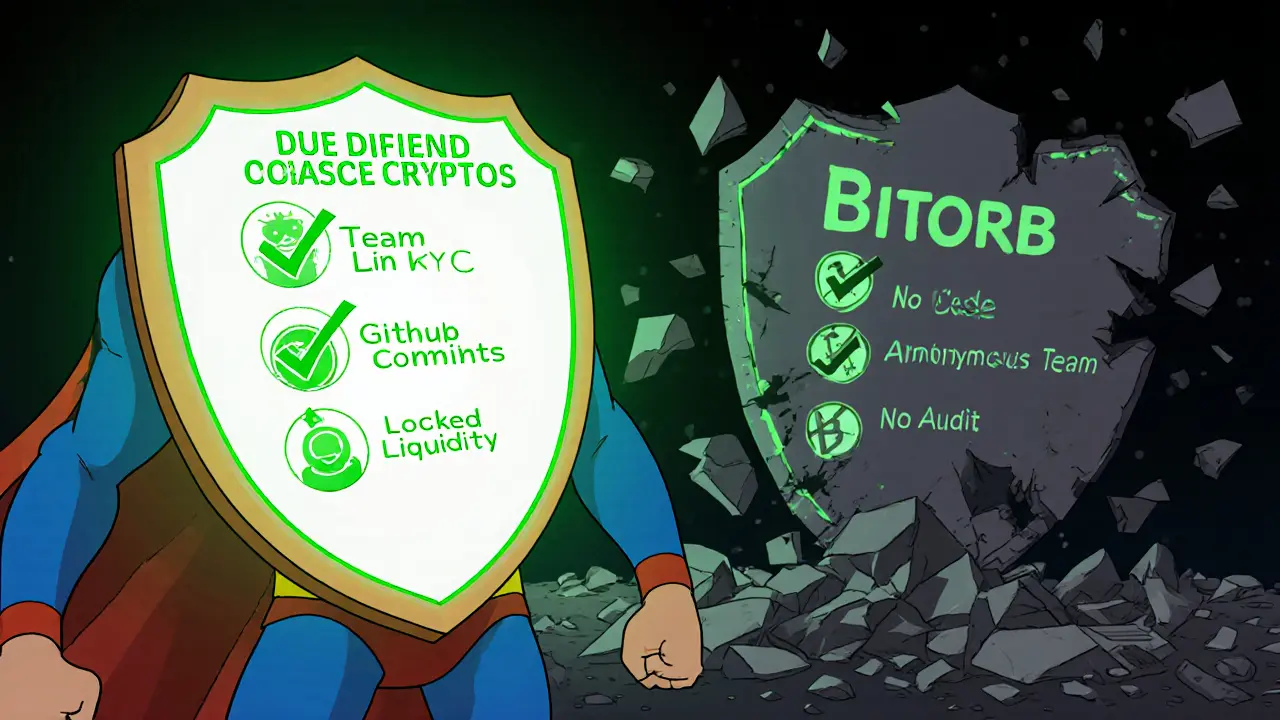

BSCPad was one of the top 10 IDO launchpads in 2021. It had traction on the Binance Smart Chain, low gas fees, and a growing user base. BitOrbit chose the right launchpad. But choosing a reputable platform doesn’t guarantee success. Back then, launchpads like BSCPad had minimal vetting. Projects could submit whitepapers with bullet points and call it a plan. Today, top launchpads like DAO Maker and Polkastarter require audits, team KYC, and proof of working code. BitOrbit didn’t have any of that. The token was deployed on BSC using a standard ERC-20 template. No smart contract vulnerabilities were found - but there was no innovation either. No DeFi integration. No staking. No utility beyond speculation. That’s why the price collapsed after the cliff ended.The $290,000 Raised - And the $2,830 Market Cap

The math is brutal. BitOrbit raised $290,000 from investors. That’s enough to pay for a solid development team for six months. Instead, the team disappeared after launch. Market cap is calculated as: token price × circulating supply. At launch, BITORB was priced around $0.005. Today, it trades at $0.0000007. That’s a 99.98% drop. Compare that to successful 2021 IDOs like Polkastarter’s own token, which peaked at 18x ROI. Or even lesser-known projects like KlimaDAO, which built real carbon credit utility and held value. BitOrbit had none of that. It was a classic case of hype without substance.

What Investors Lost - And What They Could’ve Done Differently

People who participated in the BitOrbit airdrop thought they were getting in early. They weren’t. They were betting on a team with no track record, no product, and no transparency. Here’s what you should check before joining any IDO or airdrop in 2025:- Team anonymity? If the founders use pseudonyms and no LinkedIn profiles, walk away.

- No GitHub commits? If the codebase hasn’t been updated in six months, the project is dead.

- Tokenomics with no utility? If the token can’t be used for anything - staking, voting, discounts - it’s just a speculative asset.

- No audits? Even a basic CertiK audit costs $5,000. If a project skips it, they’re hiding something.

- Locked liquidity? If the team can pull the liquidity pool at any time, your tokens are worthless.

How IDO Launchpads Have Changed Since 2021

The crypto landscape in 2025 is unrecognizable from 2021. Back then, you could join an IDO with $10 and a Metamask wallet. Now, top launchpads like Bybit Launchpad and DAO Maker require:- Minimum $500 in platform tokens to qualify

- Complete KYC with government ID

- Proof of wallet history (no newly created wallets)

- Waiting lists with lottery systems to prevent bots

Is BitOrbit Still Active in 2025?

No. The official website is offline. The Twitter account hasn’t posted since 2022. The Telegram group has 12 members. The token is listed on one obscure decentralized exchange with zero daily volume. This isn’t a dead project - it’s a ghost. And it’s not alone. Hundreds of IDOs from 2021 met the same fate. Most were never audited, never developed, and never marketed beyond a single tweet. The lesson? Don’t chase airdrops because they’re "free." Chase them because the project has real value - and a team that’s still working.What to Do If You Still Hold BITORB Tokens

If you’re sitting on BITORB tokens right now, you have three options:- Sell now. Even at $0.0000007, you’re getting back something. Holding longer won’t help - there’s no buyer.

- Write it off. Treat it as a learning expense. Many successful traders lost money on early projects - then used that knowledge to win big later.

- Don’t repeat it. Next time, check the team, check the code, check the liquidity. If any of those are missing, walk away.

Was the BitOrbit airdrop free?

Technically yes - but you had to complete tasks like joining Telegram, following Twitter, and holding BSCPad’s token to qualify. It wasn’t random. It was a marketing tactic to grow the community before launch.

Did BitOrbit have a working product?

No. The whitepaper described a "decentralized social platform," but no app, website, or prototype was ever released. No GitHub activity, no code commits, no updates. The project never moved beyond the pitch stage.

Can I still claim BitOrbit tokens?

No. The token distribution ended in early 2022. The smart contracts are inactive, and the launchpad (BSCPad) no longer supports claiming for projects that have been abandoned. Any site offering to "claim BITORB now" is a scam.

Why did BitOrbit’s price crash so hard?

The token had no utility, no team updates, and no liquidity locks. When the 90% of tokens unlocked after the one-month cliff, there was no demand to buy them. Sellers overwhelmed the market, and the price collapsed. This is common for projects with weak fundamentals.

Are there safer IDO platforms today?

Yes. Platforms like DAO Maker, Polkastarter, and Bybit Launchpad now require audits, team KYC, locked liquidity, and active development. They also offer post-listing tools like futures trading and insurance. These are the only platforms worth considering in 2025.

How do I avoid another BitOrbit?

Ask three questions before joining any airdrop: Is the team real? Is the code live? Is the liquidity locked? If you can’t verify all three, don’t participate. Most failed projects look perfect on paper - until the tokens drop.

9 Comments

man i remember when i jumped on bitorbit just cause it was free and i had like 5 mins to do the telegram thing. thought i was getting rich lol. turns out i just funded someone’s vacation. the whole crypto airdrop scene in 2021 was like a carnival with no rides. you pay to get in, get a free balloon, and then the whole tent collapses. still have the tokens. might as well use them as confetti at my next birthday.

this wasn’t a failure. this was a controlled demolition. the team knew the token would crash. they pulled the liquidity before the cliff. the 90% unlock wasn’t a mistake - it was the exit plan. they didn’t build a platform. they built a trap. and you all walked right in. don’t blame the project. blame the fact that you thought ‘free tokens’ meant ‘free money’ and not ‘free to get robbed.'

you’re all missing the real lesson here. it’s not about audits or team KYC or locked liquidity - those are just symptoms. the core issue is the collapse of the speculative paradigm. in 2021, the market was pricing in narrative velocity, not fundamental value. bitorbit was a perfect storm: low barrier to entry, high hype, zero execution. the token’s price wasn’t a function of demand - it was a function of attention. and once the tweetstorm died, so did the price. this is why we need tokenomics that aren’t just rebranded ponzi mechanics. we need utility that’s baked in, not bolted on after the dump.

if you still hold these tokens you’re either braindead or a hoarder. sell. now. no one cares. no one will ever care. this isn’t a ‘learning experience’ - it’s a financial corpse. stop romanticizing your losses. you didn’t lose $50. you lost your dignity for a free token. grow up.

i just wanted to say thanks for writing this. i lost money on a few of these too. didn’t know how to check for team info or code updates. didn’t even know what a liquidity lock was. this post helped me understand what to look for next time. not blaming myself anymore. just learning. that’s all i can do.

the metaphysical failure here isn’t the token - it’s the epistemological assumption that decentralized systems can be governed by hype alone. bitorbit operated under the illusion that community participation equates to value creation. but participation without structure is noise. the blockchain doesn’t care about your twitter follows. it only cares about verifiable, immutable, incentivized behavior. the project failed because it mistook marketing for mechanics. and in crypto, mechanics always win. eventually.

like… i get it. we all got excited back then. i did the telegram, the twitter, even held bsp. i thought ‘hey maybe this is the one.’ but looking back? it was just another glitter bomb. nobody had a real plan. just a whitepaper with buzzwords and a discord server full of bots. i don’t even hate them. i just feel bad for the people who actually believed it. maybe next time i’ll just wait for the projects that don’t need to scream ‘FREE TOKENS’ to get attention.

the fact that you’re even asking if bitorbit is still active is proof you’re still in the game. it’s not ‘dead’ - it was never alive. this isn’t a cautionary tale. it’s a monument to how stupid the entire 2021 airdrop culture was. and now you’re all acting like you’re victims. you weren’t. you were participants. in a system designed to extract, not build. stop pretending you were smart. you weren’t. you were lucky you didn’t lose more.

i think the real problem is we dont check the team. i saw bitorbit on telegram, thought it looked legit. later found out the guy who posted was using a fake name. no linkedin. no github. just a guy with a nice logo. i learned: if you cant find a real person behind it, its not real. now i only join projects where i can see the devs’ faces. even if they’re shy. at least they exist.